Get the free DE-226

Show details

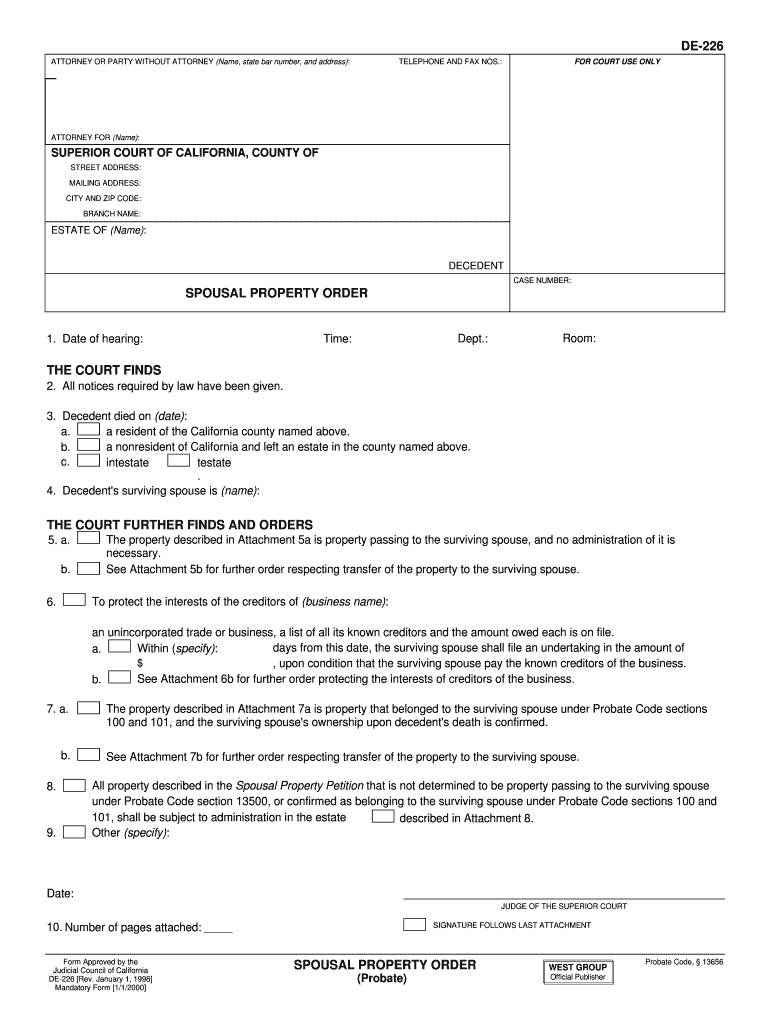

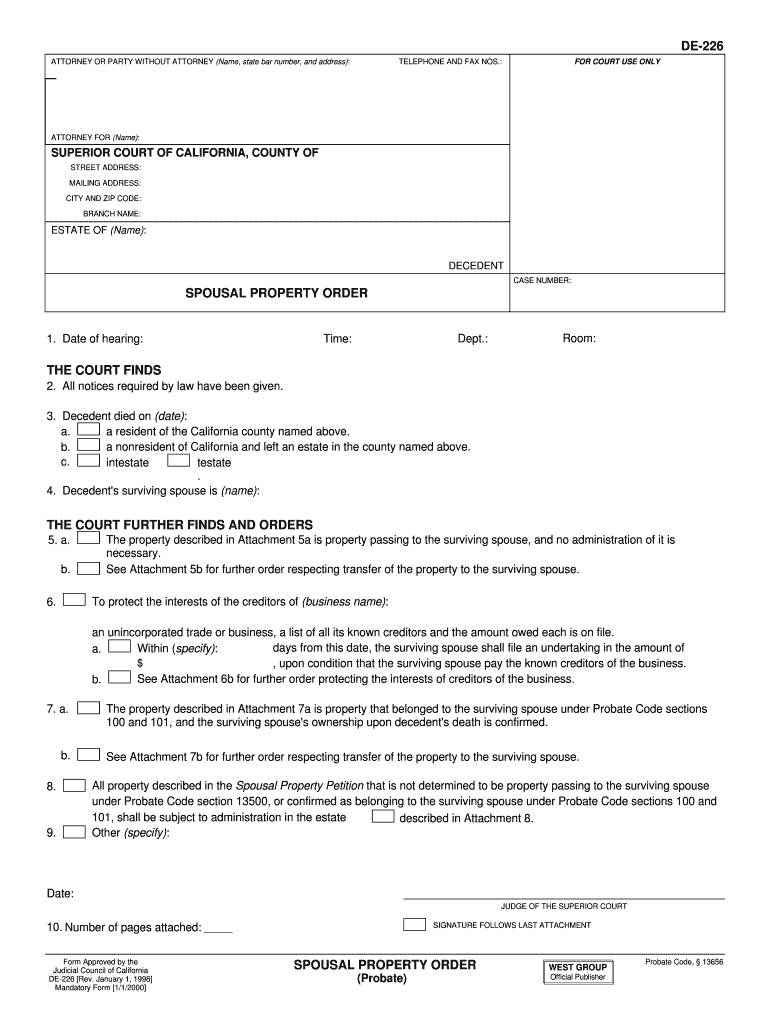

This document is a spousal property order issued by the Superior Court of California, detailing the findings and orders regarding the decedent's estate and the rights of the surviving spouse. It includes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign de-226

Edit your de-226 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de-226 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit de-226 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit de-226. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out de-226

How to fill out DE-226

01

Begin by obtaining the DE-226 form from the appropriate source or authority.

02

Fill out your personal information such as your name, address, and contact details in the designated sections.

03

Provide details regarding the incident or issue that necessitates filling out the DE-226 form.

04

Ensure that you accurately describe the circumstances and relevant information related to the case.

05

Include any necessary attachments or documentation that support your claim or request.

06

Review the completed form to ensure all information is correct and all required sections are filled out.

07

Submit the form according to the instructions provided, whether electronically or via mail.

Who needs DE-226?

01

Individuals or entities involved in a legal or administrative process that requires documentation of certain actions or events.

02

Those who need to report incidents, accidents or file claims related to specific matters.

Fill

form

: Try Risk Free

People Also Ask about

Does everything automatically go to a spouse after death in California?

Community Property Upon the death of a spouse, the surviving spouse is entitled to retain their half of the community property. The deceased spouse's half is typically distributed ing to their will or, if there is no will, ing to California's intestate succession laws.

Is California a spousal property rights state?

Yes, California is one of nine community property states in the U.S. In general, this means if a married couple divorces in California, community property state law says they must equally split assets acquired during their marriage, unless an exception applies.

How does separate property become marital property in California?

Separate property becomes community property in California through several mechanisms. One common way is through the commingling of funds. When separate property funds, such as inheritances, are mixed with community property funds (like deposits into a joint bank account), they lose their separate status.

What is a spousal property petition in California?

The spousal property petition is a legal process in California that allows surviving spouses or domestic partners to affirm or assume full ownership of certain property without going through the full probate process.

What happens to separate property at death of spouse in California?

Separate property, on the other hand, belongs solely to one spouse. As a result, the deceased spouse generally would be entitled to dispose of 100% of their separate property via their will or trust to the beneficiaries of their choosing. Most spouses own both community property and separate property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DE-226?

DE-226 is a form used for reporting specific information related to California payroll and employment data.

Who is required to file DE-226?

Employers who are required to report payroll information to the California Employment Development Department (EDD) must file DE-226.

How to fill out DE-226?

To fill out DE-226, employers must provide accurate payroll and employee information, ensuring all required fields are completed and the form is submitted by the deadline.

What is the purpose of DE-226?

The purpose of DE-226 is to collect data regarding employment and wage information to assist in state labor statistics and employment programs.

What information must be reported on DE-226?

Employers must report details such as employee wages, hours worked, and demographics on DE-226.

Fill out your de-226 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De-226 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.