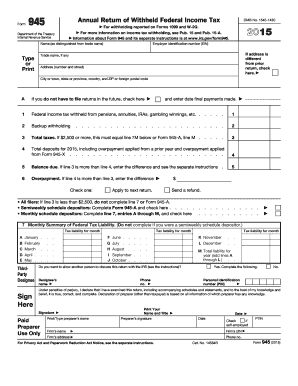

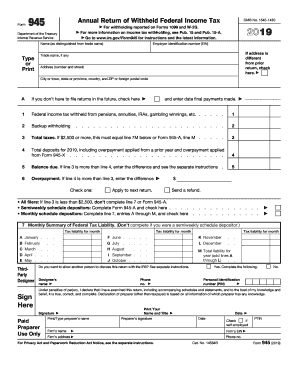

Who Can Use Form 945?

The IRS form 945 primarily aims at individuals arranging various payments and withholding the federal revenue tax. You can use it if your general tax rate for the entire year is not higher than $2,500. Also, you can use it if you are a depositor who makes payments according to the Accuracy of Deposit Rules.

What is Form 945?

The 945 Form (Annual Return of Withheld Federal Income Tax) is mainly used for nonpayroll payments. They include such issues as pensions, gambling winnings, backup withholding, voluntary withholding, military retirement, Indian gaming profits, and many others.

What is the Form 945 due date?

For 2022, you should file Form 945 by January 31, 2023. However, if you made deposits on time in full payment of the taxes for the year, you may file the return by February 10, 2023.

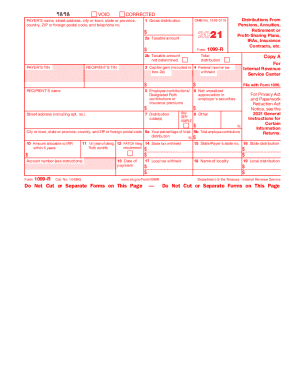

Do any other reports accompany the 945 Tax Form?

The Annual Return of Withheld Federal Income Tax sometimes requests other forms to be attached. They are Form 1099 and the Form W-2G. For more information about these two additional statements, visit the IRS website.

How do I complete IRS Form 945?

Open the web template in your browser using the ‘Get Form’ button at the top of this page and complete the required fields. You should signify the whole tax rates, backup withholding, federal revenue tax, general deposits, and the balance due. Moreover, there is a query to insert a monthly summary of the federal tax liability (here, you will see the chart to proceed with). Short Form 945 instructions are included, or you can view the full version at Form 945 instruction in PDF.

Please note that the document requires a signature and offers a credit voucher.

Where to mail Form 945?

Please, check the list of IRS Mailing Addresses for Forms 945 to choose the one that suits you.