Get the free Payroll Deduction - Development Accounting - Auburn University

Show details

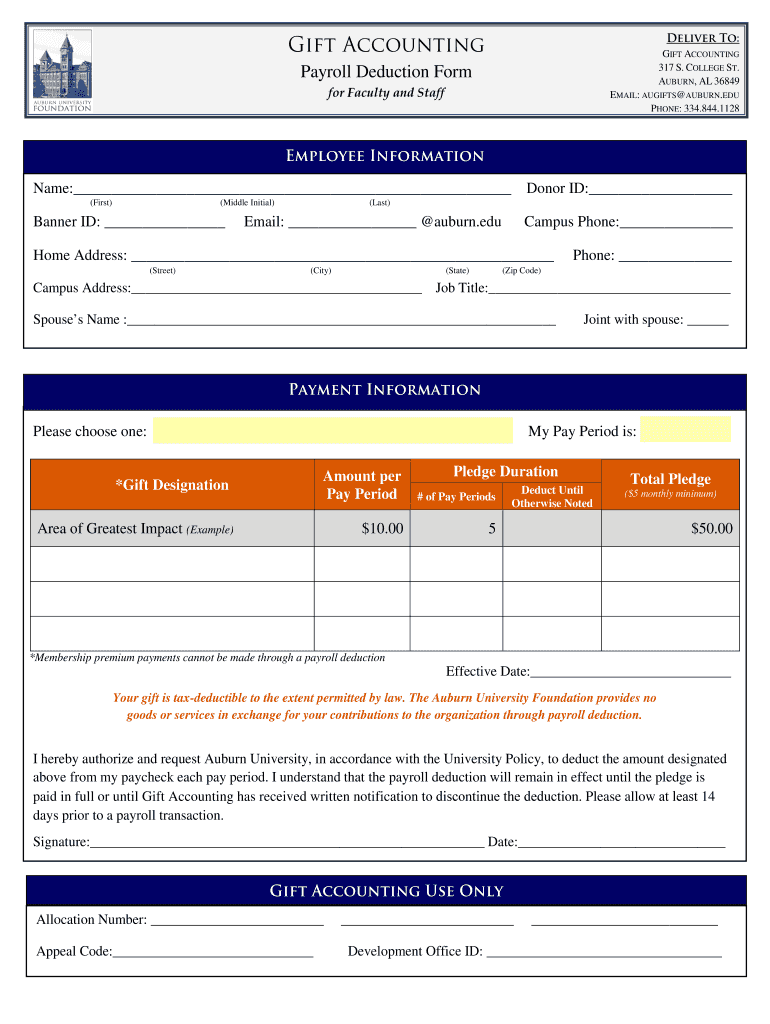

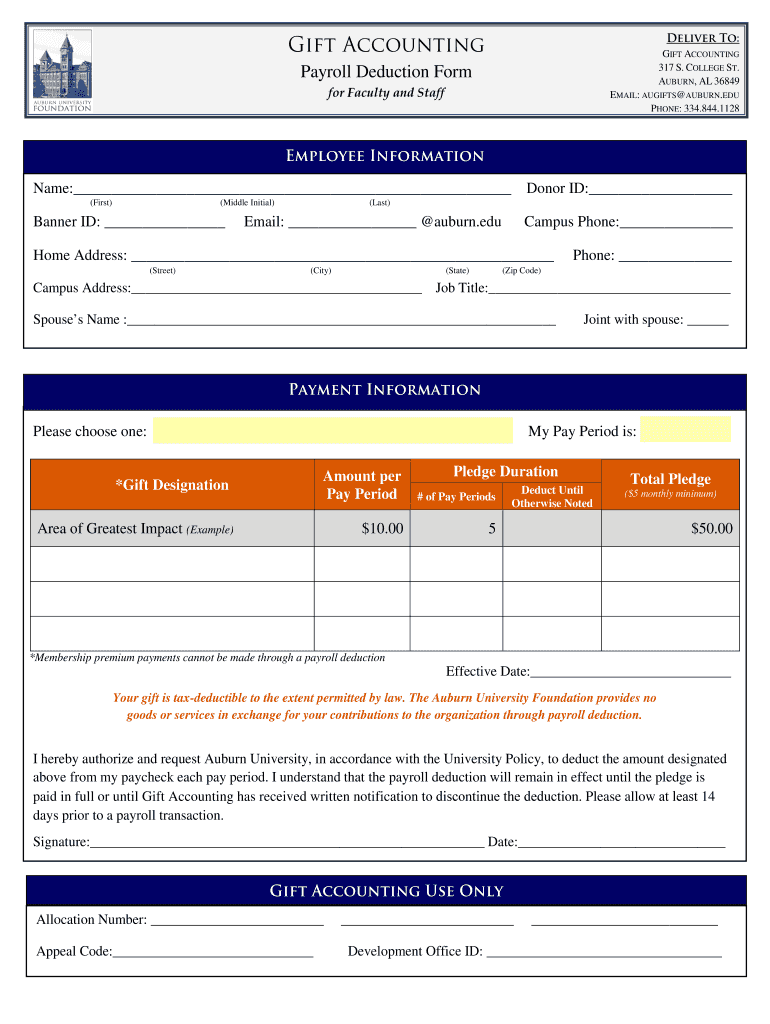

Deliver To: Gift Accounting Reset Form GIFT ACCOUNTING 317 S. COLLEGE ST. AUBURN, AL 36849 EMAIL: GIFTS AUBURN.EDU PHONE: 334.844.1128 Payroll Deduction Form for Faculty and Staff Employee Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll deduction - development

Edit your payroll deduction - development form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll deduction - development form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll deduction - development online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payroll deduction - development. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll deduction - development

How to fill out payroll deduction - development:

01

Begin by gathering all the necessary information and forms required for the payroll deduction process. This may include employee details, salary information, and any specific deduction options available.

02

Ensure that you have a clear understanding of the payroll deduction policy and guidelines provided by your organization or employer. Familiarize yourself with the types of deductions that can be made and any limitations or restrictions that apply.

03

Review the payroll deduction form carefully and accurately fill in the required fields. This may include personal information, deduction amount, frequency, and the reason for the deduction.

04

If multiple deductions need to be made, clearly separate and categorize each deduction on the form. Provide any supporting documentation or authorization if required.

05

Double-check all the entered information to ensure accuracy and completeness. Any errors or omissions may cause delays or incorrect deductions.

06

Submit the filled-out form to the appropriate department or individual responsible for processing payroll deductions. Follow any specific submission guidelines or deadlines provided by your organization.

07

Keep a copy of the completed form and any relevant supporting documentation for your records. This can serve as proof of the requested payroll deduction and can be useful for future reference or inquiries.

Who needs payroll deduction - development:

01

Employees who want to contribute to a retirement or investment plan through automatic deductions from their paycheck.

02

Individuals who are repaying a loan or debt and prefer to have the payments deducted directly from their salary.

03

Employees who wish to make charitable donations through payroll deductions.

04

Individuals who have opted for insurance coverage or benefits that require regular premium payments deducted from their earnings.

05

Employees who have elected to participate in a savings or flexible spending account that is funded through payroll deductions.

06

Individuals who are repaying an advance or salary overpayment, and need to have a specific amount deducted each pay period to clear the balance.

07

Employees who have opted for additional voluntary benefits, such as dental or vision coverage, that are paid for through payroll deductions.

08

Individuals who have signed up for union or association dues, which are typically deducted from their wages automatically.

09

Employees who have requested wage garnishments due to court-ordered child support or other legal obligations.

10

Individuals who have chosen to contribute to a company-sponsored wellness program or employee assistance program through payroll deductions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get payroll deduction - development?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the payroll deduction - development in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my payroll deduction - development in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your payroll deduction - development and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit payroll deduction - development on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share payroll deduction - development on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is payroll deduction - development?

Payroll deduction - development is the process of subtracting a certain amount of money from an employee's paycheck to cover expenses such as taxes, benefits, or retirement contributions.

Who is required to file payroll deduction - development?

Employers are required to file payroll deduction - development for each employee to ensure compliance with tax regulations and employee benefit programs.

How to fill out payroll deduction - development?

Payroll deduction - development is typically filled out by the employer using the employee's information and deduction amounts, then deducted from each paycheck accordingly.

What is the purpose of payroll deduction - development?

The purpose of payroll deduction - development is to ensure that employees contribute their share towards taxes, benefits, or retirement savings in an organized and consistent manner.

What information must be reported on payroll deduction - development?

Information such as employee name, Social Security number, deduction amounts, and the reason for each deduction must be reported on payroll deduction - development.

Fill out your payroll deduction - development online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Deduction - Development is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.