Get the free Direct Payment Form - isu

Show details

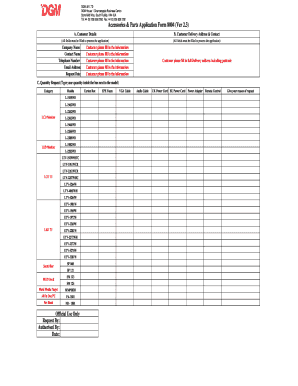

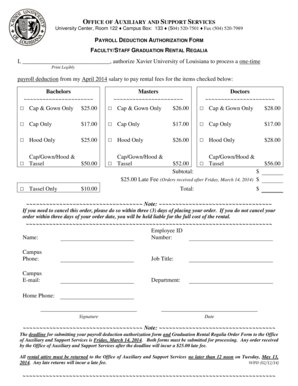

This form is used to process direct payments to vendors. It requires detailed vendor information, payment type selection, and necessary signatures for verification. All relevant documentation must

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct payment form

Edit your direct payment form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct payment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct payment form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit direct payment form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct payment form

How to fill out Direct Payment Form

01

Obtain a Direct Payment Form from your employer or the relevant authority.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your social security number or other identification number as required.

04

Indicate the type of payment you are requesting.

05

Fill in the amount you wish to receive and the frequency of payment.

06

Sign and date the form at the designated section.

07

Submit the completed form according to the instructions provided.

Who needs Direct Payment Form?

01

Individuals who are receiving benefits and wish to manage their payments directly.

02

Employees who are opting for direct deposit of their salaries.

03

Individuals who need to submit payment requests for services rendered.

04

Anyone participating in programs that require direct payments.

Fill

form

: Try Risk Free

People Also Ask about

Is PayPal a direct payment?

Direct Debit is a simple and convenient way to make one-time or recurring payments using your PayPal balance using your PayPal balance. Direct Debit authorizes a merchant (or service provider) to initiate payments from your PayPal Balance account for things like utilities, subscriptions, or memberships.

Is PayUSAtax legit for IRS?

PayUsaTax is one of the three approved third party payment processors listed on the IRS web page.

What is an example of a direct payment?

The types of bills people will often pay using direct payment: Mortgage or rent. Car payments. Loan payments. Tuition. Insurance. Utilities. Credit cards.

What is an example of direct billing?

One example is direct billing in the hotel industry for corporate travel. Here, it spares employees and providers from having to process payments on the spot. And it saves accounts receivables departments from having to separately reimburse employees.

What is a direct payment form?

DIRECT PAYMENT FORM. This form is used to authorize payment to a company or individual when a requisition/purchase order is not required. Original itemized receipt (s) and/or invoice (s) must be attached.

What is considered direct payment?

Direct payment is the electronic transfer of funds directly between bank accounts, bypassing physical checks or cash for faster, secure transactions.

What is an example of direct payment?

A direct payment means that she can employ a personal assistant (PA) to help her to wash, dress, shop for groceries and prepare meals. Riaz employs a personal assistant (PA) to take his wife, who is living with dementia, out on day trips and supports her to pursue her hobbies while giving him some respite from caring.

What are the types of direct payment?

Examples of Direct Payment Direct payments encompass various methods, including: Direct Deposits: Employers transfer salaries directly into employees' bank accounts. Wire Transfers: Large sums of money are moved between banks. Online Payments: Payments made through digital wallets or banking apps.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Payment Form?

The Direct Payment Form is a document used to facilitate the direct payment of certain expenses or revenues, allowing individuals or entities to make payments directly to the specified recipient without going through intermediary processes.

Who is required to file Direct Payment Form?

Entities or individuals who are engaged in specific transactions that require direct payment, often related to sales tax or use tax, are typically required to file the Direct Payment Form.

How to fill out Direct Payment Form?

To fill out the Direct Payment Form, one must provide the required personal or business information, details about the payment being made, including the amount and nature of the transaction, and any relevant tax identification numbers.

What is the purpose of Direct Payment Form?

The purpose of the Direct Payment Form is to streamline the payment process by allowing direct transactions, ensuring compliance with tax regulations and simplifying bookkeeping.

What information must be reported on Direct Payment Form?

The Direct Payment Form must typically report the payer's information, the recipient's information, the transaction amount, the purpose of the payment, and any applicable tax identification numbers.

Fill out your direct payment form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Payment Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.