Get the free CUSTOMS POWER OF ATTORNEY

Show details

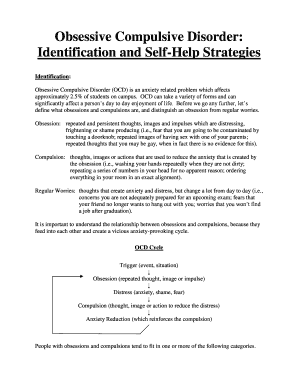

This document serves as a power of attorney for an individual, partnership, corporation, or sole proprietorship, delegating authority to an agent to act on behalf of the grantor in customs matters,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs power of attorney

Edit your customs power of attorney form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs power of attorney form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customs power of attorney online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit customs power of attorney. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customs power of attorney

How to fill out CUSTOMS POWER OF ATTORNEY

01

Obtain a Customs Power of Attorney form from the relevant customs authority or their website.

02

Fill in the name and address of the grantor (the person or company giving the power).

03

Provide the name and address of the attorney-in-fact (the person or company that will act on behalf of the grantor).

04

Specify the types of transactions the attorney-in-fact is authorized to perform.

05

Include any additional information as required, such as identification numbers or specific instructions.

06

Sign and date the form in the designated space.

07

If required, have the form notarized or witness-signed, depending on local regulations.

08

Submit the completed form to the customs authority or keep it for your records as needed.

Who needs CUSTOMS POWER OF ATTORNEY?

01

Importers who need someone to handle their customs documentation.

02

Exporters who require a representative to deal with export procedures.

03

Individuals or businesses sending goods internationally that require customs clearance.

04

Customs brokers or agents acting on behalf of clients in import and export transactions.

Fill

form

: Try Risk Free

People Also Ask about

What three decisions cannot be made by a legal power of attorney?

When someone makes you the agent in their power of attorney, you cannot: Write a will for them, nor can you edit their current will. Take money directly from their bank accounts. Make decisions after the person you are representing dies. Give away your role as agent in the power of attorney.

How long is an IRS power of attorney good for?

You can find the address and fax number for your state in the 'Where to File Chart' included with the IRS Instructions for Form 2848. An IRS power of attorney stays in effect for seven years, or until you or your representative rescinds it.

How often does a power of attorney need to be updated?

It is commonly used for estate planning, medical management, financial management, and real estate transactions. A POA should be reviewed every few years for possible updates. It may become necessary to update a power of attorney when life situations change, a new agent is needed, or when there are changes in the law.

What is the maximum validity of a power of attorney?

The agent under this POA can handle various tasks like buying or selling real estate or entering into contracts on behalf of the principal. Usually, General Power of Attorney remains valid for the entire life of the principal, but it can also have a specific duration, such as one year or more, if mentioned.

What is a customs power of attorney?

A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf. A signed POA is necessary in order to clear your goods through US Customs.

What is a customs power of attorney?

A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf. A signed POA is necessary in order to clear your goods through US Customs.

How long is a customs power of attorney good for?

By granting a Power of Attorney, the grantor authorizes the broker to transact with the CBP in their name. Power of Attorney is valid indefinitely until it has been revoked. An exception to this rule is partnerships - a PoA issued by a partnership is valid for two years only, after which time it must be renewed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

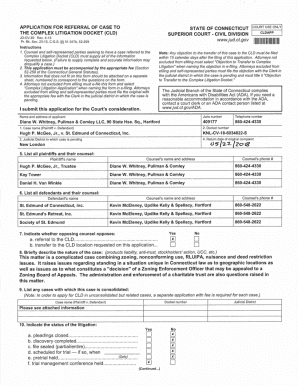

What is CUSTOMS POWER OF ATTORNEY?

CUSTOMS POWER OF ATTORNEY is a legal document that allows a customs broker to act on behalf of a principal (usually an importer or exporter) in customs matters, including the submission of import and export documentation to customs authorities.

Who is required to file CUSTOMS POWER OF ATTORNEY?

Any individual or business that wishes to have a customs broker clear goods through customs on their behalf is required to file a CUSTOMS POWER OF ATTORNEY.

How to fill out CUSTOMS POWER OF ATTORNEY?

To fill out a CUSTOMS POWER OF ATTORNEY, you need to provide accurate information about the principal's details (name, address, and contact information) and specify the customs broker's details. You may also need to indicate the type of power of attorney being granted (temporary or permanent) and sign the document.

What is the purpose of CUSTOMS POWER OF ATTORNEY?

The purpose of CUSTOMS POWER OF ATTORNEY is to authorize a customs broker to handle customs transactions on behalf of the principal, ensuring that all legal obligations related to importing and exporting are properly managed and fulfilled.

What information must be reported on CUSTOMS POWER OF ATTORNEY?

Information that must be reported on a CUSTOMS POWER OF ATTORNEY includes the principal's name, address, and contact details, the broker's name and address, the type of authority being granted, and the signature of the principal or their authorized representative.

Fill out your customs power of attorney online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs Power Of Attorney is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.