Get the free publication template

Show details

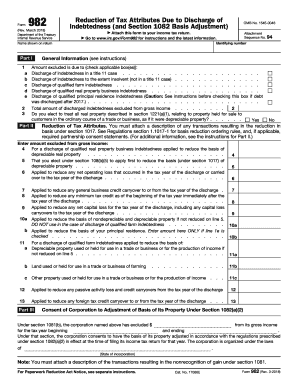

Publication 4681ContentsCanceled Debts, Foreclosures, Repossessions, and AbandonmentsWhat's Newest. No. 51508F Department of the Treasury Internal Revenue Service(for Individuals) For use in preparing2021

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication template

Edit your publication template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication template online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit publication template. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication template

How to fill out IRS Publication 4681

01

Gather necessary financial information, including details on the decedent and the beneficiaries.

02

Obtain the IRS Publication 4681 form from the IRS website or your tax professional.

03

Begin with Part I by filling out the decedent's information, such as name and Social Security number.

04

Complete Part II, which involves providing information about the estate property and liabilities.

05

Fill out Part III to calculate the allowable deduction for the estate tax.

06

Review the form for accuracy and compliance with IRS instructions.

07

Submit the completed Publication 4681 with your estate tax return.

Who needs IRS Publication 4681?

01

Individuals handling an estate that has to file an estate tax return due to the death of a loved one.

02

Executors or administrators of estates who need to report minor's trusts or inherited property.

03

Beneficiaries who may need to understand the tax implications related to an inheritance.

Fill

form

: Try Risk Free

People Also Ask about

How do you structure a publication?

There are variations between journals (again – always check the guidelines for authors!), but published articles are generally structured as follows: Title. Abstract. Introduction. Materials & Methods. Results (figures and tables) Discussion. Conclusion. References.

How do you write an article for publication template?

Newspaper article template Choose a descriptive headline. Lede should be the main point (the reader should know the whole story after reading the first paragraph) Summarize the key points. Add story details and supporting information in order of importance. Cut any unnecessary information or details.

How do you draft a publication?

How to Write and Publish a Research Paper in 7 Steps Check whether your research is publication-ready. Choose an article type. Choose a journal. Construct your paper. Decide the order of authors. Check and double-check. Submit your paper.

What is the structure of paper publication?

Most journal-style scientific papers are subdivided into the following sections: Title, Authors and Affiliation, Abstract, Introduction, Methods, Results, Discussion, Acknowledgments, and Literature Cited, which parallel the experimental process. This is the system we will use.

What is IEEE template?

IEEE article templates let you quickly format your article and prepare a draft for peer review. Templates help with the placement of specific elements, such as the author list. They also provide guidance on stylistic elements such as abbreviations and acronyms.

What is a journal template?

A journal template is a Microsoft® Excel spreadsheet that has been formatted so that you can enter journal entries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get publication template?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific publication template and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the publication template form on my smartphone?

Use the pdfFiller mobile app to fill out and sign publication template. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit publication template on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign publication template. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is IRS Publication 4681?

IRS Publication 4681 is a document that provides guidance on the tax implications of receiving a distribution from a qualified retirement plan or similar arrangement.

Who is required to file IRS Publication 4681?

Individuals who have received a distribution from a qualified retirement plan or arrangement and need to report this distribution on their tax return are required to file IRS Publication 4681.

How to fill out IRS Publication 4681?

To fill out IRS Publication 4681, taxpayers must provide accurate information regarding the distribution, including details about the plan, type of distribution received, and any taxes withheld.

What is the purpose of IRS Publication 4681?

The purpose of IRS Publication 4681 is to inform taxpayers about the requirements and tax implications of retirement plan distributions and help ensure accurate reporting.

What information must be reported on IRS Publication 4681?

Information that must be reported on IRS Publication 4681 includes the amount of the distribution, type of retirement plan, date received, and any federal income taxes withheld.

Fill out your publication template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication Template is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.