Get the free Form IT-370 Application for Automatic Six-Month Extension of ...

Show details

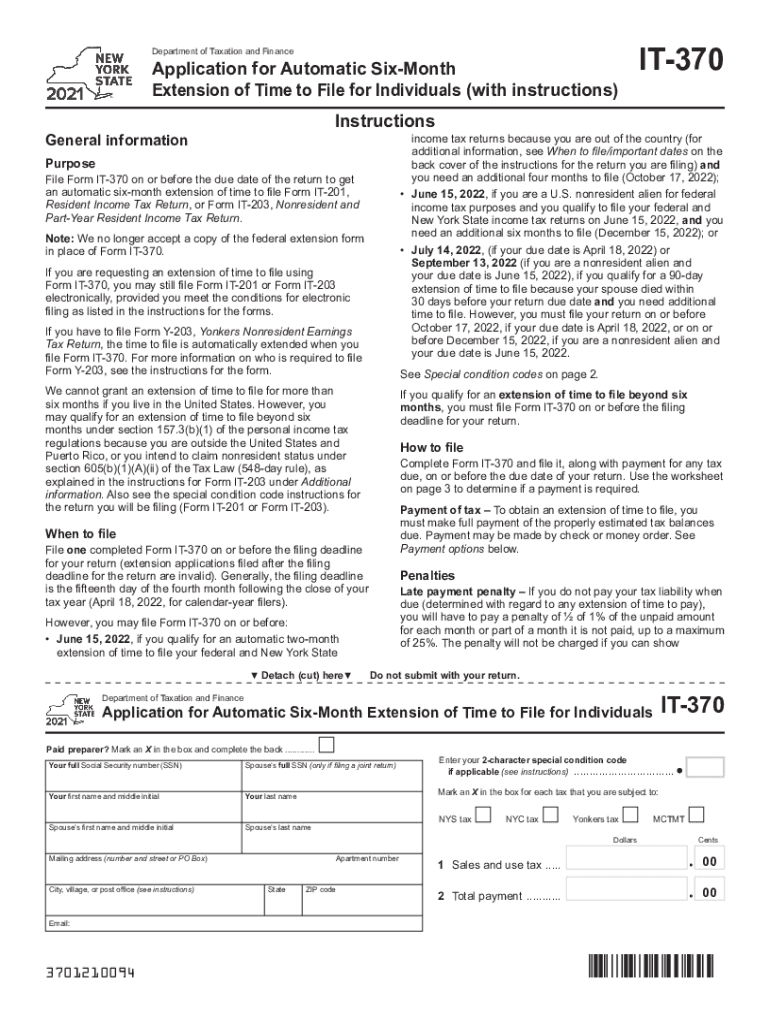

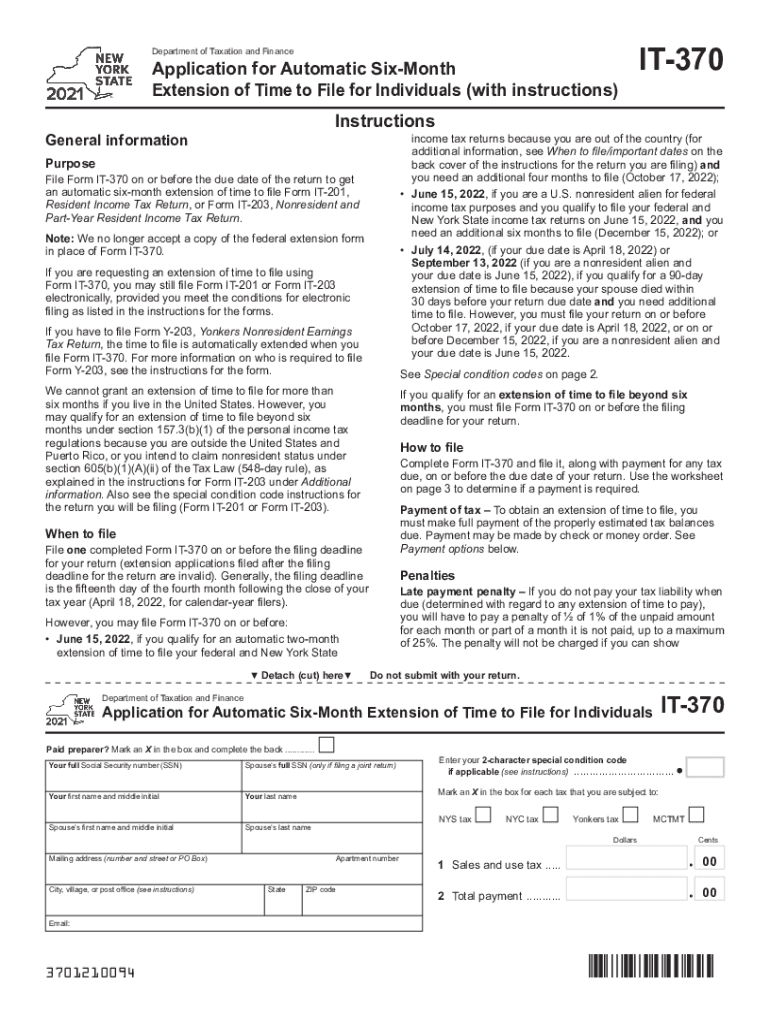

Department of Taxation and FinanceApplication for Automatic Month Extension of Time to File for Individuals (with instructions)IT370InstructionsGeneral information Purposeful Form IT370 on or before

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form it-370 application for

Edit your form it-370 application for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form it-370 application for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form it-370 application for online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form it-370 application for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form it-370 application for

How to fill out form it-370 application for:

01

Ensure you have all the necessary documentation and information, such as your income statements, tax returns, and any supporting documents related to your business.

02

Begin by filling out the basic information section of the form, including your name, address, and social security number.

03

Move on to the sections that pertain to your business, such as the type of entity and the specific tax year being reported.

04

Fill in the sections that require information about your business activities and gross receipts, providing accurate figures and details.

05

Complete any additional sections that apply to your specific situation, such as the recapture of investment credit or the disposition of assets.

06

Once you have filled out all relevant sections, review the form for completeness and accuracy, making any necessary corrections.

07

Sign and date the form, along with providing any required authorization or consent.

08

Make copies of the completed form for your records before submitting it to the appropriate tax authority.

Who needs form it-370 application for:

01

Individuals or businesses that have taxable business income in New York State.

02

Taxpayers who need to report their gross receipts and calculate their New York State modifications.

03

Businesses that need to recapture investment credit or report any disposition of assets for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I request a 6-month IRS extension?

To get this automatic extension, you must file a paper Form 4868 or use IRS efile (electronic filing). The form must show your properly estimated tax liability based on the information available to you. You will not receive any notification from the IRS unless your extension request is denied.

What form does she need to complete to obtain an automatic six month extension?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Does NY extend with federal extension?

New York does not recognize a federal extension. If you cannot meet the filing deadline for a NY business return, you should request a six-month extension of time by filing Form CT-5, Request for Six-Month Extension to File (For Franchise/Business Taxes, MTA Surcharge, or Both), on or before the due date of the return.

Does NY State require an extension?

If you owe New York income taxes by April 18, 2023, you need to submit a NY extension or tax return to avoid late filing penalties. An extension will only avoid late filing penalties until Oct. 16, 2023. Note: Unless you pay all of your Taxes, or eFile your tax return by Oct.

How long of a tax extension can you get?

You may request up to an additional 6 months to file your U.S. individual income tax return. There are three ways to request an automatic extension of time to file your return. You must request the extension of time to file by the regular due date of your return to avoid the penalty for filing late.

What is form 4868 Automatic extension of time?

A U.S. citizen or resident files this form to request an automatic extension of time to file a U.S. individual income tax return.

Is California Automatic Extension?

File and Pay Extension California grants you an automatic extension to file your state tax return. No form is required. You must file by October 17, 2022.

How do I get a second extension on taxes beyond six months?

To do so, you'll need to include a letter explaining why you're in need of an additional tax extension. Mail your letter to the address found on Form 4868 under the heading “Where to File”.

Can I call the IRS and ask for an extension?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. We can't process extension requests filed electronically after April 18, 2022.

Are all tax extensions 6 months?

We automatically allow a 6-month extension for businesses to file Form 100S that are not suspended. For business entities that are not corporations, we automatically allow a 7-month extension.

Do you get an automatic extension on taxes?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022. An extension to file your tax return is not an extension to pay.

Is there an extension for California state taxes?

Use Payment for Automatic Extension for Individuals (FTB 3519) to make a payment by mail if both of the following apply: You cannot file your 2021 tax return by April 18, 2022.

Does CA require an extension?

Extensions - California has an automatic six-month extension to file an individual tax return. No form is required to request an extension. Form FTB 3519, Payment for Automatic Extension for Individuals.

How can I get a 6 month extension?

To get this automatic extension, you must file a paper Form 4868 or use IRS efile (electronic filing). The form must show your properly estimated tax liability based on the information available to you. You will not receive any notification from the IRS unless your extension request is denied.

Does NY give an automatic extension?

If you can't file on time, you can request an automatic extension of time to file the following forms: Form IT-201, Resident Income Tax Return. Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Is the IRS extension automatic?

The IRS will automatically process an extension of time to file when you pay part or all of your estimated income tax electronically. You can pay online or by phone.

Does New York grant automatic extension?

If you cannot file on time, you can request an automatic extension of time to file the following forms: Form IT-201, Resident Income Tax Return. Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Which form should he file to apply for an automatic extension?

Taxpayers who want more time for any reason to file federal income tax returns can use Form 4868. You can file the form when you need an extension for a variety of returns in the 1040 series including: Form 1040: U.S. Individual Tax Return.

Does form 8868 need to be filed electronically?

You can electronically file Form 8868 to request a 6-month automatic extension of time to file any of the forms listed below with the exception of Form 8870, Information Return for Transfers Associated With Certain Personal Benefit Contracts, for which an extension request must be sent to the IRS in paper format (see

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form it-370 application for to be eSigned by others?

Once you are ready to share your form it-370 application for, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete form it-370 application for online?

Easy online form it-370 application for completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in form it-370 application for?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form it-370 application for to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is form it-370 application for?

Form IT-370 is an application for an extension of time to file a New York State personal income tax return.

Who is required to file form it-370 application for?

Any individual taxpayer who needs an extension to file their New York State personal income tax return is required to file Form IT-370.

How to fill out form it-370 application for?

To fill out Form IT-370, provide personal information such as name, address, and Social Security number, indicate the type of tax return, the tax year, and the reasons for requesting the extension.

What is the purpose of form it-370 application for?

The purpose of Form IT-370 is to grant taxpayers an extension of time to file their income tax return without incurring penalties for late filing.

What information must be reported on form it-370 application for?

Form IT-370 requires reporting personal identification details, tax year, reason for extension, and the estimated amount of tax due, if any.

Fill out your form it-370 application for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form It-370 Application For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.