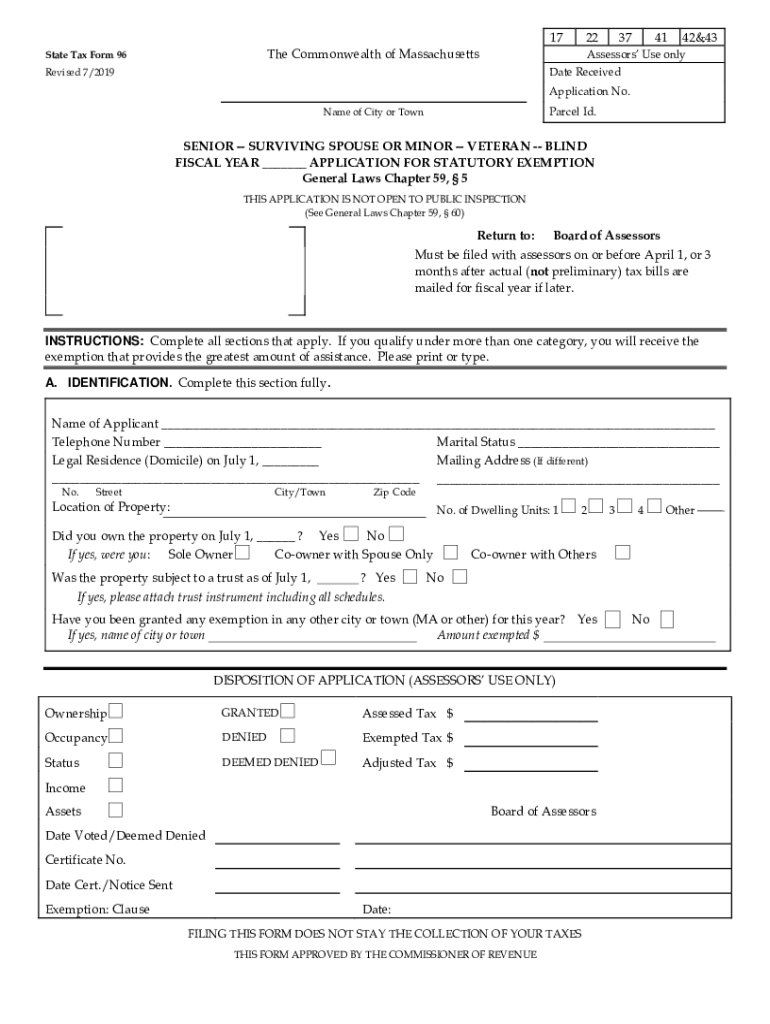

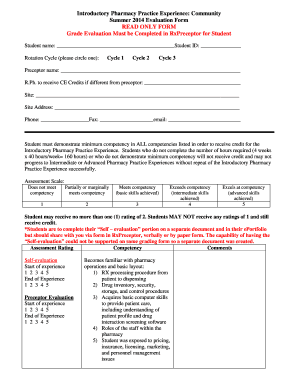

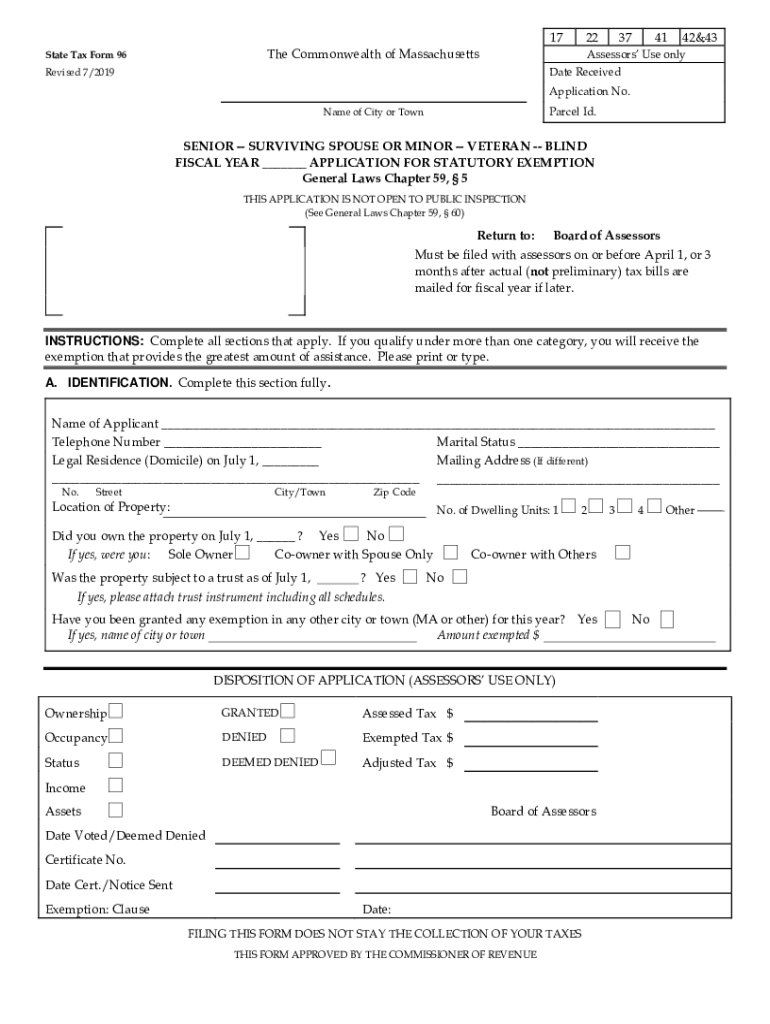

MA State Tax Form 96 2019 free printable template

Get, Create, Make and Sign MA State Tax Form 96

Editing MA State Tax Form 96 online

Uncompromising security for your PDF editing and eSignature needs

MA State Tax Form 96 Form Versions

How to fill out MA State Tax Form 96

How to fill out MA State Tax Form 96

Who needs MA State Tax Form 96?

Instructions and Help about MA State Tax Form 96

Today I'm gonna talk about the IRS Formw-4 for 2019 this is going to be the full walkthrough it's gonna start with the online version, but then I'm going to show you how to put it on to the pa perversion because it's the easiest way to do it I'm also going to put a link at the bottom, so you can check out our w-4 playlist for other variations of filling out the w-4 if this is your first time at our channel, or you haven't subscribed to click on the subscribe button at the bottom my name is Travis SickleCERTIFIED FINANCIAL PLANNER with Sickle Hunter Financial Advisors I'm going to pull it up on the screen right now we're going to jump right into the IRS Form w-42019 I'm going to pull it up on the screen so here we go, so this is exactly where you want to go this is the URL it's iron forward slash individuals forward slash IRS — withholding— — calculator I know it's a big one I'll put this link at the bottom click on it, and you can get right to the IRS calculator if you scroll right down you're going to see the button that sayswithholdings calculator go ahead and click on it, and it's going to bring you right into this calculator and this is going to be super simple, so we're going to start out with married filing jointly so what's your filing status whatever your filing status is go ahead and check it off start with married filing jointly the next section is going to be can someone claim you as a dependent on visor her tax return now remember your spouse is not your dependent this is only if you have qualifying children or qualifying relatives if you have question go ahead and click on the dependents it gives you a brief description what's also really nice is if you're wondering whether you have a dependent you can always go to the whom may I claim as a dependent and there's this nice little worksheet you can click on begin, and you can go through it is will help on whether you have a qualifying dependent solo through that we're not going to go through that in this video I'm going to go right back into the w-4 calculator so we have married filing jointly let's click off no can someone else claim you as a dependent no click continue so the first line is select the total number of jobs which you and your spouse are currently or will be employed so if you're restarting this job are you currently employed that's what you want to checkoff here if you have other jobs that you no longer are employed that's the next checkbox so just go ahead and check off your current jobs are the ones that you will have so if you're starting a job and say February and your spouse is job right now you want to put in two I'm going to flip this to two jobs to show you what that's gonna look like the first checkbox if you already had a job that you don't know longer employed at again check that off check it off or don'thatcheck it off the next checkbox if you or your spouse contributed to atax-deferred retirement such as a 401k this year so if it's a step as simple a401k...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MA State Tax Form 96?

How do I make changes in MA State Tax Form 96?

Can I sign the MA State Tax Form 96 electronically in Chrome?

What is MA State Tax Form 96?

Who is required to file MA State Tax Form 96?

How to fill out MA State Tax Form 96?

What is the purpose of MA State Tax Form 96?

What information must be reported on MA State Tax Form 96?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.