Get the free PSC EmployeeIndependent Contractor Classification Checklist

Show details

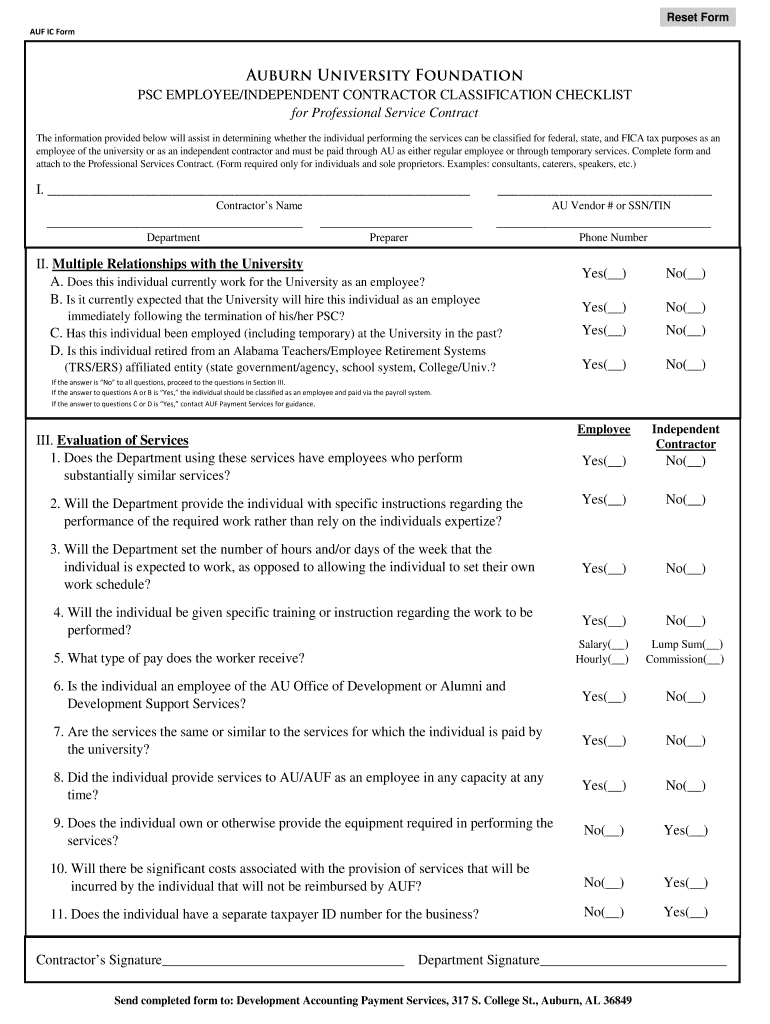

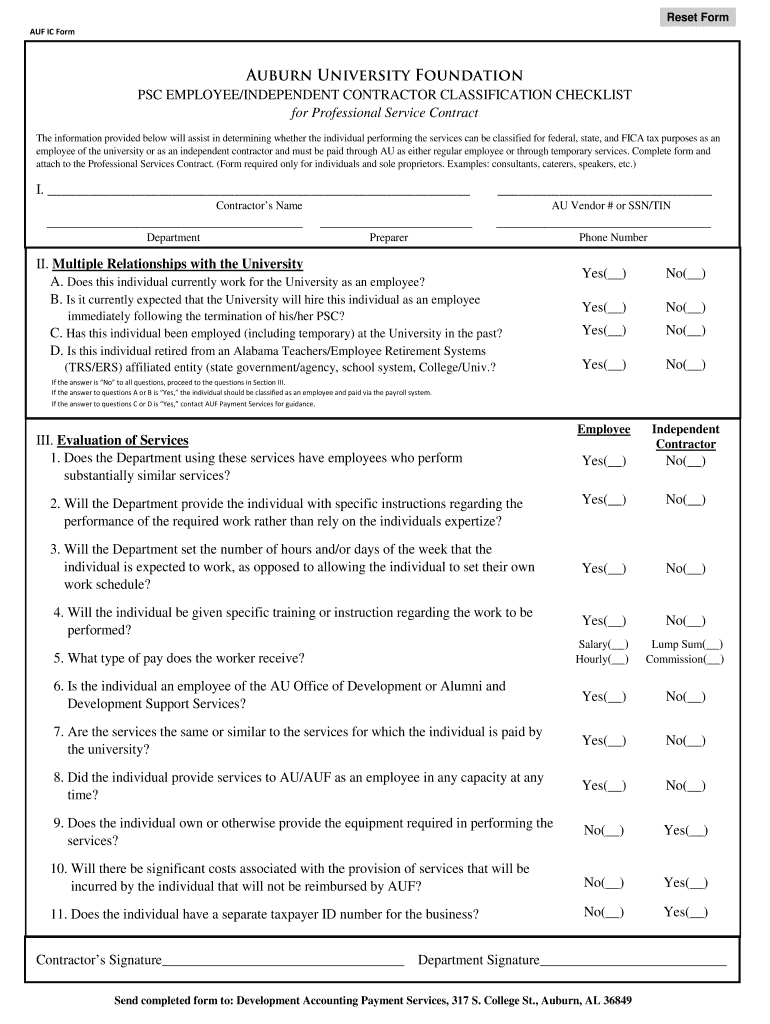

Reset Form AUF IC Form Auburn University Foundation PSC EMPLOYEE/INDEPENDENT CONTRACTOR CLASSIFICATION CHECKLIST for Professional Service Contract The information provided below will assist in determining

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign psc employeeindependent contractor classification

Edit your psc employeeindependent contractor classification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your psc employeeindependent contractor classification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing psc employeeindependent contractor classification online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit psc employeeindependent contractor classification. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out psc employeeindependent contractor classification

How to fill out PSC (Personal Service Company) Employee/Independent Contractor classification?

01

Determine your employment status: Before filling out the classification form, it's essential to determine if you should be classified as an employee or an independent contractor. Consider factors such as control over your work, the level of financial risk, and the degree of independence in decision-making.

02

Obtain and read the PSC classification form: Look for the specific form provided by your local tax or labor authorities that is designed for PSC employee/independent contractor classification. Read through the instructions carefully to understand the requirements and guidelines for completing the form accurately.

03

Provide personal information: Start by filling out your personal information, including your full name, address, contact details, and any identification numbers required by your jurisdiction, such as a social security or national insurance number.

04

Employment history: Provide details about your employment history, including the names of previous employers, the duration of employment, and your job titles or roles. This information helps establish the context for your current classification.

05

Job description and responsibilities: Describe in detail the nature of the work you perform for your clients or employer. Include information about your job duties, tasks, responsibilities, and any required qualifications or skills.

06

Control and independence: Answer the questions related to the level of control and independence you have in your work. These questions typically inquire about your freedom to choose how, when, and where to complete the tasks, as well as whether you provide your own equipment or tools.

07

Financial aspects: Provide information about the financial arrangements of your work, such as how you are compensated, whether you have the opportunity to profit or incur losses, and if you receive benefits or participate in pension plans through your client or employer.

08

Legal and contractual agreements: Indicate any legal or contractual agreements you have with your clients or employer that specifically outline your employment status. This may include service agreements or contracts that designate you as an employee or an independent contractor.

09

Submit the form: Once you have completed all the required sections of the classification form, review it for accuracy and completeness. Make sure you have provided all the necessary supporting documents, such as contracts or agreements, as instructed. Sign and date the form, and submit it according to the designated process outlined by your jurisdiction.

Who needs PSC Employee/Independent Contractor classification?

01

Individuals working through a Personal Service Company (PSC): If you operate through a PSC, it is crucial to determine your employment status correctly. This classification helps ensure compliance with tax laws, labor regulations, and appropriate entitlements.

02

Employers or Clients: The classification also provides clarity for employers or clients engaging the services of individuals through a PSC. Understanding whether someone is an employee or an independent contractor helps employers fulfill their legal and financial obligations accurately.

03

Tax and Labor Authorities: Tax and labor authorities require PSC employee/independent contractor classification to ensure proper tax collection, social security contributions, and to monitor compliance with labor laws. This process helps to prevent tax evasion and protect workers' rights.

The correct classification is essential to avoid misunderstandings between parties, maintain compliance with legal requirements, and protect the rights of both individuals and organizations involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in psc employeeindependent contractor classification without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing psc employeeindependent contractor classification and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete psc employeeindependent contractor classification on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your psc employeeindependent contractor classification. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete psc employeeindependent contractor classification on an Android device?

Use the pdfFiller Android app to finish your psc employeeindependent contractor classification and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is psc employee/independent contractor classification?

PSC employee/independent contractor classification is a classification system used to distinguish between individuals who are considered employees and those who are considered independent contractors.

Who is required to file psc employee/independent contractor classification?

Employers or businesses who hire individuals as either employees or independent contractors are required to file psc employee/independent contractor classification forms.

How to fill out psc employee/independent contractor classification?

To fill out psc employee/independent contractor classification, employers need to provide information about the individual's work status, job responsibilities, and any relevant employment contracts or agreements.

What is the purpose of psc employee/independent contractor classification?

The purpose of psc employee/independent contractor classification is to determine the tax and employment status of individuals working for a business, and to ensure compliance with labor laws and regulations.

What information must be reported on psc employee/independent contractor classification?

Information such as the individual's name, address, social security number, job title, duties, and payment arrangements must be reported on psc employee/independent contractor classification forms.

Fill out your psc employeeindependent contractor classification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Psc Employeeindependent Contractor Classification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.