KS K-BEN 3113 2021-2025 free printable template

Show details

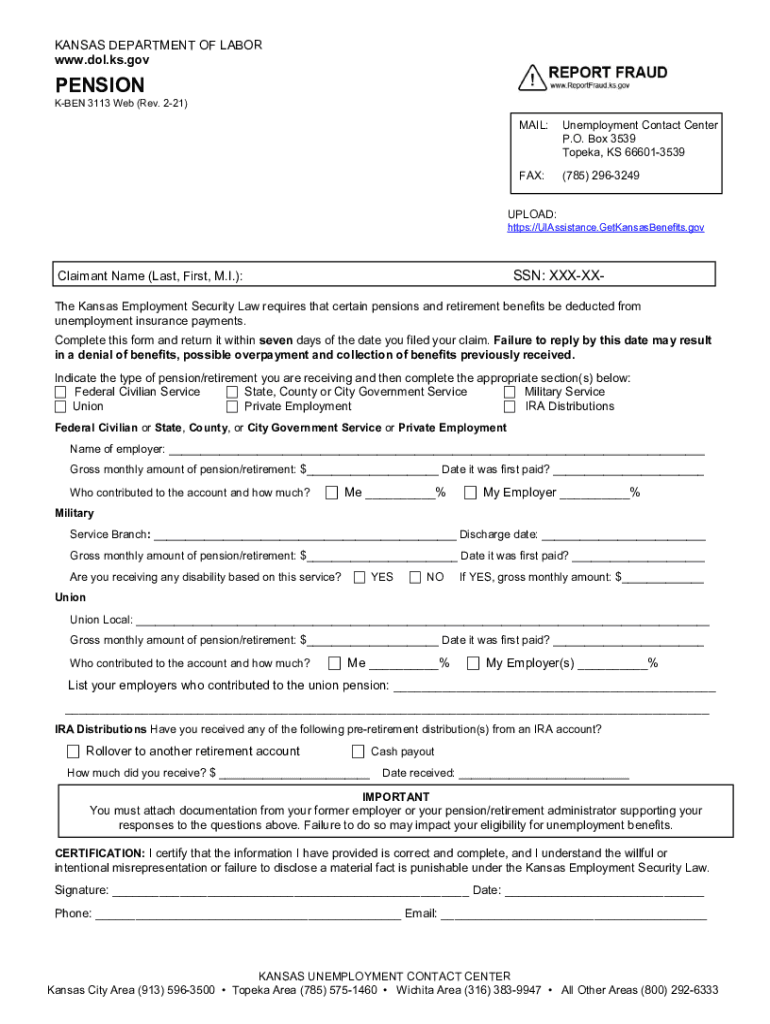

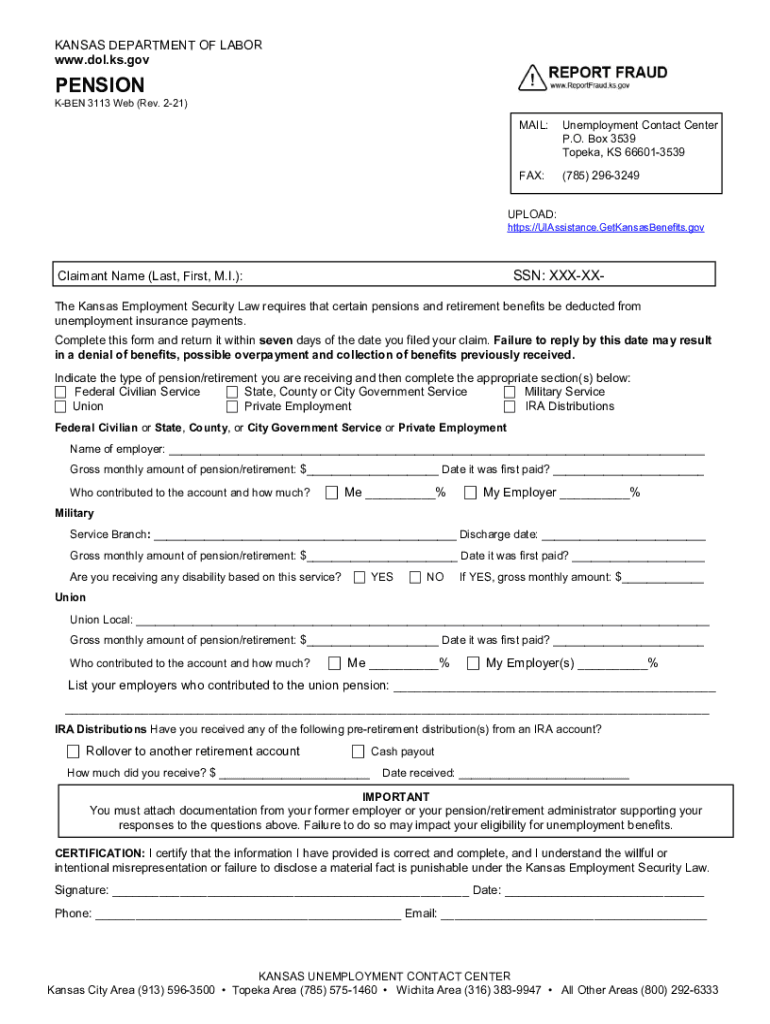

KANSAS DEPARTMENT OF LABOR www.dol.ks.govPENSIONKBEN 3113 Web (Rev. 221)MAIL:Unemployment Contact Center P.O. Box 3539 Topeka, KS 666013539FAX:(785) 2963249UPLOAD:https://UIAssistance.GetKansasBenefits.govSSN:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign reemployment plan template form

Edit your kansas labor unemployment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension center form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unemployment contact center online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit labor department kansas 2021-2025. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS K-BEN 3113 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out labor department kansas 2021-2025

How to fill out KS K-BEN 3113

01

Obtain the KS K-BEN 3113 form from the official website or local tax office.

02

Fill in your personal information, including your name, address, and social security number.

03

Provide details regarding your business entity, if applicable.

04

Indicate the type of income you are reporting on the form.

05

Fill out any applicable sections regarding deductions or credits.

06

Review the form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed form to the appropriate tax authority.

Who needs KS K-BEN 3113?

01

Individuals or entities who earn income that is subject to Kansas state income tax.

02

People who need to report income from specific sources as required by Kansas tax laws.

03

Taxpayers who are claiming specific deductions or credits on their income.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 causes of unemployment?

This occurs due to a mismatch of skills in the labour market it can be caused by: Occupational immobilities. Geographical immobilities. Technological change. Structural change in the economy. See: structural unemployment.

What is unemployment summary?

Unemployment is a term referring to individuals who are employable and actively seeking a job but are unable to find a job. Included in this group are those people in the workforce who are working but do not have an appropriate job.

What is the real cause of unemployment?

Unemployment is caused by various reasons that come from both the demand side, or employer, and the supply side, or the worker. Demand-side reductions may be caused by high interest rates, global recession, and financial crisis. From the supply side, frictional unemployment and structural employment play a great role.

How do you define someone unemployed?

People who are jobless, looking for a job, and available for work are unemployed. The labor force is made up of the employed and the unemployed. People who are neither employed nor unemployed are not in the labor force.

What determines if a person is in the labor force?

The labor force includes all people age 16 and older who are classified as either employed and unemployed, as defined below. Conceptually, the labor force level is the number of people who are either working or actively looking for work.

What are the 5 sources of unemployment?

What are the Five Types of Unemployment? Frictional Unemployment. Frictional unemployment is when workers change jobs and are unemployed while waiting for a new job. Structural Unemployment. Cyclical Unemployment. Seasonal Unemployment. Technological Unemployment. Review.

What disqualifies you from unemployment benefits in California?

"An individual is disqualified for unemployment compensation benefits if the director finds that he or she left his or her most recent work voluntarily without good cause or that he or she has been discharged for misconduct connected with his or her most recent work."

What are the four factors of unemployment?

4 Types of Unemployment and Their Causes There are four main types of unemployment in an economy—frictional, structural, cyclical, and seasonal—and each has a different cause.

How long do you have to be on a job to get unemployment in GA?

Your claim is based on insured wages earned in the base period, which is the first four of the last five calendar quarters completed at the time you file your claim. You must have earned qualifying wages in at least two of the four quarters in the base period.

What qualifies me for unemployment in Illinois?

Who Qualifies for Unemployment Insurance? 1. To qualify, you must have earned at least $1,600 during a recent 12-month period (known as the base period) and you must have earned at least $440 outside of the base period quarter in which your earnings were the highest.

Can I apply for unemployment?

Each state sets its own unemployment insurance benefits eligibility guidelines, but you usually qualify if you: Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work. Meet work and wage requirements.

How does the Department of Labor define the unemployed?

Who is counted as unemployed? People are classified as unemployed if they do not have a job, have actively looked for work in the prior 4 weeks, and are currently available for work.

What is the meaning of unemployment?

unemployment, the condition of one who is capable of working, actively seeking work, but unable to find any work. It is important to note that to be considered unemployed a person must be an active member of the labour force and in search of remunerative work.

How do you calculate the number of unemployed workers?

The equation looks like this: Percentage of employed individuals = Number of people working / Working-age population x 100. Total percentage of unemployed = Unemployed individuals / Working-age population x 100. Unemployment rate = Total number unemployed / Total number in labor force x 100.

How the unemployment rate is calculated?

Unemployment Rate: the number of unemployed divided by the labor force, expressed as a percentage.

How is unemployment calculated?

In simple terms, the unemployment rate for any area is the number of area residents without a job and looking for work divided by the total number of area residents in the labor force.

Can I collect unemployment if I quit my job due to stress California?

Can you get unemployment benefits if you quit your job due to stress? Californians must be unemployed due to someone else's fault in order to be eligible for unemployment benefits. You most likely won't be qualified for unemployment if you left your work voluntarily without a valid reason.

How to measure unemployment?

Unemployment rates are calculated, in ance with international guidelines, as the number of unemployed people divided by the economically active population (those in employment plus those who are unemployed).

What are the 7 causes of unemployment?

Main causes of unemployment Frictional unemployment. Structural unemployment. Classical or real-wage unemployment: Voluntary unemployment. Demand deficient or “Cyclical unemployment” European unemployment. Related.

What is unemployment in simple words?

unemployment, the condition of one who is capable of working, actively seeking work, but unable to find any work. It is important to note that to be considered unemployed a person must be an active member of the labour force and in search of remunerative work.

What is unemployment in simple sentence?

Unemployment is the fact that people who want jobs cannot get them. an area that had the highest unemployment rate in the country.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my labor department kansas 2021-2025 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign labor department kansas 2021-2025 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit labor department kansas 2021-2025 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including labor department kansas 2021-2025, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit labor department kansas 2021-2025 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute labor department kansas 2021-2025 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is KS K-BEN 3113?

KS K-BEN 3113 is a form used in Kansas for reporting certain business entity information to the state tax authority.

Who is required to file KS K-BEN 3113?

Entities including partnerships, corporations, and other business organizations doing business in Kansas are required to file KS K-BEN 3113.

How to fill out KS K-BEN 3113?

To fill out KS K-BEN 3113, provide the necessary business information such as the entity's name, address, Federal Employer Identification Number (FEIN), and details about the business structure and ownership.

What is the purpose of KS K-BEN 3113?

The purpose of KS K-BEN 3113 is to collect information that helps the Kansas Department of Revenue identify and assess business entities for taxation and regulatory compliance.

What information must be reported on KS K-BEN 3113?

KS K-BEN 3113 must report information such as the business name, address, type of business entity, Federal Employer Identification Number (FEIN), and names of any owners or partners.

Fill out your labor department kansas 2021-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Labor Department Kansas 2021-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.