Get the free Fairfield Individual Income Tax Return 2010 - fairfield-city

Show details

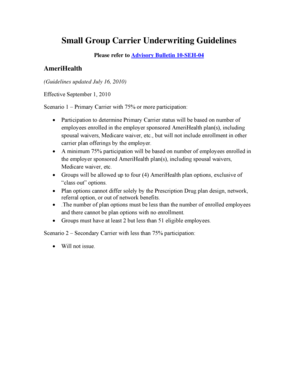

This document is an individual income tax return form for residents and non-residents of the City of Fairfield for the year 2008. It requires taxpayers to provide their financial information, including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fairfield individual income tax

Edit your fairfield individual income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fairfield individual income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fairfield individual income tax online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fairfield individual income tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fairfield individual income tax

How to fill out Fairfield Individual Income Tax Return 2010

01

Gather your personal information including Social Security Number, address, and filing status.

02

Collect documentation of all income sources such as W-2s, 1099s, and any other relevant tax statements.

03

Obtain a copy of the Fairfield Individual Income Tax Return form for the year 2010.

04

Complete the personal information section at the top of the form.

05

Report your total income on the designated line, including wages, dividends, and other income.

06

Deductions: Determine if you will take the standard deduction or itemize your deductions and fill in the appropriate section.

07

Calculate your taxable income by subtracting deductions from total income.

08

Determine your tax liability using the tax tables provided for the year 2010.

09

Fill out any applicable credits or payments sections to lower your overall tax bill.

10

Sign and date the return before submitting it either electronically or via postal mail.

Who needs Fairfield Individual Income Tax Return 2010?

01

Individuals who earned income in Fairfield during the tax year 2010.

02

Residents of Fairfield who are required to file a state income tax return.

03

Self-employed individuals or business owners operating in Fairfield during 2010.

04

Those who have a tax obligation to the state of Connecticut or local jurisdiction related to their Fairfield residency.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax rate in Fairfield?

The combined sales tax rate for Fairfield, California is 8.38%. Your total sales tax rate is the sum of the California state tax (6.25%), the Solano County sales tax (1.00%), and the special tax (1.13%). Fairfield doesn't levy a city sales tax.

Where do I find past tax returns?

Online is the fastest and easiest way to get your transcript. All transcript types are also available by mail by submitting Form 4506-T, Request for Transcript of Tax Return. Additionally, Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript can be used to request just a tax return transcript.

Does Fairfield, Ohio have city income tax?

Fairfield delivers high-quality public services at highly competitive tax rates for our businesses. Income Tax: The city collects a 1.5% income tax on the gross wages of employees and net profits of businesses operating within the city.

How much is sales tax in Fairfield, Ohio?

Fairfield County sales tax details The minimum combined 2025 sales tax rate for Fairfield County, Ohio is 6.75%. This is the total of state, county, and city sales tax rates. The Ohio sales tax rate is currently 5.75%.

Does Fairfield have income tax?

The City of Fairfield has mandatory filing for all residents between the age of 18-65, residents over the age of 65 with taxable income or loss, part-year residents, businesses working in Fairfield, employees working in Fairfield whose employer failed to withhold Fairfield taxes at 1.5%, non-residents who own property

What is the property tax rate in Fairfield Ohio?

Median Fairfield, OH effective property tax rate: 2.31%, significantly higher than the national median of 1.02%, but lower than the Ohio state median of 1.80%. Median annual Fairfield, OH tax bill: $2,772, $372 higher than the national median property tax bill of $2,400.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fairfield Individual Income Tax Return 2010?

The Fairfield Individual Income Tax Return 2010 is a tax form used by residents of Fairfield to report their individual income and calculate their tax liability for the year 2010.

Who is required to file Fairfield Individual Income Tax Return 2010?

Residents of Fairfield who earned income during the year 2010, including wages, salaries, dividends, and other taxable incomes, are required to file the Fairfield Individual Income Tax Return 2010.

How to fill out Fairfield Individual Income Tax Return 2010?

To fill out the Fairfield Individual Income Tax Return 2010, gather all necessary financial documents, complete the form with your personal information, report your income, claim any deductions or credits, and sign the return before submitting it to the appropriate tax authority.

What is the purpose of Fairfield Individual Income Tax Return 2010?

The purpose of the Fairfield Individual Income Tax Return 2010 is to allow residents to report their earnings and pay the appropriate taxes due to the municipality, thus contributing to local government funding and services.

What information must be reported on Fairfield Individual Income Tax Return 2010?

The information that must be reported includes personal identification details, total income earned, deductions and exemptions claimed, taxable income, tax liability calculated, and payment information.

Fill out your fairfield individual income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fairfield Individual Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.