NE Substitute W-9 & ACH Enrollment 2019-2026 free printable template

Show details

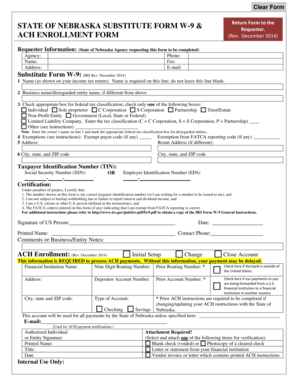

(Rev. February 2019)Clear Formulate OF NEBRASKA W9 & ACH ENROLLMENT FORMULAS SUBMIT FORM TO INVOICED AGENCY 1 Name (as shown on your income tax return). Name is required on this line; do not leave

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE Substitute W-9 ACH Enrollment

Edit your NE Substitute W-9 ACH Enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE Substitute W-9 ACH Enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NE Substitute W-9 ACH Enrollment online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NE Substitute W-9 ACH Enrollment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE Substitute W-9 & ACH Enrollment Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE Substitute W-9 ACH Enrollment

How to fill out NE Substitute W-9 & ACH Enrollment

01

Obtain the NE Substitute W-9 form from the official state website or your organization's HR department.

02

Fill in your name in the first field, ensuring it matches your Social Security or Employer Identification Number.

03

Provide your business name, if applicable, in the second field.

04

Input your address, including city, state, and zip code.

05

Indicate your tax classification by checking the appropriate box (individual/sole proprietor, corporation, partnership, etc.).

06

Enter your Social Security Number or Employer Identification Number in the designated field.

07

Sign and date the form at the bottom.

08

For ACH Enrollment, complete the ACH Enrollment form by inputting your banking information, including account number and routing number.

09

Ensure to sign the ACH Enrollment form where indicated and provide any additional required documentation.

10

Submit both forms to the appropriate department or agency as instructed.

Who needs NE Substitute W-9 & ACH Enrollment?

01

Individuals or businesses receiving payments from the State of Nebraska need to complete the NE Substitute W-9 & ACH Enrollment.

02

Vendors or contractors who provide services to the state government.

03

Anyone requiring direct deposit for payments or reimbursements from state agencies.

Fill

form

: Try Risk Free

People Also Ask about

What can I use instead of W9 for non resident alien?

If you are a foreign person, do not use Form W-9. Instead, use the appropriate Form W-8 (see Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities).

What is a w9 form used for?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

What is a W9 form used for?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

What is a substitute w9 form?

NYS Office of the State Comptroller uses the Substitute Form W-9 to obtain certification of your TIN in order to ensure accuracy of information contained in its payee/vendor database and to avoid backup withholding.

Why would a contractor ask for a W9?

A W-9 is needed when the business pays a freelancer, independent contractor, or self-employed worker $600 or more in one year. The purpose of a W-9 form is to create an official record of a business relationship between a company and an individual who is not a regular employee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the NE Substitute W-9 ACH Enrollment electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NE Substitute W-9 ACH Enrollment.

How do I fill out the NE Substitute W-9 ACH Enrollment form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NE Substitute W-9 ACH Enrollment and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out NE Substitute W-9 ACH Enrollment on an Android device?

Use the pdfFiller mobile app and complete your NE Substitute W-9 ACH Enrollment and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is NE Substitute W-9 & ACH Enrollment?

The NE Substitute W-9 & ACH Enrollment is a form used by individuals and entities to provide their taxpayer identification information to a payor and to authorize electronic payments through ACH (Automated Clearing House) transactions.

Who is required to file NE Substitute W-9 & ACH Enrollment?

Any individual or business that receives payments subject to federal income tax reporting is required to file the NE Substitute W-9 & ACH Enrollment form.

How to fill out NE Substitute W-9 & ACH Enrollment?

To fill out the NE Substitute W-9 & ACH Enrollment, you need to provide your name, business name (if applicable), taxpayer identification number, address, and your banking information for ACH transactions, including account number and routing number.

What is the purpose of NE Substitute W-9 & ACH Enrollment?

The purpose of NE Substitute W-9 & ACH Enrollment is to ensure the payor has accurate taxpayer information for reporting purposes and to facilitate electronic payments directly to the recipient's bank account.

What information must be reported on NE Substitute W-9 & ACH Enrollment?

The information that must be reported includes the name of the individual or business, taxpayer identification number, address, and banking details needed for ACH transactions.

Fill out your NE Substitute W-9 ACH Enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE Substitute W-9 ACH Enrollment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.