MO MO-C 2022 free printable template

Show details

Reset FormPrint FormDepartment Use Only

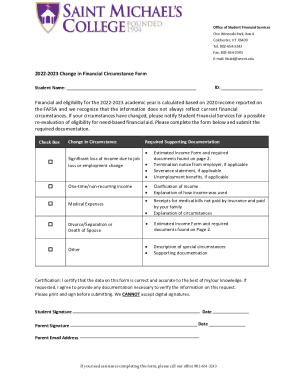

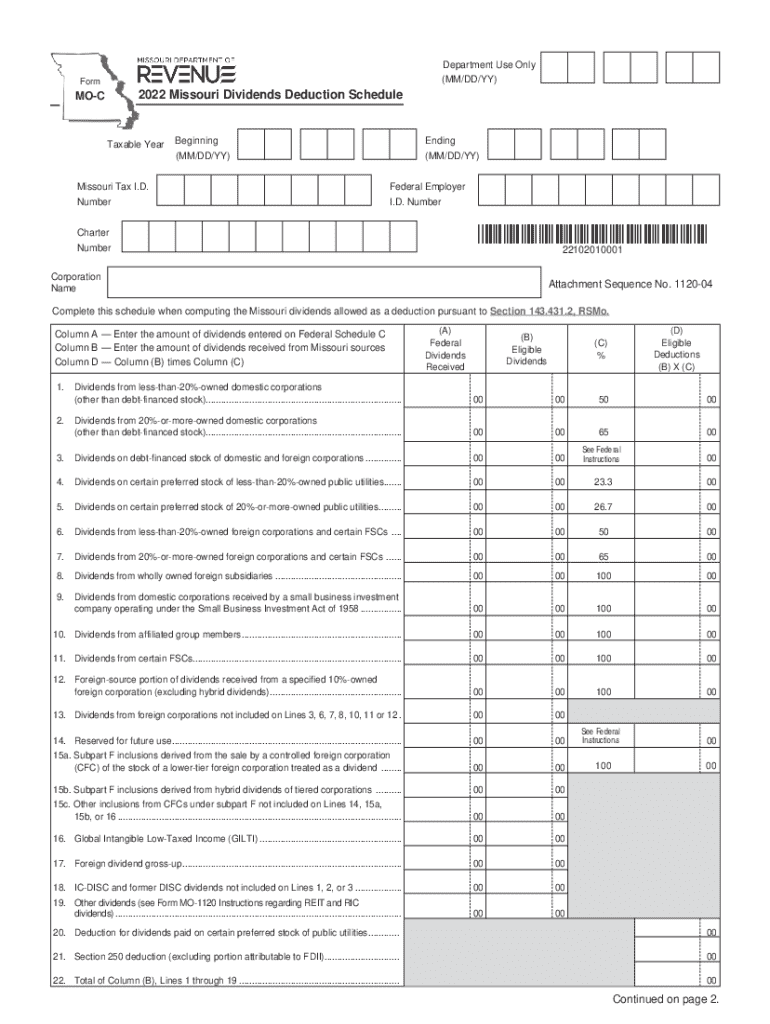

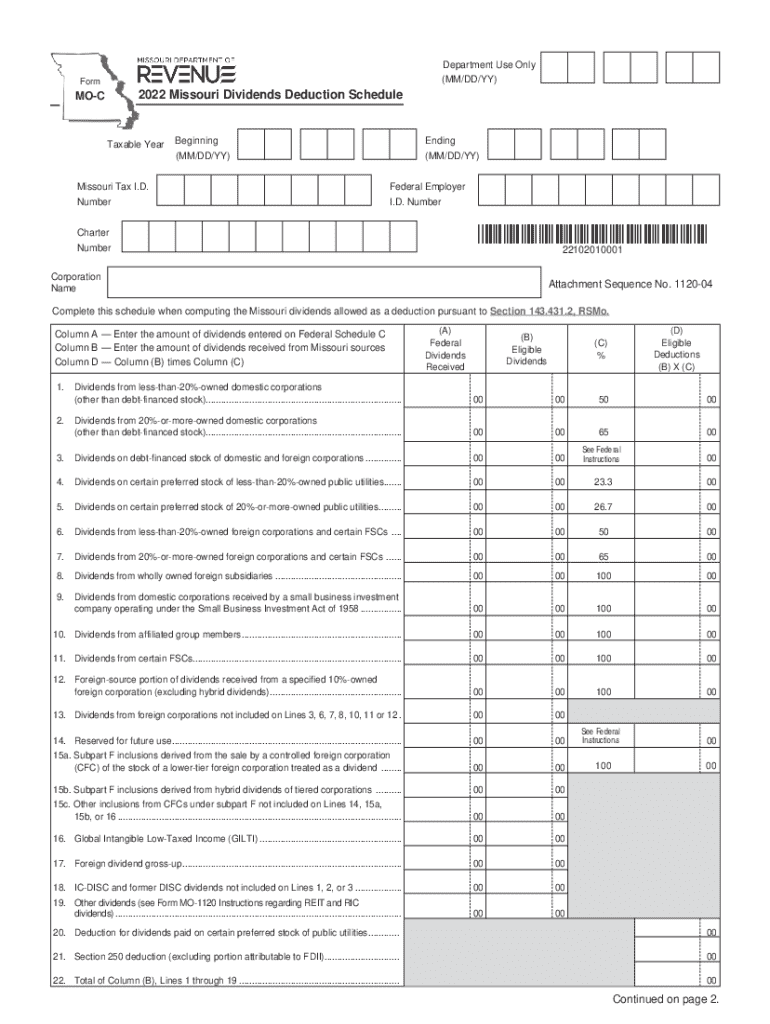

(MM/DD/YY)Form2022 Missouri Dividends Deduction ScheduleMOCTaxable YearBeginningEnding(MM/DD/YY)(MM/DD/YY)Missouri Tax I.D.Federal EmployerNumberI.D. Number*22102010001*

22102010001Charter

Number

Corporation

NameAttachment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MO-C

Edit your MO MO-C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MO-C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MO-C

How to fill out MO MO-C

01

Gather all necessary financial documents and information.

02

Obtain the MO MO-C form from the official website or relevant authority.

03

Fill in your personal information at the top of the form.

04

Complete the income section with accurate figures from your tax return.

05

Add any relevant deductions or credits that you are eligible for.

06

Review the filled-out form for any errors or missing information.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate agency or authority.

Who needs MO MO-C?

01

Individuals who are seeking to claim a tax credit or refund.

02

Taxpayers who need to report additional income not reflected on their standard forms.

03

Those who have experienced financial changes that affect their tax status.

04

Residents of specific jurisdictions that require the MO MO-C for tax purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MO MO-C?

MO MO-C is a tax form used in Missouri for the annual tax reconciliation of certain tax credits and withholdings.

Who is required to file MO MO-C?

Individuals and businesses that have claimed certain tax credits or have tax withholding and reconciliation obligations in Missouri are required to file MO MO-C.

How to fill out MO MO-C?

To fill out MO MO-C, gather all relevant tax documents, complete the required sections by providing accurate financial information, and ensure that all claimed credits and withholdings are properly reported.

What is the purpose of MO MO-C?

The purpose of MO MO-C is to reconcile tax credits and withholdings for the tax year, ensuring that taxpayers report the correct amount of tax liability.

What information must be reported on MO MO-C?

The information that must be reported on MO MO-C includes income details, claimed tax credits, withholding amounts, and any adjustments necessary for accurate tax reconciliation.

Fill out your MO MO-C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MO-C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.