Get the free Agriculture Real Property Special Assessment Application - jaspercountysc

Show details

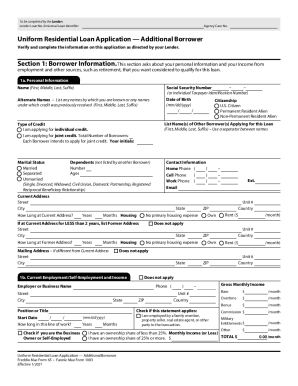

This application is used to apply for special assessment for agricultural real property in Jasper County, SC. It includes sections for property information, qualification requirements, and certification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agriculture real property special

Edit your agriculture real property special form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agriculture real property special form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit agriculture real property special online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit agriculture real property special. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agriculture real property special

How to fill out Agriculture Real Property Special Assessment Application

01

Obtain the Agriculture Real Property Special Assessment Application form from the local tax assessor's office or their website.

02

Fill in the applicant's information including name, address, and contact details.

03

Provide details about the property including its location, size, and current use.

04

Indicate the type of agricultural activities being conducted on the property.

05

Attach any required documentation that proves agricultural use, such as sales receipts or crop production records.

06

Sign and date the application form.

07

Submit the completed application to the local tax assessor's office before the deadline.

Who needs Agriculture Real Property Special Assessment Application?

01

Farmers and landowners who engage in agricultural production and want to benefit from reduced property taxes based on the agricultural use of their land.

02

Individuals applying for special assessment status for new agricultural operations.

03

Those who own land that qualifies as agricultural property under state or local guidelines.

Fill

form

: Try Risk Free

People Also Ask about

What is agricultural transfer tax in Maryland?

The rate is 3 percent for a transfer of less than 20 acres of agricultural land being removed from agricultural use with either or both of the following included in the sale price of the lot or parcel: a) Structures or other items that are separately assessed by the Department; or b) Site improvements, for example,

Who pays the transfer tax in MD?

Normally a Maryland contract provides who is responsible for the payment of transfer and recordation taxes. If the contract is silent, Maryland law states the presumption is that the buyer and seller shall split the taxes provided the buyer does not qualify as a First Time Maryland Homebuyer.

What is the agricultural transfer tax in Maryland?

The rate is 5 percent for a transfer of 20 acres or more of agricultural land being removed from agricultural use, whether improved or unimproved. In the rare case when a parcel less than 20 acres has only a minimally valued agricultural structure, the rate is 4% for transfer.

What is an agricultural assessment?

An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value.

What is the agricultural exemption for estate tax in Maryland?

During the 2012 Legislative Session the Maryland General Assembly enacted the Family Farm Preservation Act of 2012, which adds a new subsection to Title 7 of the Tax-General Article allowing for the exclusion of up to $5,000,000 of the value of qualified agricultural property from the value of the gross estate for

Who pays transfer tax in me?

The tax is imposed ½ on the grantor (seller), and ½ on the grantee (buyer). Sale of Real Estate - RETT is imposed on each deed by which any real property in Maine is transferred.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Agriculture Real Property Special Assessment Application?

The Agriculture Real Property Special Assessment Application is a form that property owners use to apply for a special assessment that reduces the property tax rate on land used for agricultural purposes.

Who is required to file Agriculture Real Property Special Assessment Application?

Property owners who have land that is primarily used for agricultural production and wish to obtain a special assessment to lower their property taxes are required to file this application.

How to fill out Agriculture Real Property Special Assessment Application?

To fill out the application, property owners should provide accurate information regarding the size of the property, its agricultural use, and any relevant identification details. It typically requires information about the type of agricultural activities conducted and proof of income generated from the property.

What is the purpose of Agriculture Real Property Special Assessment Application?

The purpose of the application is to allow landowners to obtain a lower property tax rate for land used in agricultural production, thereby supporting the agricultural industry and promoting the preservation of farmland.

What information must be reported on Agriculture Real Property Special Assessment Application?

The application must report information such as the property's location, size, use, ownership details, income from agricultural activities, and any supporting documentation that verifies its use for agriculture.

Fill out your agriculture real property special online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agriculture Real Property Special is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.