Get the free Nonresident Payment Request for Travel ONLY - hr uark

Show details

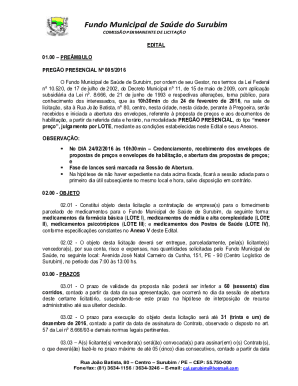

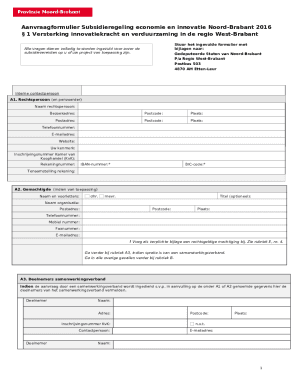

This form is used to request payments for nonresident individuals related to travel activities. It requires detailed information about the payee, payment amounts, and departmental charge codes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonresident payment request for

Edit your nonresident payment request for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonresident payment request for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonresident payment request for online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nonresident payment request for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonresident payment request for

How to fill out Nonresident Payment Request for Travel ONLY

01

Obtain the Nonresident Payment Request form for Travel ONLY.

02

Fill out your personal details, including your name and contact information.

03

Indicate the purpose of travel in the designated section.

04

Provide details of the travel itinerary, including dates, locations, and duration.

05

Include any supporting documentation, such as travel tickets, itineraries, or invoices.

06

Specify the payment method you prefer for reimbursement.

07

Review all information for accuracy and completeness.

08

Sign and date the form.

09

Submit the completed form along with supporting documentation to the appropriate department.

Who needs Nonresident Payment Request for Travel ONLY?

01

Nonresident individuals who travel for business-related purposes and require reimbursement for travel expenses.

Fill

form

: Try Risk Free

People Also Ask about

Who is not required to file Schedule SE?

If you realize a net business loss on Schedule C (Form 1040) Profit or Loss From Business, you are not required to file Schedule SE (Form 1040) Self-Employment Tax or pay self-employment taxes.

Who must file Form 1040-nr?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign students, scholars, teachers, researchers and exchange visitors for more information.

How does traveling for work affect taxes?

Key Takeaways. Typically, you can deduct travel expenses if they are ordinary (common and accepted in your industry) and necessary (helpful and appropriate for your business). You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home).

What are the three rules that must be met for expense reimbursement to employees to be considered an accountable plan?

The requirements of the accountable plan rules are found in Treasury Regulation 1.62-2; and they require that the payee (1) establish the business purpose and connection of the expenses; (2) substantiate the expenses claimed to the payer within a reasonable period of time; and (3) return any amounts to the payer which

Who qualifies as a nonresident alien?

A non-resident alien for tax purposes is a person who is not a U.S. citizen and who does not meet either the “green card” or the “substantial presence” test as described in IRS Publication 519, U.S. Tax Guide for Aliens.

Who is required to file Schedule L?

Schedule L is a key component of IRS Form 1120, the annual tax form corporations file with the IRS. It gives the IRS a clear view of a corporation's financial health by detailing its assets, liabilities, and shareholder equity, providing a financial snapshot of the company.

Who should file Schedule O?

Who Must File. All organizations that file Form 990 and certain organizations that file Form 990-EZ must file Schedule O (Form 990). At a minimum, the schedule must be used to answer Form 990, Part VI, lines 11b and 19.

Who needs to file a schedule oi?

Nonresident aliens who are filing U.S. taxes using Form 1040-NR are required to submit Form 1040-NR (Schedule OI). This form provides necessary personal and general information for the accurate processing of their tax returns, ensuring compliance with U.S. tax laws and eligibility for any applicable treaty benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

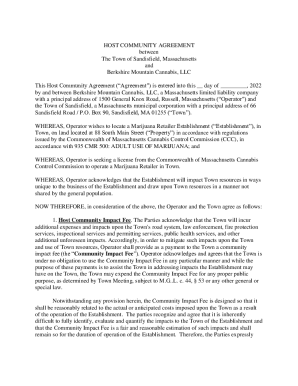

What is Nonresident Payment Request for Travel ONLY?

The Nonresident Payment Request for Travel ONLY is a form used to request payment for travel-related expenses incurred by nonresidents who are visiting for business or other purposes.

Who is required to file Nonresident Payment Request for Travel ONLY?

Nonresidents who are in need of reimbursement for travel expenses incurred while conducting business or attending events in a specific jurisdiction are required to file this form.

How to fill out Nonresident Payment Request for Travel ONLY?

To fill out the form, provide your personal details, travel itinerary, expense breakdown, and any required supporting documentation, ensuring all information is accurate and complete.

What is the purpose of Nonresident Payment Request for Travel ONLY?

The purpose of this request is to facilitate the reimbursement of travel expenses for nonresidents, ensuring compliance with tax regulations and proper documentation for such payments.

What information must be reported on Nonresident Payment Request for Travel ONLY?

Required information includes the traveler's name, taxpayer identification number, addresses, details of the trip, nature of the expenses, and copies of receipts or documentation to support the claims.

Fill out your nonresident payment request for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonresident Payment Request For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.