Get the free Form 500

Show details

Este formulario puede ser utilizado por un contribuyente para autorizar a la Oficina del Comisionado de Impuestos del Estado a divulgar información fiscal confidencial a otro individuo o firma no

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 500

Edit your form 500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 500 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 500. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

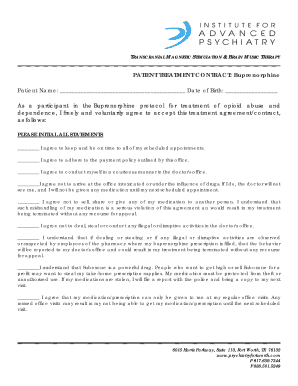

How to fill out form 500

How to fill out Form 500

01

Download Form 500 from the official website or obtain it from your local office.

02

Provide your personal information at the top of the form, including your name, address, and contact details.

03

Fill out the sections regarding your income, deductions, and any exemptions that apply to you.

04

Double-check the instructions for any additional required information specific to your situation.

05

Sign and date the form at the designated area to certify that the information provided is accurate.

06

Submit the completed form by mail or electronically based on the instructions provided.

Who needs Form 500?

01

Individuals or businesses who are required to report their income or tax liability.

02

Taxpayers looking to claim specific deductions or credits associated with their income.

03

Those who may be eligible for any exemptions under tax regulations.

04

Any residents or entities mandated by local tax laws to submit Form 500.

Fill

form

: Try Risk Free

People Also Ask about

What is a form 500?

The FCC Form 500 (Funding Commitment Adjustment Request Form) is used to submit changes to funding requests after USAC has issued commitments for those requests.

What is Georgia form 500 Nol for?

This form is for a net operating loss carry-back adjustment by an individual or fiduciary that desires a refund of taxes afforded by carry-back of a net operating loss. Complete, save and print the form online using your browser.

What is a 1098 tax form used for?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor. Report only interest on a mortgage, defined later.

What is a schedule e form used for?

Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

What is the e file form?

Electronic filing, or e-filing, is the process of submitting your completed individual income tax return (which includes all of your filing information) to the Internal Revenue Service (IRS) over the Internet.

What form do I use to file NC state taxes?

2021 FormTax YearDescription D-400 2021 Individual Income Tax Return D-401 2021 Individual Income Tax Instructions Schedule A 2021 North Carolina Itemized Deductions Schedule S 2021 North Carolina Supplemental Schedule6 more rows

What is a Georgia form 500?

Georgia Form 500 is used by individuals to report annual income earned during the tax year. This important document ensures that residents comply with state tax laws and accurately calculate their liabilities and eligible deductions.

What is form E 500?

This file provides detailed instructions for completing Form E-500, used for filing North Carolina state, local, and transit sales and use taxes. It outlines necessary information, penalties for non-compliance, and specific requirements for various types of transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 500?

Form 500 is a tax form used to report certain financial information, typically in relation to income or business activities, to the appropriate tax authority.

Who is required to file Form 500?

Individuals or entities that meet specific income thresholds or engage in certain business activities as defined by the tax regulations are required to file Form 500.

How to fill out Form 500?

To fill out Form 500, individuals should gather the necessary financial information, follow the instructions provided on the form, and accurately complete each section before submitting it to the tax authority.

What is the purpose of Form 500?

The purpose of Form 500 is to provide the tax authority with detailed information regarding income, deductions, and other relevant financial details to ensure proper tax assessment and compliance.

What information must be reported on Form 500?

Information that must be reported on Form 500 typically includes total income, taxable income, deductions, tax credits, and any other pertinent financial data as specified by the tax authorities.

Fill out your form 500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 500 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.