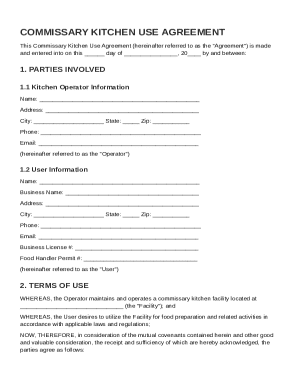

IA DoR 14-101a 2022 free printable template

Show details

IA 2848 Iowa Department of Revenue Power of Attorney The form begins on the third page. Purpose of form This form gives the representative(s) listed in section 2, and on any attached IA 2848As, the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IA DoR 14-101a

Edit your IA DoR 14-101a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IA DoR 14-101a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IA DoR 14-101a online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IA DoR 14-101a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA DoR 14-101a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IA DoR 14-101a

How to fill out IA DoR 14-101a

01

Gather all required personal and financial information.

02

Start by filling in your name, address, and contact details in the designated sections.

03

Provide your Social Security Number or taxpayer identification number when prompted.

04

Fill out the information regarding your income sources, including wages, self-employment, or other income.

05

Include any necessary deductions or credits that you are eligible for.

06

Review your completed sections to ensure accuracy and completeness.

07

Sign and date the form at the bottom where indicated.

08

Submit the form electronically or via mail as instructed.

Who needs IA DoR 14-101a?

01

Individuals or entities required to report their financial information to the relevant authority.

02

Taxpayers who have specific income, deductions, or credits that must be disclosed.

03

Anyone who is completing their annual income tax documentation.

Fill

form

: Try Risk Free

People Also Ask about

How does power of attorney work in Iowa?

An Iowa Power of Attorney (PoA) is a legal document that grants a trusted individual or entity the authority to manage your finances, such as accessing accounts, signing contracts, and buying or selling real estate.

What is a power of attorney in Iowa real estate?

An Iowa real estate power of attorney is a document that allows a principal title holder of real property to appoint an agent to take over the sale, closing, or even the management of his or her real estate.

How do I get a power of attorney in Iowa?

Steps for Making a Financial Power of Attorney in Iowa Create the POA Using a Statutory Form, Software, or Attorney. Sign the POA in the Presence of a Notary Public. Store the Original POA in a Safe Place. Give a Copy to Your Agent or Attorney-in-Fact. File a Copy With the Recorder's Office.

How many years can you put on a form 2848?

Do not write “all years.” Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.

What is a 2848 form for power of attorney in Iowa?

The IA 2848 form must be signed by a person who has filed a valid Representative Certification Form. The filing of this form automatically revokes the authority of all representatives appointed previously on IA 2848, IA 2848-A, IA 706, or IA 1041 forms for the same matters covered by this document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IA DoR 14-101a in Gmail?

IA DoR 14-101a and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I fill out the IA DoR 14-101a form on my smartphone?

Use the pdfFiller mobile app to fill out and sign IA DoR 14-101a. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete IA DoR 14-101a on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your IA DoR 14-101a. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IA DoR 14-101a?

IA DoR 14-101a is a specific form used for reporting certain financial information to the Iowa Department of Revenue.

Who is required to file IA DoR 14-101a?

Individuals and businesses engaging in certain transactions or activities specified by Iowa state law are required to file IA DoR 14-101a.

How to fill out IA DoR 14-101a?

To fill out IA DoR 14-101a, one must provide accurate financial information as specified in the form's instructions, including personal or business details and financial data.

What is the purpose of IA DoR 14-101a?

The purpose of IA DoR 14-101a is to ensure compliance with Iowa tax laws by collecting necessary financial information from taxpayers.

What information must be reported on IA DoR 14-101a?

IA DoR 14-101a requires reporting of details such as income, deductions, credits, and any other relevant financial information as outlined in the form.

Fill out your IA DoR 14-101a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IA DoR 14-101a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.