Get the free 2012/2013 Earnings Form - utb

Show details

Este formulario es utilizado para reportar los ingresos ganados y la asistencia gubernamental de los estudiantes y sus padres para el año fiscal 2011. Se requiere información sobre los empleadores,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 20122013 earnings form

Edit your 20122013 earnings form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 20122013 earnings form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 20122013 earnings form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 20122013 earnings form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 20122013 earnings form

How to fill out 2012/2013 Earnings Form

01

Obtain the 2012/2013 Earnings Form from your employer or the relevant tax authority website.

02

Fill in your personal information at the top of the form, including your name, address, and social security number.

03

Report your earnings from your employer in the designated section, ensuring that you include all applicable wages, bonuses, and allowances.

04

If you had multiple employers, repeat the reporting for each employer's earnings in separate sections if required.

05

Enter any deductions or adjustments as specified on the form, if applicable.

06

Review all the entered information for accuracy and completeness before submission.

07

Sign and date the form as required and submit it to the relevant tax authority by the deadline.

Who needs 2012/2013 Earnings Form?

01

Individuals who worked and earned income during the 2012/2013 tax year.

02

Employees who need to report their earnings for tax purposes.

03

Self-employed individuals who need to record their earnings.

04

Individuals applying for certain benefits that require proof of earnings.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1040 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return. Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

What is the earned income credit for 2012?

Income Thresholds to Receive the EITC for FY 2012: $36,920 ($42,130 for married filing jointly) for a family or household with one eligible child. $13,980 ($19,190 for married filing jointly) for workers or household with no eligible children.

What is the 19 form that lists your earnings from the previous year and all the withholdings?

W-2. Each year, employees receive a Form W-2 that provides details of the prior year's earnings, taxes withheld, and other miscellaneous data (such as the taxable cost of group term life insurance, the cost of employer-sponsored health coverage, and contributions to retirement or tax-deferred savings plans).

Who must file a 1040?

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

Is a 1040 the same as a W-2?

Form 1040 is different from a W-2. A W-2 is a wage and tax statement that an employee receives from a company they worked for during the tax year. The information listed on the W-2 is used to fill out Form 1040.

Why would I need a 1040 form?

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Who is required to use Form 1040?

Most U.S. citizens or permanent residents who work in the U.S. have to file a tax return. Generally, you need to file if: Your income is over the filing requirement. You have over $400 in net earnings from self-employment (side jobs or other independent work)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

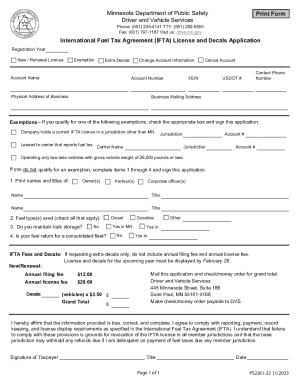

What is 2012/2013 Earnings Form?

The 2012/2013 Earnings Form is a document used to report income earned during the specified tax year, typically for individuals and businesses for tax filing purposes.

Who is required to file 2012/2013 Earnings Form?

Individuals and businesses that earned income during the 2012/2013 tax year and meet the filing requirements set by the tax authority are required to file this form.

How to fill out 2012/2013 Earnings Form?

To fill out the 2012/2013 Earnings Form, gather all relevant income documentation, carefully follow the instructions for each section, and provide accurate details regarding your earnings, tax withheld, and any applicable deductions.

What is the purpose of 2012/2013 Earnings Form?

The purpose of the 2012/2013 Earnings Form is to accurately report income to the tax authorities, determine tax liability, and ensure compliance with tax regulations.

What information must be reported on 2012/2013 Earnings Form?

The information that must be reported includes total income earned, types of income (e.g., wages, business income), tax withheld, and any relevant deductions or credits applicable to the tax year.

Fill out your 20122013 earnings form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

20122013 Earnings Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.