Get the free IT-606 - tax ny

Show details

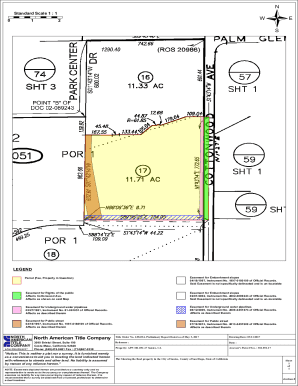

Form IT-606 is designed for businesses to claim the Qualified Empire Zone Enterprise Credit for real property taxes. It provides necessary instructions for businesses certified in Empire Zones to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-606 - tax ny

Edit your it-606 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-606 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-606 - tax ny online

To use the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit it-606 - tax ny. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-606 - tax ny

How to fill out IT-606

01

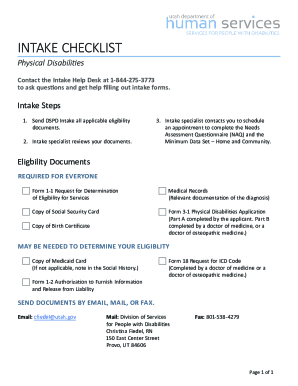

Obtain the IT-606 form from the official tax website or your local tax office.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal information in the designated fields, including your name, address, and Social Security number.

04

Provide the necessary financial information, including income, deductions, and credits applicable to your situation.

05

Review all entries for accuracy and completeness.

06

Sign and date the form to certify its correctness.

07

Submit the form by the designated deadline, either electronically or via mail.

Who needs IT-606?

01

Individuals who have overpaid their income tax and wish to claim a refund.

02

Taxpayers seeking to amend their previous tax returns.

03

Anyone needing to report additional income or deductions not previously filed.

Fill

form

: Try Risk Free

People Also Ask about

What is (;) used for?

It can replace a subject or object that has already been referred to in a sentence. In this usage, we only use it to refer to an inanimate object or an animal, not a person. It is a third-person singular pronoun.

What is ASC 606 in simple terms?

ASC 606, or Accounting Standards Codification 606, is a set of accounting rules that governs how companies recognize revenue from contracts with customers. It provides a standardized framework for revenue recognition, ensuring consistency and comparability across industries.

What is it used for in English?

It is used as the subject or object of a verb, or as the object of a preposition. You use it to refer to an object, animal, or other thing that has already been mentioned.

What is the ASC 606 revenue recognition checklist?

ASC 606 Revenue Recognition Summary Identify the contract with a customer. Identify the performance obligations in the contract. Determine the transaction price. Allocate the transaction price to the performance obligations. Recognize revenue when (or as ) each performance obligation is satisfied.

Who must comply with ASC 606?

ASC 606 is especially important for the following types of businesses: Public companies or large businesses with over US$25 million in annual revenue; these businesses are legally required to comply with ASC 606, GAAP and International Financial Reporting Standards (IFRS)

What are the 5 steps in ASC 606?

The five-step model for ASC 606 revenue recognition Identify the contract with a customer. Identify the performance obligations in the contract. Determine the transaction price. Allocate the transaction price. Recognize revenue when the entity satisfies a performance obligation.

What are the 14 punctuation marks?

Apostrophe (') Apostrophes are meant to show that a letter or letters have been omitted and also to indicate the possessive or contractions. It can also be used to pluralize lowercase letters.

What is ASC 606 English?

ASC 606 directs entities to recognize revenue when the promised goods or services are transferred to the customer. The amount of revenue recognized should equal the total consideration an entity expects to receive in return for the goods or services.

What is the use of it in English grammar?

The 14 punctuation marks in English are period (called “full stop” in the UK), question mark, exclamation point, comma, colon, semicolon, dash, hyphen, brackets, braces, parentheses, apostrophe, quotation mark, and ellipsis.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

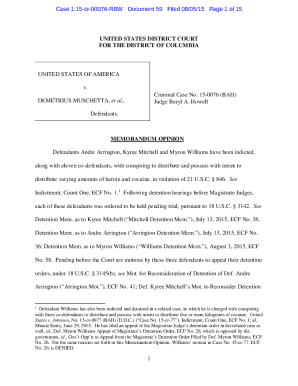

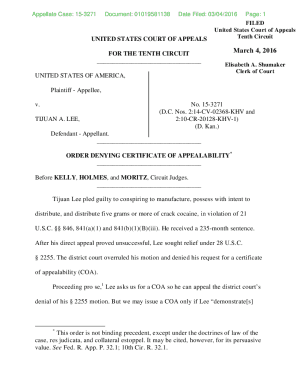

What is IT-606?

IT-606 is a state tax form used for reporting income and calculating taxes owed for specific taxpayers in a state.

Who is required to file IT-606?

Individuals or entities that meet certain income thresholds or have specific tax obligations as defined by state tax regulations are required to file IT-606.

How to fill out IT-606?

To fill out IT-606, taxpayers should gather necessary financial documents, follow the instructions provided on the form, and accurately report their income, deductions, and credits.

What is the purpose of IT-606?

The purpose of IT-606 is to ensure proper reporting of income and calculation of tax liabilities for specific taxpayer categories as per state tax laws.

What information must be reported on IT-606?

IT-606 requires reporting of personal identification information, total income, applicable deductions, credits, and any other relevant financial details required by state tax authorities.

Fill out your it-606 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-606 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.