NY DTF DTF-4 2022 free printable template

Show details

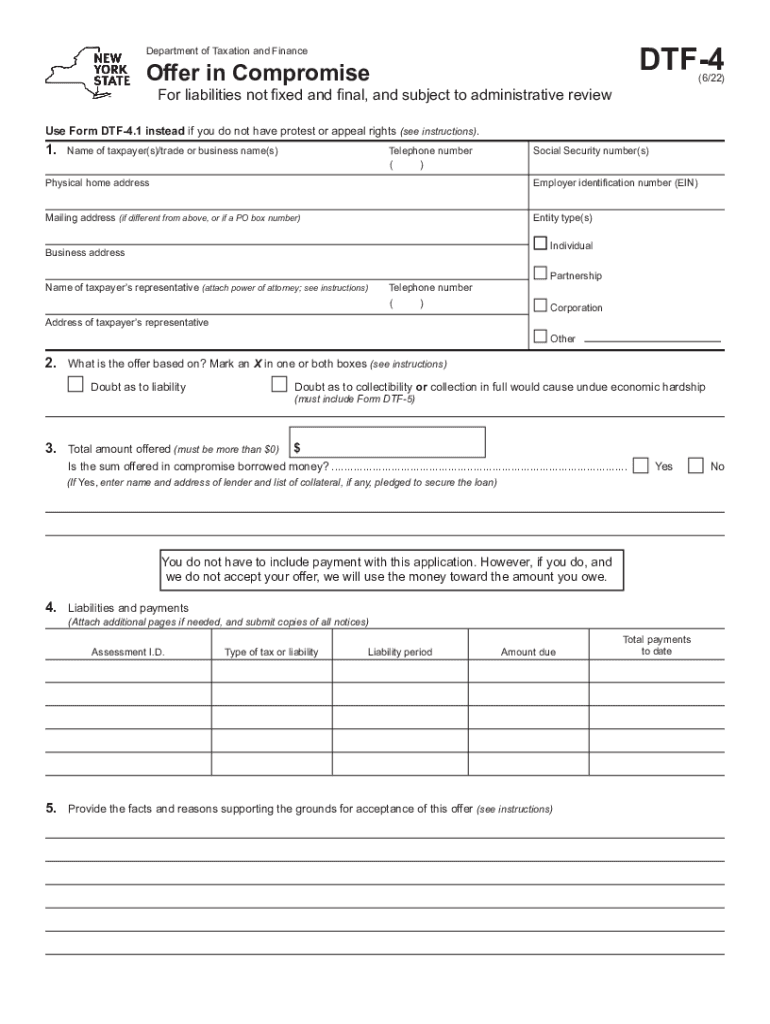

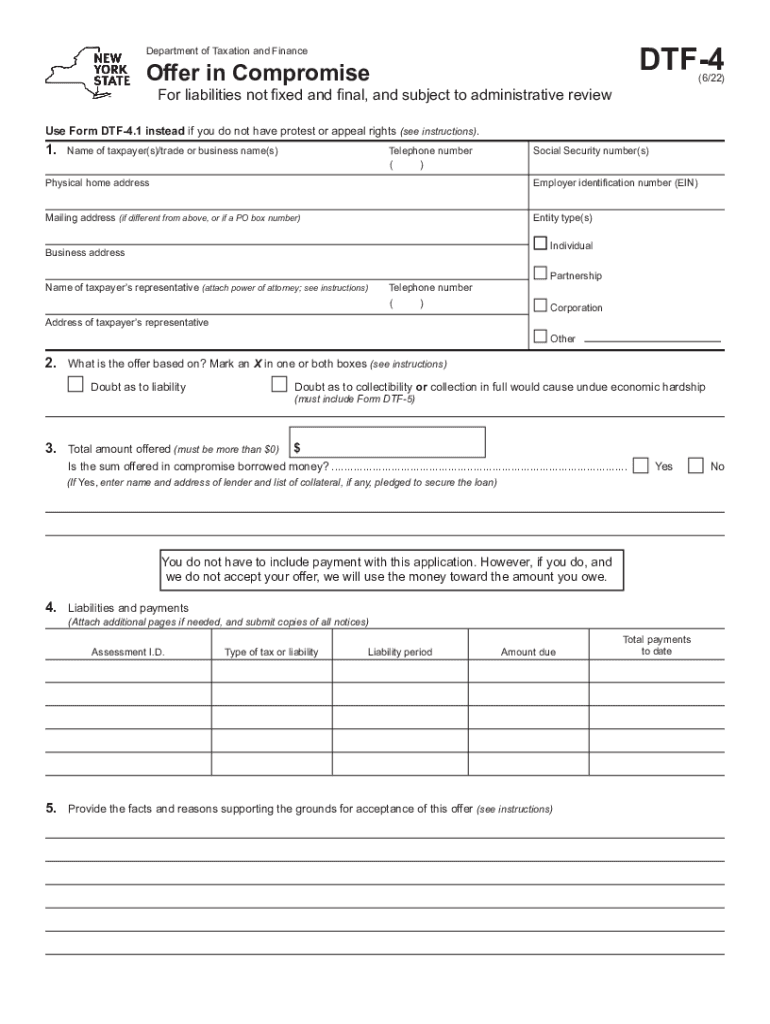

Mailing your Form DTF-4 Along with your completed Form DTF-4 be sure to include copies of all notices listed in Section 4 and all supporting documents. DTF-4 Department of Taxation and Finance Offer in Compromise For Liabilities Not Fixed and Final and Subject to Administrative Review 12/16 Use Form DTF-4. However for any other type of joint liability such as a partnership each must submit separate DTF-4 forms. Also submitting Form DTF-4 does not affect the interest and penalties that...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF DTF-4

Edit your NY DTF DTF-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF DTF-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF DTF-4 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF DTF-4. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF DTF-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF DTF-4

How to fill out NY DTF DTF-4

01

Gather personal identification information, including your name, Social Security Number (SSN), and address.

02

Determine your residency status for tax purposes.

03

Fill in the 'Exemptions' section if applicable, stating the reason for exemption.

04

Include any deductions or credits you qualify for.

05

Review and confirm the accuracy of all entered information.

06

Sign and date the form before submission.

Who needs NY DTF DTF-4?

01

Individuals seeking a refund for New York State income tax withholding.

02

People who are exempt from New York State income tax withholding.

03

Workers who receive wages in New York but are not residents.

Instructions and Help about NY DTF DTF-4

Fill

form

: Try Risk Free

People Also Ask about

Where do I file DTF 95?

Mail your completed form to: NYS TAX DEPARTMENT. ST REGISTRATION/ACCOUNT SERVICES. W A HARRIMAN CAMPUS. ALBANY NY 12227-0865.

What is a debit block letter?

Debit blocks protect your bank accounts from unauthorized electronic charges. If you need to authorize debit payments to the Tax Department from a bank account with a debit block, you must communicate with your bank to authorize these payments. Your bank will process only these authorized transactions.

What is the NYS sales tax rate for 2022?

Introduction. Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

What if my refund was lost stolen or destroyed?

What if my refund was lost, stolen, or destroyed? Generally, you can file an online claim for a replacement check if it's been more than 28 days from the date we mailed your refund.

What is NYS DTF sales tax?

The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

How do I get a tax refund check reissued?

How do I get a new one? If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation).

Can I get copies of my NYS tax returns online?

Log in or create an Online Services account to view and print a copy of your e-filed return for the following tax types: corporation (ten most recent filing periods since 2008) sales and use (five most recent filing periods) fuel use (six most recent filing periods)

How do I get a replacement tax refund check in NY?

Lost, stolen, or destroyed checks If your refund check is lost, stolen, or destroyed, contact the Personal Income Tax Information Center at 518-457-5181. You will need a copy of your most recently filed tax return when you call.

What is DTF tax?

October 2021. Introduction. The Department of Taxation and Finance (DTF) is the state agency charged with administering the Tax Law and, in conjunction with local governments, with administering the Real Property Tax Law.

What is a DTF 960 E form?

DTF-960-E (unemployment benefits)

What is a DTF 5 form?

Department of Taxation and Finance. Statement of Financial Condition. DTF-5(8/18) Complete Form DTF-5 and include it with your request for a payment plan, offer in compromise, or other proposal.

What is the phone number for New York State taxes?

518-457-5149—Para español, oprima el dos. 8:30 a.m. – 4:30 p.m.

Why would I get a certified letter from NYS tax?

Typically, we send this letter if we need to verify: your amounts of wages and withholding, your residency, your eligibility for refundable tax credits, or.

What is NYS DTF payment?

New York State Department of Tax & Finance. If you're seeing it as an ACH withdrawal from your checking, it's a tax payment. Possibly your NYS Sales Tax, but it could be some other tax that NYS is grabbing. 1.

Why would I get a letter from New York State Department of Taxation and Finance?

Common reasons we send RFI letters include: We need to verify you reported the correct amount of wages and withholding for New York State, New York City, and Yonkers (see Checklist for acceptable proof of wages and withholding). We need to verify you lived or worked in New York State, New York City, or Yonkers.

How long does it take to get a replacement refund check?

You should receive your replacement within six to eight weeks. If your check has been cashed: the Bureau of the Fiscal Service (BFS) will provide you with a claim package that includes a copy of the cashed check.

What is DTF in Tax?

October 2021. Introduction. The Department of Taxation and Finance (DTF) is the state agency charged with administering the Tax Law and, in conjunction with local governments, with administering the Real Property Tax Law.

What does NYS DTF CT stand for?

New York State Department of Tax & Finance (NY DTF) is the tax agency that manages and collects tax revenues to support New York State services and programs. To set up your state tax, here's how: Add your New York employee's information. Set up New York State Tax Information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NY DTF DTF-4?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your NY DTF DTF-4 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my NY DTF DTF-4 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your NY DTF DTF-4 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit NY DTF DTF-4 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing NY DTF DTF-4 right away.

What is NY DTF DTF-4?

NY DTF DTF-4 is a form used by the New York State Department of Taxation and Finance for reporting tax information related to certain payments received by individuals or businesses.

Who is required to file NY DTF DTF-4?

Individuals or businesses that make certain payments, such as those subject to New York State withholding tax, are required to file NY DTF DTF-4.

How to fill out NY DTF DTF-4?

To fill out NY DTF DTF-4, gather all relevant tax information, complete the form by entering the necessary details, and ensure accuracy before submitting it to the New York State Department of Taxation and Finance.

What is the purpose of NY DTF DTF-4?

The purpose of NY DTF DTF-4 is to report certain payments made to individuals or businesses and ensure compliance with New York State tax laws.

What information must be reported on NY DTF DTF-4?

The information that must be reported on NY DTF DTF-4 includes payee identification, amounts paid, type of payment, and any taxes withheld, among other relevant details.

Fill out your NY DTF DTF-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF DTF-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.