Get the free faisalabad tax bar association

Show details

This document is a registration form for a seminar organized by the CPD Committees of ICMAP and ICAP Faisalabad and the Faisalabad Tax Bar Association, focusing on the impact of new sales tax regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign faisalabad tax bar association

Edit your faisalabad tax bar association form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your faisalabad tax bar association form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit faisalabad tax bar association online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit faisalabad tax bar association. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

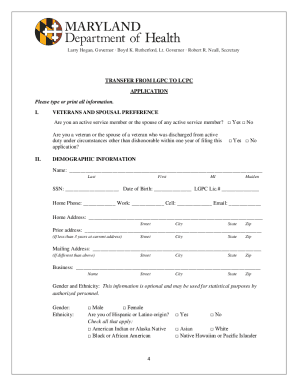

How to fill out faisalabad tax bar association

01

To fill out the Faisalabad Tax Bar Association, you will need to follow the steps outlined by the association.

02

Start by obtaining the necessary application form from the association's office or website. This form will require you to provide your personal and professional details.

03

Fill out the form accurately and make sure to include any required supporting documents, such as your educational qualifications, professional experience, and proof of membership with any relevant professional bodies.

04

Review the form to ensure that all the information provided is correct and complete. Any mistakes or missing information may delay the processing of your application.

05

Once you have completed the form, submit it along with any required fees or membership dues to the designated office or address specified by the Faisalabad Tax Bar Association.

06

After submitting your application, you may be required to attend an interview or provide any additional information requested by the association. It is important to cooperate and promptly respond to any further inquiries.

07

After your application has been reviewed and approved by the Faisalabad Tax Bar Association, you will receive confirmation of your membership or registration.

08

Congratulations! You are now a member of the Faisalabad Tax Bar Association, and you can enjoy the benefits and privileges offered by the association.

Who Needs Faisalabad Tax Bar Association?

01

Lawyers specializing in tax law and practicing in Faisalabad can greatly benefit from joining the Faisalabad Tax Bar Association.

02

Tax consultants, accountants, and other professionals involved in the field of taxation may also find the association useful for networking, professional development, and access to resources.

03

Individuals or businesses seeking legal assistance and guidance related to tax matters in Faisalabad can approach members of the Faisalabad Tax Bar Association for expert advice and representation.

04

Students pursuing a career in tax law or taxation may find value in joining the association to connect with experienced professionals and gain insights into the industry.

05

The Faisalabad Tax Bar Association can also serve as a platform for individuals interested in staying updated and informed about the latest developments and changes in tax laws and regulations.

06

Anyone wishing to contribute to the advancement of tax law and promote professional standards in Faisalabad's legal and taxation community may find the Faisalabad Tax Bar Association a suitable forum for their involvement.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the faisalabad tax bar association in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your faisalabad tax bar association right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out faisalabad tax bar association using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign faisalabad tax bar association and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out faisalabad tax bar association on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your faisalabad tax bar association. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is faisalabad tax bar association?

The Faisalabad Tax Bar Association is a professional organization representing tax practitioners, including lawyers and accountants, in Faisalabad, Pakistan. It aims to promote the interests of its members and provide a platform for discussion on tax-related matters.

Who is required to file faisalabad tax bar association?

Members of the Faisalabad Tax Bar Association, including tax consultants, lawyers, and accountants who practice in the field of taxation, are required to file with the association.

How to fill out faisalabad tax bar association?

To fill out the Faisalabad Tax Bar Association forms, members should follow the provided guidelines, which usually include entering personal details, professional qualifications, and relevant tax practice information. It is important to ensure all required fields are completed accurately.

What is the purpose of faisalabad tax bar association?

The purpose of the Faisalabad Tax Bar Association is to facilitate collaboration among tax professionals, advocate for members' rights, enhance the understanding of tax laws, and provide members with resources and training related to taxation.

What information must be reported on faisalabad tax bar association?

Members are typically required to report information such as their name, contact details, professional qualifications, areas of specialization in tax practice, and any disciplinary actions if applicable.

Fill out your faisalabad tax bar association online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Faisalabad Tax Bar Association is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.