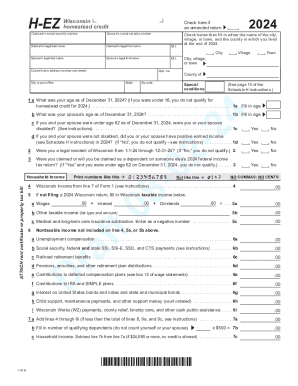

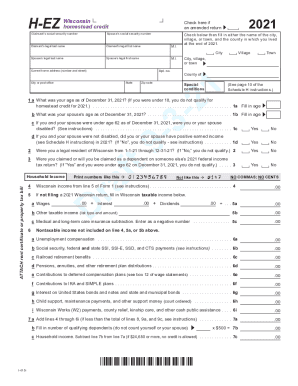

Who needs a form For Schedule H-EZ?

Schedule H-EZ is the Wisconsin Department of Revenue form that must be filled out by individuals wanting to apply for the homestead credit. Homestead credit allows renters and homeowners to be granted with a tax benefit which will decrease the impact of rent and property taxes. The following are the specific conditions that must be met so that a person can qualify for the 2015 tax benefit:

-

An individual rented or owned their home in 2015;

-

An individual is a legal resident of the state of Wisconsin during the whole year (Jan 1 – Dec 31);

-

A person turned 18 on Dec 31, 2015 or earlier;

-

An individual will not be indicated as someone else’s dependent on the 2015 federal tax return.

When is the form For Schedule H-EZ due?

Because Schedule H-EZ is essentially a claim for a tax benefit, the form should be submitted at the moment of filing the Wisconsin Income tax return and attached to form 1 or 1A. If the filer fails to submit the Homestead credit form with the tax return form, the separate filing can delay the homestead refund.

The deadline for 2015 form’s submission is April 15, 2020.

Is the WI Schedule H-EZ 2015 accompanied by any other forms?

Except for forms 1 or 1A (whichever is appropriate), the claiming homeowners have to attach an official copy of their property tax bill. Renters are required to attach their rent certificate indicating the price of rent, completed and signed by the landlord.

How do I fill out the form?

The following details are required on the Schedule H-EZ:

-

Information about the claimant and their spouse (name, SSN, home address);

-

Calculation of the household income:

-

Taxes and rent amounts;

-

Computation of credit.

Finally, the claimant must sign and date the form.

The detailed instructions for the form can be read here.

Where do I submit the completed form?

Schedule H-EZ must be directed to the Department of Revenue in the Wisconsin at: PO Box 34, Madison WI 53786-0001.