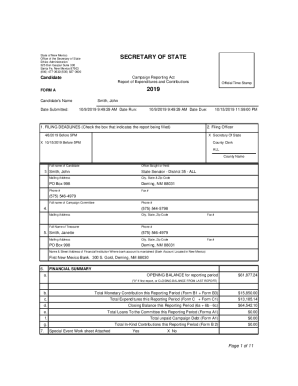

Get the free PEO Quarterly Report Form - consumer sc

Show details

Este formulario es requerido para que las organizaciones de empleadores profesionales en Carolina del Sur cumplan con los requisitos de patrimonio neto según el Código Seccional 40-68-40 (E). Requiere

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign peo quarterly report form

Edit your peo quarterly report form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your peo quarterly report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit peo quarterly report form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit peo quarterly report form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out peo quarterly report form

How to fill out PEO Quarterly Report Form

01

Obtain the PEO Quarterly Report Form from the official website or your PEO provider.

02

Fill in your PEO's name and address at the top of the form.

03

Enter the reporting period date range for the quarter.

04

Provide the number of employees covered under your PEO for the quarter.

05

List the total payroll expenses for the quarter.

06

Detail any workers' compensation claims filed during the quarter.

07

Fill in tax liabilities and any other necessary financial information.

08

Review the completed form for accuracy.

09

Sign and date the form at the designated section.

10

Submit the form to the appropriate state agency by the due date.

Who needs PEO Quarterly Report Form?

01

Professional Employer Organizations (PEOs) that manage employee-related services for businesses.

02

Employers utilizing PEO services to report employment and payroll details.

03

State agencies that require reporting for compliance with labor laws.

Fill

form

: Try Risk Free

People Also Ask about

What is a PEO report?

A PEO is sometimes referred to as an employee leasing organization. The contract between the PEO and the employer will provide that the PEO will perform some or all of the employment tax withholding, reporting and payment activities related to workers performing services for the employer.

What are the three types of PEO?

In this blog we will explain the three main types of PEO's – co-employers, professional employer organizations and staffing companies. Co-employers. The idea of giving complete power in the hands of an HR outsource company might not settle with everyone. Professional Employer Organization. Staffing Companies.

What is the difference between client reporting and PEO reporting?

A PEO is a firm that businesses partner with to outsource a wide range of employee management tasks, including but not limited to payroll, benefits administration, HR tasks, and compliance with state and federal laws. When you partner with a PEO, you enter into a co-employment relationship.

Which states do not recognize a PEO?

While every state recognizes them as employers, there are no uniform laws for PEOs across all 50 states.

What qualifies as a PEO?

A PEO (professional employer organization) acts as a co-employer and performs more services for its clients and shares the financial risk of your business. An HRO (human resources outsourcing) only provides the specific services that you choose.

What does PEO stand for?

In PEO- and hybrid-reporting states, your business gets the rate assigned to your PEO. In client-reporting states, your business gets its own rate from the state. If you have an unemployment account in a client-reporting state, the state sends you an annual notice with your SUI rate for the upcoming calendar year.

What is the difference between client reporting and PEO reporting?

In PEO- and hybrid-reporting states, your business gets the rate assigned to your PEO. In client-reporting states, your business gets its own rate from the state. If you have an unemployment account in a client-reporting state, the state sends you an annual notice with your SUI rate for the upcoming calendar year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PEO Quarterly Report Form?

The PEO Quarterly Report Form is a document that Professional Employer Organizations (PEOs) must submit to report payroll and employment information to state agencies.

Who is required to file PEO Quarterly Report Form?

PEOs that provide employee leasing services and manage payroll, benefits, and compliance obligations for their clients are required to file the PEO Quarterly Report Form.

How to fill out PEO Quarterly Report Form?

To fill out the PEO Quarterly Report Form, gather payroll information, employee details, and tax data for the reporting period. Accurately complete each section of the form, ensuring all required fields are filled in and any supplementary documentation is attached.

What is the purpose of PEO Quarterly Report Form?

The purpose of the PEO Quarterly Report Form is to provide state agencies with necessary information regarding the employees and payroll activities managed by PEOs, enabling proper tax reporting and compliance.

What information must be reported on PEO Quarterly Report Form?

The PEO Quarterly Report Form must include details such as total wages paid, number of employees, tax identification numbers, and any other relevant payroll data mandated by state regulations.

Fill out your peo quarterly report form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Peo Quarterly Report Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.