OH CCA Form 120-16-IR 2021 free printable template

Show details

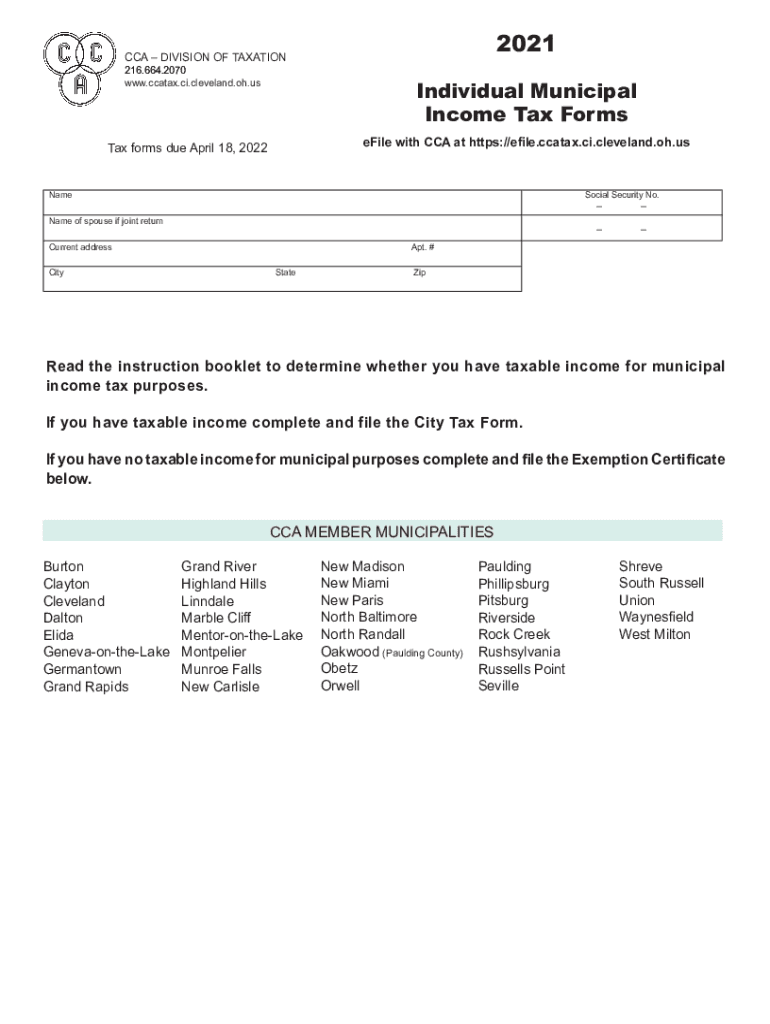

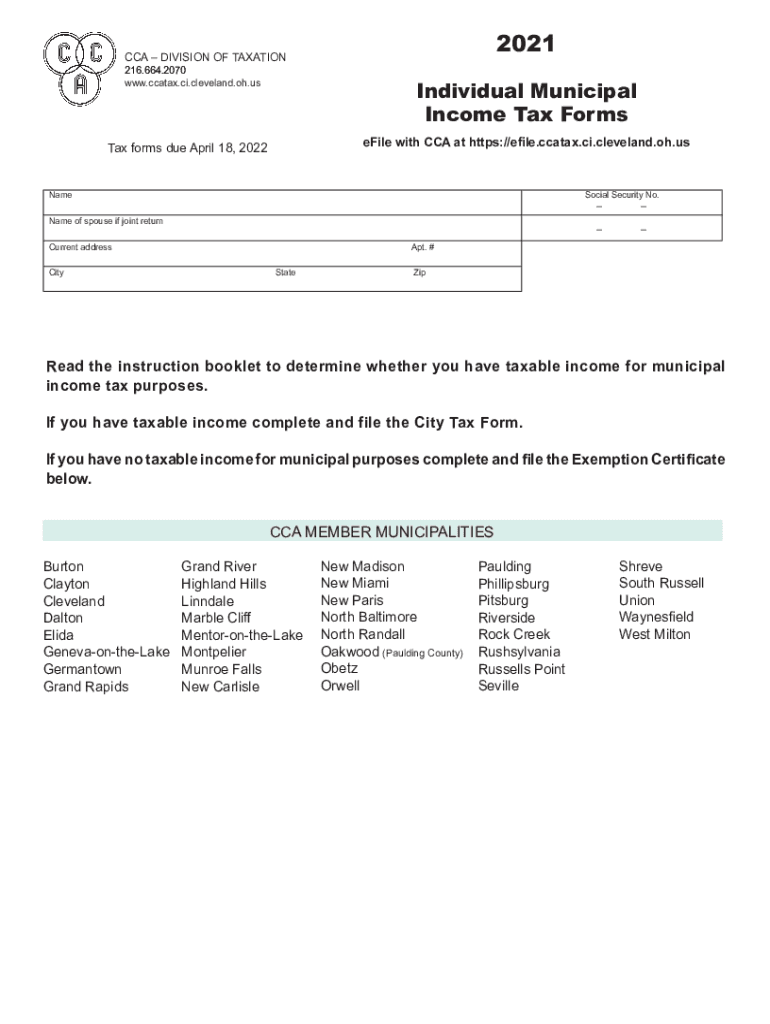

2021CCA DIVISION OF TAXATION 216.664.2070 www.ccatax.ci.cleveland.oh.usIndividual Municipal Income Tax Forms H)LOHZLWK&&$DWKWWSVHOHFFDWD[FLFOHYHODQGRKXVTax forms due April 18, 2022NameSocial Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH CCA Form 120-16-IR

Edit your OH CCA Form 120-16-IR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH CCA Form 120-16-IR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH CCA Form 120-16-IR online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OH CCA Form 120-16-IR. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH CCA Form 120-16-IR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH CCA Form 120-16-IR

How to fill out OH CCA Form 120-16-IR

01

Obtain the OH CCA Form 120-16-IR from the designated website or office.

02

Fill in your personal information in the designated fields including name, address, and contact details.

03

Provide details about the specific services or assistance you are applying for.

04

Include any required documentation or evidence that supports your application.

05

Review the form for accuracy and completeness before submission.

06

Submit the form according to the instructions provided, either online or via mail.

Who needs OH CCA Form 120-16-IR?

01

Individuals who are applying for assistance through the OH CCA program.

02

Families seeking support for child care costs.

03

Anyone who qualifies for financial assistance related to child care services in Ohio.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file a Cleveland tax return?

Every Ohio resident and every part-year resident is subject to the Ohio income tax. Every nonresident having Ohio-sourced income must also file.

Where can I file my taxes in Cleveland Ohio?

Free tax service and preparation in Cleveland, Ohio Tax Site HostAddressESOP11890 Fairhill Road, Cleveland, OH 44120Famicos Foundation1325 Ansel Rd, Cleveland, OH 44106Gordon Square6516 Detroit Ave, Cleveland, OH 44102Mt. Pleasant13815 Kinsman Rd, Cleveland, OH 441204 more rows

Do Ohio cities tax capital gains?

In addition, municipalities generally exempt the following: • Old-age pensions and disability benefits. Capital gains and losses. Personal exemptions are not granted.

Who has to file CCA Ohio?

1120C Corporations, Subchapter S Corporations, and Partnerships, including LLC's and REIT's doing business in our area are required to file the Net Profit form. Trusts with rental in a CCA community are required to file a CCA Net Profit form.

What happens if you don't file local taxes in Ohio?

A late filing penalty may be imposed at the rate of $25 per month (or fraction of a month) that a return, other than an estimated income tax return, remains unfiled. This late filing penalty applies regardless of the liability on the return. The late filing penalty shall not exceed $150 for each failure to timely file.

Is Cleveland a CCA city?

CCA is the City of Cleveland Central Collection Agency. CCA collects municipal income tax for the City of Cleveland and approximately 50 other cities and villages.

Is City of Columbus RITA or CCA?

Central Collection Agency (CCA) Note: The City of Columbus will still administer income tax for the North Pickaway County and Prairie Township Joint Economic Development Districts (JEDDs).

What cities in Ohio have CCA tax?

Links to Member Municipalities Burton. Clayton. Dalton. Elida. Geneva-on-the-Lake. Germantown. Grand Rapids. Grand River.

Who must file a Cleveland tax return?

Resident individuals who are 18 years of age and older must file an annual return, even if no tax is due.

Who is exempt from filing Ohio State taxes?

You DO NOT have to file an Ohio return if: Your Ohio AGI is less than or equal to $0. Your Senior Citizen Credit, Lump-Sum Distribution Credit and Joint Filing Credit is equal to or exceeds you income tax liability AND you are not liable for school district income tax.

How do I pay my city taxes in Ohio?

Payment can be made by credit or debit card (Discover, Visa, MasterCard or American Express) using the department's Online Services, Guest Payment Service, directly visiting ACI Payments, Inc. or by calling 1-800-272-9829.

Do I have to file Cleveland City taxes?

As of Jan. 1, Ohio law has changed, and cities must return taxes paid for employees who never worked inside their boundaries. For some, this could mean a lot of money – up to 2.5% in Cleveland. For others, the savings could be non-existent.

Who must file an Ohio city tax return?

Ohio IT 1040 Filing Requirement: Every Ohio resident and every part-year resident is subject to the Ohio income tax.

Who is obligated to file a tax return?

Most U.S. citizens – and permanent residents who work in the United States – need to file a tax return if they make more than a certain amount for the year. You may want to file even if you make less than that amount, because you may get money back if you file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OH CCA Form 120-16-IR from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your OH CCA Form 120-16-IR into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in OH CCA Form 120-16-IR without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing OH CCA Form 120-16-IR and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the OH CCA Form 120-16-IR in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your OH CCA Form 120-16-IR.

What is OH CCA Form 120-16-IR?

OH CCA Form 120-16-IR is a tax form used by Ohio residents to report income received from various sources for taxation purposes.

Who is required to file OH CCA Form 120-16-IR?

Individuals who receive income from sources such as wages, pensions, or other non-business income and are subject to Ohio taxes must file OH CCA Form 120-16-IR.

How to fill out OH CCA Form 120-16-IR?

To fill out the OH CCA Form 120-16-IR, taxpayers need to provide their personal information, including name, address, and Social Security number, report their income sources and amounts, and calculate the applicable Ohio taxes.

What is the purpose of OH CCA Form 120-16-IR?

The purpose of OH CCA Form 120-16-IR is to allow taxpayers to report their income to the Ohio tax authorities and ensure that they fulfill their tax obligations.

What information must be reported on OH CCA Form 120-16-IR?

The information that must be reported on OH CCA Form 120-16-IR includes personal identification details, total income received, deductions if applicable, and the corresponding Ohio tax liability.

Fill out your OH CCA Form 120-16-IR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH CCA Form 120-16-IR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.