IRS W-8BEN 2000 free printable template

Show details

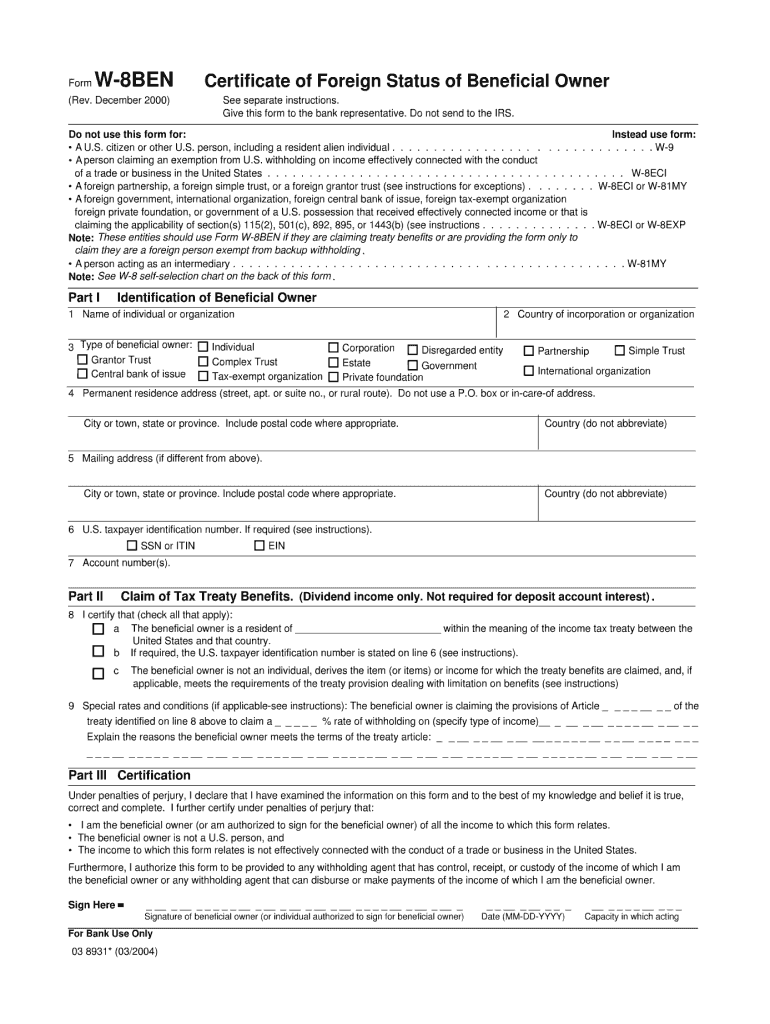

Clear Form W-8BEN Certificate of Foreign Status of Beneficial Owner See separate instructions. Give this form to the bank representative. Do not send to the IRS. (Rev. December 2000) Do not use this

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

How to fill out IRS W-8BEN

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

To edit the IRS W-8BEN form, use a reliable PDF editing tool such as pdfFiller. First, upload your completed form to the platform. Then, utilize the editing features available to modify text or add signatures as necessary. Ensure you save your changes before downloading or submitting the updated form.

How to fill out IRS W-8BEN

Filling out the IRS W-8BEN involves several key steps. Start by downloading the form from the IRS website or accessing it through a service like pdfFiller. Provide your name, country of citizenship, and address in the first section. Ensure that you accurately complete the tax identification numbers if applicable. After filling out all sections, review for any errors before submission.

About IRS W-8BEN previous version

What is IRS W-8BEN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-8BEN previous version

What is IRS W-8BEN?

The IRS W-8BEN is a form used by non-U.S. persons to certify their foreign status for tax withholding purposes. This form is necessary for individuals receiving certain types of income from U.S. sources to claim treaty benefits and avoid or reduce taxes on such income.

What is the purpose of this form?

The purpose of the IRS W-8BEN is to certify a non-U.S. person's identity and foreign status, thus ensuring compliance with U.S. tax law. By submitting this form, foreign individuals can claim exemptions or reduced rates on income that would typically be subject to U.S. withholding tax.

Who needs the form?

Individuals who receive income such as dividends, interest, or royalties from U.S. sources typically need to file the W-8BEN form. It applies to foreign individuals who earn income from U.S. payors or financial institutions. U.S. tax law requires these individuals to establish their non-resident status for withholding purposes.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS W-8BEN if you are a U.S. citizen or a U.S. resident alien. Additionally, if your income falls under certain exemptions provided in tax treaties, or if your income does not require U.S. tax withholding, you may not need to submit this form.

Components of the form

The IRS W-8BEN consists of various sections that require the following information: personal identification details such as name and address; foreign tax identifying numbers; claim for tax treaty benefits if applicable; and signature and date. Each section must be completed accurately to avoid withholding tax on your income.

What are the penalties for not issuing the form?

Failure to issue the IRS W-8BEN form when required may result in mandatory withholding tax at the maximum rate on U.S. source income. Additionally, not filing or submitting incorrect information could lead to time-consuming disputes with the IRS and potential penalties.

What information do you need when you file the form?

When filing the IRS W-8BEN, you will need your name, country of citizenship, permanent address, and foreign tax identification number if available. Familiarizing yourself with your income types and their corresponding U.S. tax treaty benefits is crucial for accurate completion of the form.

Is the form accompanied by other forms?

While the IRS W-8BEN is a standalone document, in certain cases, it may need to be accompanied by other forms depending on specific taxpayers' situations. For example, if you're claiming benefits under a tax treaty, additional paperwork may be necessary to substantiate your claim.

Where do I send the form?

The completed IRS W-8BEN form should not be sent to the IRS directly. Instead, it must be submitted to the withholding agent or financial institution from which you are receiving income. Ensure that they are notified of your non-resident status to ensure proper withholding tax treatment.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am really new at trying this out. The fax feature sounds like it would be very useful to me. I am very interested in learning about all the features offered through this service.

Just what I needed to fill out promptly and neatly PDF applications and forms.

See what our users say