VA COR 001 2016-2025 free printable template

Show details

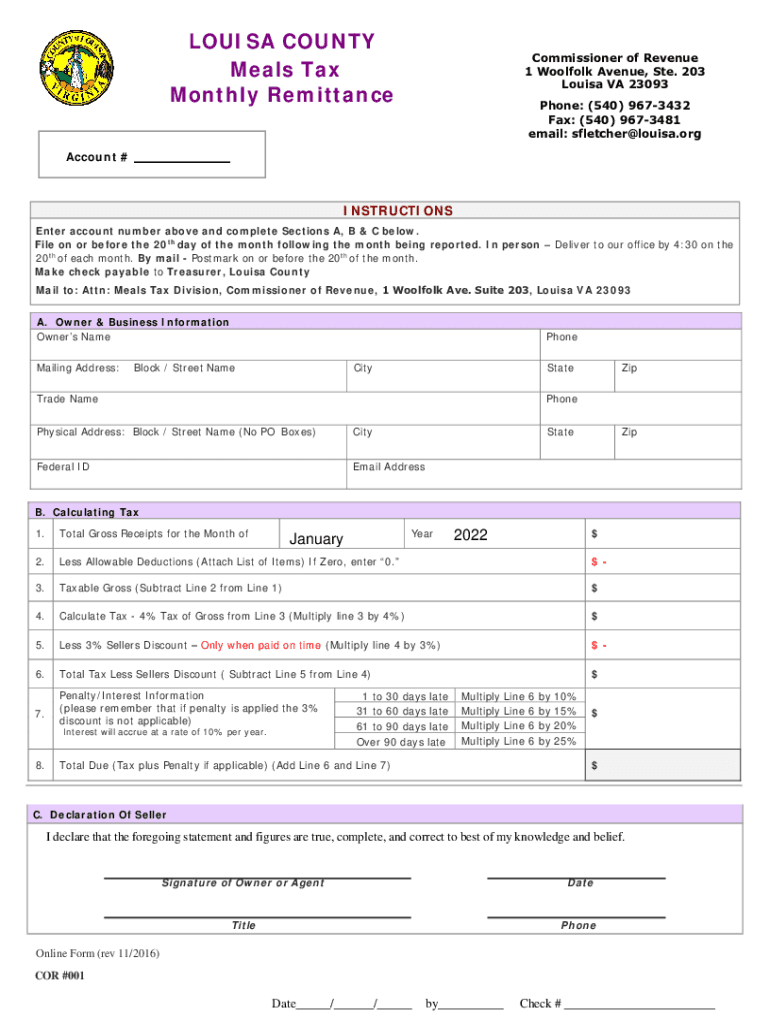

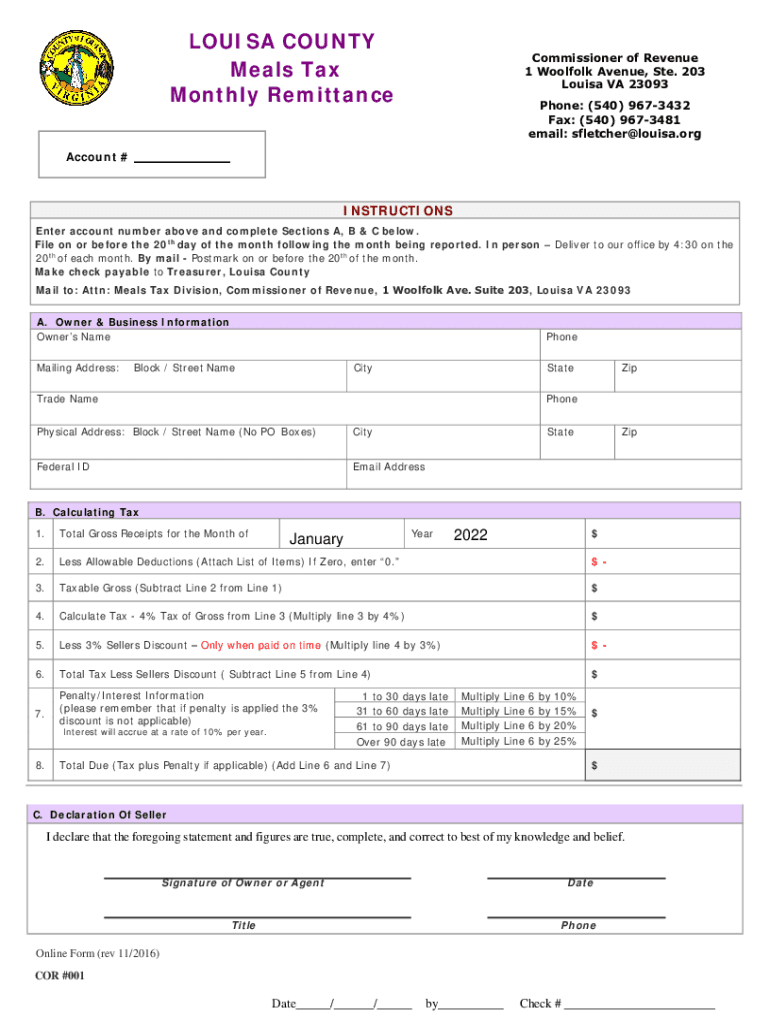

LOUISA COUNTY Meals Tax Monthly RemittanceCommissioner of Revenue 1 Wool folk Avenue, Ste. 203 Louisa VA 23093 Phone: (540) 9673432 Fax: (540) 9673481 email: sfletcher@louisa.orgAccount #INSTRUCTIONS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA COR 001

Edit your VA COR 001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA COR 001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA COR 001 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit VA COR 001. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA COR 001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA COR 001

How to fill out VA COR 001

01

Obtain the VA COR 001 form from the official VA website or your contracting officer.

02

Fill out the contractor's information, including the name, address, and contact details.

03

Provide the project title and the contract number associated with the VA project.

04

Indicate the period of performance for the contract.

05

Specify the tasks and deliverables that are expected from the contractor.

06

Include any relevant government specifications or requirements.

07

Sign and date the form, ensuring that it is completed accurately.

08

Submit the completed form to the appropriate VA office as specified in the instructions.

Who needs VA COR 001?

01

Contractors working with the Department of Veterans Affairs (VA) on government contracts.

02

VA Contracting Officers who require documentation for contract management.

03

Project Managers overseeing projects that involve VA contracts.

Fill

form

: Try Risk Free

People Also Ask about

What is Massachusetts local sales tax?

The Massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property (including gas, electricity, and steam) and telecommunications services1 sold or rented in Massachusetts.

What is the meals tax in Louisa County?

The rate for Meals Tax shall be 4% of the amount paid where food is prepared and served to the public on or off the premises, or any place where food is served. This tax is collected by the seller and remitted monthly to the County, by the 20th of month following the month collected.

What is the Massachusetts use tax?

Overview. Use tax is a 6.25% tax paid on out-of-state or out-of-country purchases of tangible personal property that are used, stored or consumed in Massachusetts and on which no Massachusetts sales tax (or less than 6.25%) was paid.

What is the meals tax in Bristol Virginia?

Bristol, Virginia's seven percent meals tax applies to purchases of prepared food in restaurants, on top of the state's sales tax.

What is the tax in Louisa County Virginia?

The minimum combined 2023 sales tax rate for Louisa County, Virginia is 5.3%. This is the total of state and county sales tax rates. The Virginia state sales tax rate is currently 4.3%. The Louisa County sales tax rate is 1%.

What is mass hotel tax rate?

Massachusetts has a state room occupancy excise tax rate of 5.7%. Depending on the city or town, a local option room occupancy tax and other taxes and fees may also apply. The room occupancy excise tax applies to room rentals of 90 days or less in hotels, motels, bed and breakfast establishments, and lodging houses.

What is mass local meals tax?

Overview. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. The meals tax rate is 6.25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify VA COR 001 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your VA COR 001 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in VA COR 001?

The editing procedure is simple with pdfFiller. Open your VA COR 001 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit VA COR 001 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing VA COR 001.

What is VA COR 001?

VA COR 001 is a form used by the Department of Veterans Affairs to collect information regarding contract oversight and performance from CORs (Contracting Officer Representatives).

Who is required to file VA COR 001?

VA COR 001 must be filed by Contracting Officer Representatives (CORs) who oversee contracts on behalf of the Department of Veterans Affairs.

How to fill out VA COR 001?

To fill out VA COR 001, you need to provide detailed information about the contract, including contract number, contractor details, performance metrics, and any issues observed during the contract execution.

What is the purpose of VA COR 001?

The purpose of VA COR 001 is to ensure proper oversight and documentation of contract performance, facilitating accountability and compliance within the contracting process.

What information must be reported on VA COR 001?

VA COR 001 requires reporting of information such as contract details, performance evaluations, contractor compliance, any challenges faced, and recommendations for improvements.

Fill out your VA COR 001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA COR 001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.