IRS 1120-PC 2022 free printable template

Show details

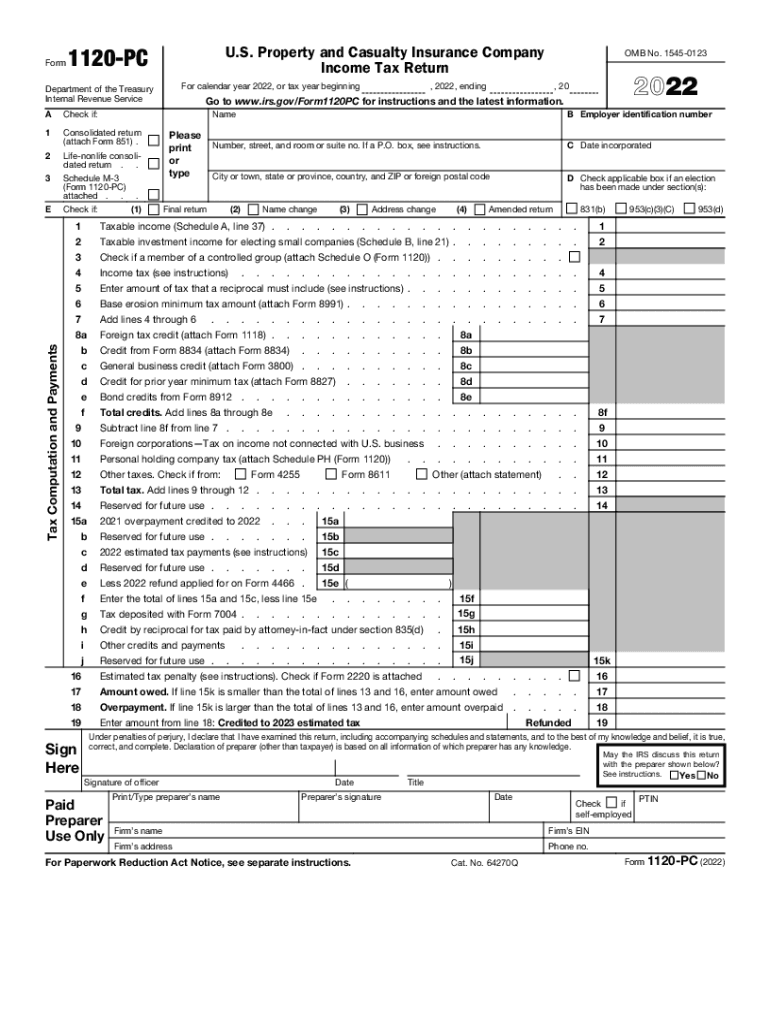

Form. S. Property and Casualty Insurance Company

Income Tax Return1120PCFor calendar year 2022, or tax year beginningDepartment of the Treasury

Internal Revenue Service

Check if:1Consolidated return

(attach

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-PC

How to edit IRS 1120-PC

How to fill out IRS 1120-PC

Instructions and Help about IRS 1120-PC

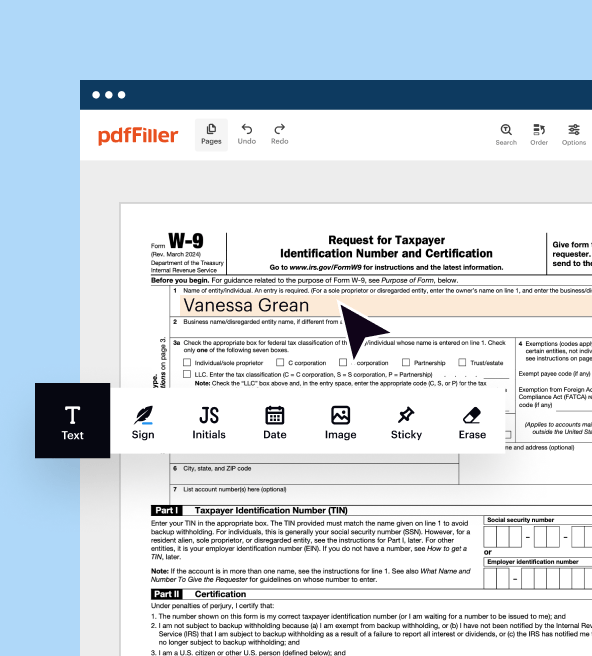

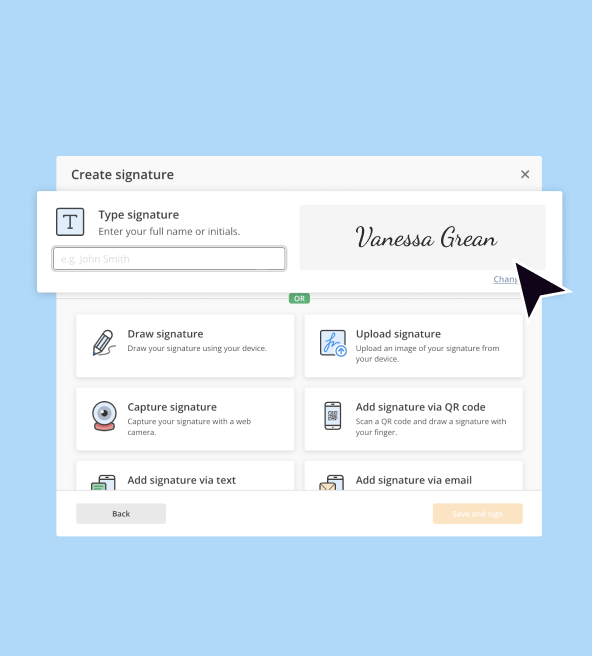

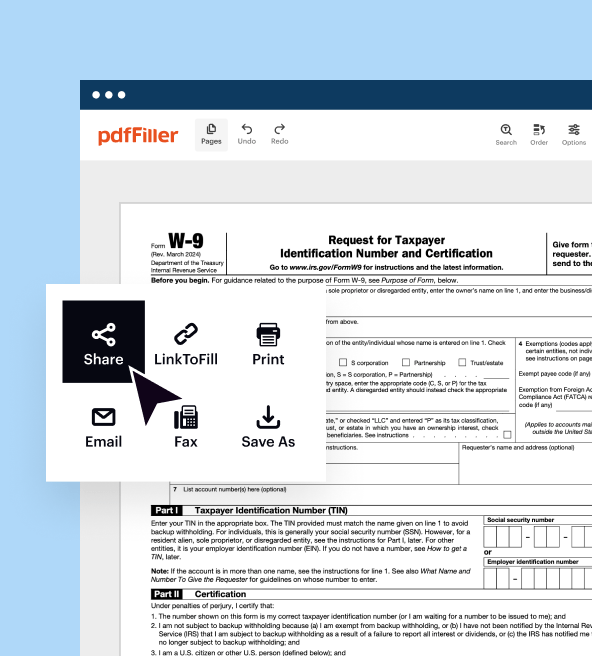

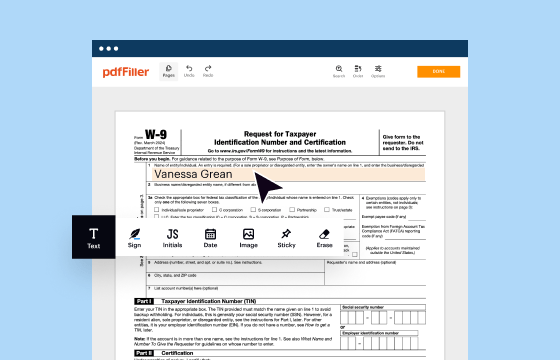

How to edit IRS 1120-PC

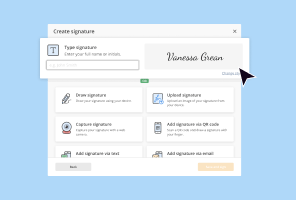

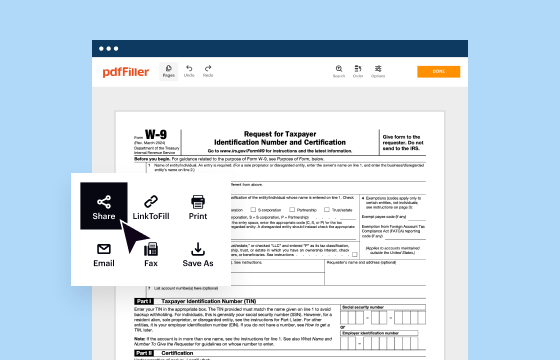

To edit the IRS 1120-PC tax form, use a reliable document editor like pdfFiller. This platform allows you to modify text, add signatures, and insert checkboxes or other interactive elements. Simply upload the form, make the required changes, and save your updated document. Ensure that you double-check your edits for accuracy before submitting.

How to fill out IRS 1120-PC

Filling out the IRS 1120-PC tax form involves several key steps:

01

Gather necessary documentation, including income, deductions, and credits.

02

Complete the identification section of the form, entering your corporation's name, address, and Employer Identification Number (EIN).

03

Fill in the financial information accurately, ensuring totals match your accounting records.

04

Review your entries for accuracy before signing and dating the form.

About IRS 1120-PC 2022 previous version

What is IRS 1120-PC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-PC 2022 previous version

What is IRS 1120-PC?

IRS 1120-PC is the U.S. federal tax form specifically designed for corporations engaged in providing insurance. This form allows these corporations to report their income, gains, losses, deductions, and credits for tax purposes. Understanding its structure is vital for compliance with U.S. tax law.

What is the purpose of this form?

The primary purpose of the IRS 1120-PC is to report the financial activity and tax liability of property and casualty insurance companies. Accurate reporting is essential for these companies to fulfill their tax obligations and to enable the IRS to assess the correct tax amount. This ensures that the tax system is fair and operational.

Who needs the form?

Corporations that provide property and casualty insurance must use IRS 1120-PC to report their income and tax liability. This includes businesses that write any forms of insurance against fire, theft, or other losses. If your corporation operates in this field, timely filing of this form is required to avoid penalties.

When am I exempt from filling out this form?

Certain entities may be exempt from filing IRS 1120-PC if they do not meet the definition of a property and casualty insurance company as defined by the IRS. Additionally, small corporations that do not have a tax liability under the applicable thresholds may also qualify for exemptions. Review IRS guidelines to confirm eligibility for exemption.

Components of the form

The IRS 1120-PC consists of several key components, including:

01

Identification section for the corporation’s details.

02

Income and deductions tables that capture various sources of revenue.

03

Tax computation section to determine taxable income and tax liability.

Each component must be filled out accurately to avoid discrepancies in reporting.

Due date

The due date for filing IRS 1120-PC typically aligns with the 15th day of the third month after the end of the corporation’s tax year. For many corporations operating on a calendar year, this means the due date is March 15. Failing to meet this deadline can result in penalties and interest charges.

What payments and purchases are reported?

IRS 1120-PC requires reporting on various financial activities. This includes premiums received, underwriting gains or losses, investment income, and operational expenses. Additionally, significant purchases related to operational activities must also be documented to ensure accurate reporting of overall expenditures.

How many copies of the form should I complete?

When filing IRS 1120-PC, corporations typically need to submit one original form to the IRS. However, it may be wise to retain copies for your records and potentially for state tax reporting. It is essential to follow IRS instructions regarding additional copies for specific needs.

What are the penalties for not issuing the form?

Failing to file IRS 1120-PC can lead to significant penalties. The IRS may impose a failure-to-file penalty, which can accumulate daily until the form is submitted. Moreover, late filings may incur interest on any taxes due, further increasing the financial implications of non-compliance.

What information do you need when you file the form?

Before filing IRS 1120-PC, gather comprehensive information including your corporation's income, deductible expenses, tax credits, and any prior year data that may influence the current year's tax obligations. This data is essential to ensure accuracy and compliance.

Is the form accompanied by other forms?

IRS 1120-PC may require the submission of additional forms, such as Form 8960 (Net Investment Income Tax) or Form 2220 (Underpayment of Estimated Tax). Depending on your corporation's financial activities and structure, consulting IRS instructions or a tax professional can clarify necessary accompanying documents.

Where do I send the form?

Submit the completed IRS 1120-PC according to the mailing address specified in the form’s instructions. This varies based on the corporation's location and whether it includes a payment. Always check the IRS website to confirm the correct mailing address to ensure timely processing.

See what our users say