Get the free LLC-5.5

Show details

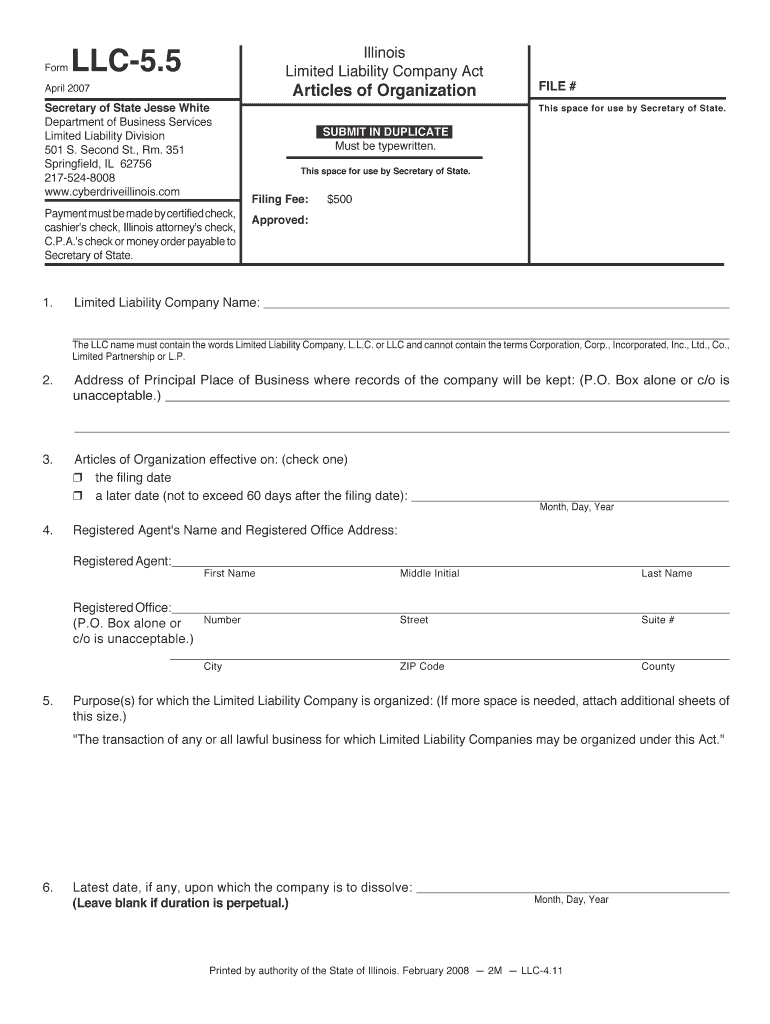

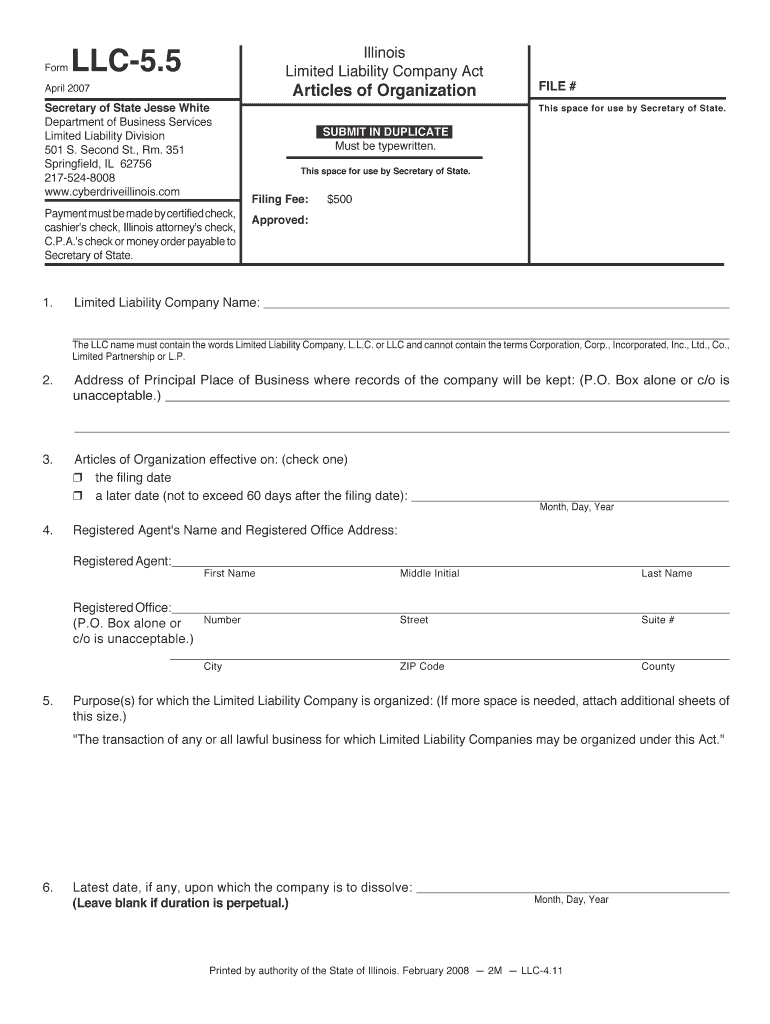

This form is used to file the Articles of Organization for a Limited Liability Company in Illinois, detailing the necessary information such as the LLC name, address, registered agent, and purpose

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign llc-55

Edit your llc-55 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your llc-55 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit llc-55 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit llc-55. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out llc-55

How to fill out LLC-5.5

01

Obtain the LLC-5.5 form from the appropriate state agency website or office.

02

Enter the name of the Limited Liability Company (LLC) at the top of the form.

03

Provide the LLC's official address including street, city, state, and zip code.

04

Fill out the contact information for the LLC’s registered agent.

05

Specify the purpose of the LLC in the designated section.

06

Input the date of formation of the LLC and the duration of its existence if applicable.

07

Confirm any additional information or documents required by your state, such as member or manager information.

08

Review the completed form carefully for accuracy and completeness.

09

Sign and date the form where indicated.

10

Submit the form to the state agency along with any applicable filing fees.

Who needs LLC-5.5?

01

Business owners who wish to formally establish an LLC.

02

Individuals looking to maintain or update their LLC information with the state.

03

Organizations seeking to comply with local business regulations.

04

Entrepreneurs applying for certain permits or licenses that require proof of LLC registration.

Fill

form

: Try Risk Free

People Also Ask about

What does LLC mean in English?

Limited liability company (LLC)

How much is the Illinois LLC fee?

In general, the base price for an Illinois LLC is $150. That is the only required fee for all new LLCs in the state. You can choose to add on services, such as hiring a registered agent or paying for expedited processing of your application.

How much does it cost for LLC in Illinois?

Many websites claim to help you get an LLC for free, but every LLC will require a fee paid to the state. In Illinois, it's $150.

Can you get a free LLC in Illinois?

State LLC Costs: Overview StateState FeeAnnual Fee California $70.00 $800 Colorado $50.00 $10 Connecticut $120.00 $80 Delaware $110.00 $30047 more rows

How much does an LLC normally cost?

Illinois State Income Tax Illinois has a flat income tax rate of 4.95% for both individuals and corporations. This means that LLC members will pay 4.95% of their share of the LLC's profits, regardless of their income level.

How much is a Series LLC in Illinois?

These rules typically apply to all LLCs, no matter what state they are formed in. Your LLC Name Must Be Unique. The business name you've chosen cannot be used by any other LLC or corporation in the State of Illinois. Your LLC Name Must Not Be Confusable with Another Business Name. Your LLC Name Must Contain Certain Words.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LLC-5.5?

LLC-5.5 is a specific form used for reporting information related to limited liability companies (LLCs) for tax purposes.

Who is required to file LLC-5.5?

Owners of limited liability companies (LLCs) that are subject to the reporting requirements must file LLC-5.5.

How to fill out LLC-5.5?

To fill out LLC-5.5, provide all requested information accurately, including details about the LLC's ownership, management, and financial status as per the form's instructions.

What is the purpose of LLC-5.5?

The purpose of LLC-5.5 is to collect pertinent information regarding LLCs for regulatory and tax purposes, ensuring compliance with state laws.

What information must be reported on LLC-5.5?

The information that must be reported on LLC-5.5 generally includes the LLC's name, address, ownership structure, income, and any other details as specified on the form.

Fill out your llc-55 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Llc-55 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.