Get the free Direct Pay Request

Show details

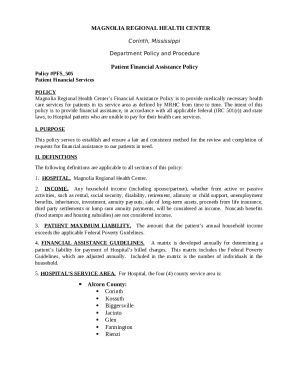

This document is used to submit a request for direct payment for services or goods, excluding university purchases. It requires various departmental approvals and must be submitted alongside an original

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct pay request

Edit your direct pay request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct pay request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct pay request online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit direct pay request. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct pay request

How to fill out Direct Pay Request

01

Obtain the Direct Pay Request form from your employer or official website.

02

Fill in your personal details, including your name, address, and contact information.

03

Specify the payment amount and purpose of the payment clearly.

04

Provide any necessary account numbers or reference information related to the payment.

05

Sign and date the form to confirm its accuracy.

06

Submit the completed form to the appropriate department or designated contact.

Who needs Direct Pay Request?

01

Individuals or businesses that require direct payment from an organization.

02

Employees requesting reimbursement for expenses.

03

Contractors or freelancers seeking payment for services rendered.

04

Anyone needing to initiate a direct payment process with a payer organization.

Fill

form

: Try Risk Free

People Also Ask about

What does direct pay mean?

1. What is Direct Pay? Direct Pay is a free IRS service that lets you make tax payments online directly from your bank account to the IRS. Direct Pay lets you pay the IRS directly.

What does direct pay mean?

1. What is Direct Pay? Direct Pay is a free IRS service that lets you make tax payments online directly from your bank account to the IRS. Direct Pay lets you pay the IRS directly.

Who is eligible for direct pay?

Direct pay is a way for state and local governments, and other tax-exempt entities, to recover costs of making clean energy investments after the project is placed in service.

How do I use direct pay?

How to pay your taxes with IRS Direct Pay [Step-by-step guide] Step 1: Visit the IRS Direct Pay page. Step 2: Enter your tax information. Step 3: Verify your identity. Step 4: Enter your payment information. Step 5: Confirm your information and submit it to the IRS.

What is an example of direct pay?

Examples of Direct Payment Direct Deposits: Employers transfer salaries directly into employees' bank accounts. Wire Transfers: Large sums of money are moved between banks.

Who is eligible for direct pay?

Direct pay is a way for state and local governments, and other tax-exempt entities, to recover costs of making clean energy investments after the project is placed in service.

What is a direct pay request?

The Direct Payment Request (DPR) process is used to request a payment to a vendor when a purchase requisition is not required.

What is an example of direct pay?

Examples of Direct Payment Direct Deposits: Employers transfer salaries directly into employees' bank accounts. Wire Transfers: Large sums of money are moved between banks.

How does a direct payment work?

Direct payments allow you to receive cash payments from your local authority instead of care services. This can give you much more flexibility and greater control of your support package.

What are the disadvantages of direct payments?

Disadvantages of direct payments You may find it a burden having to commission your own care and support. You may have to employ people and comply with tax and employment law. This can be quite complicated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Pay Request?

A Direct Pay Request is a process through which taxpayers can request to make direct payments to the government for certain taxes or fees, streamlining the payment process and reducing delays.

Who is required to file Direct Pay Request?

Businesses and individuals who need to make direct payments for taxes, including estimated taxes, and other applicable fees are typically required to file a Direct Pay Request.

How to fill out Direct Pay Request?

To fill out a Direct Pay Request, taxpayers must provide relevant information such as identification details, payment amounts, and tax periods, then submit the request form through the appropriate channels, often online.

What is the purpose of Direct Pay Request?

The purpose of a Direct Pay Request is to facilitate quicker and more efficient tax payments, ensuring that taxpayers can settle their obligations directly without unnecessary paperwork or intermediaries.

What information must be reported on Direct Pay Request?

Information that must be reported includes taxpayer identification, payment amount, tax type, tax period, and any necessary supporting documentation to validate the payment.

Fill out your direct pay request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Pay Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.