NZ IR 348 2012 free printable template

Show details

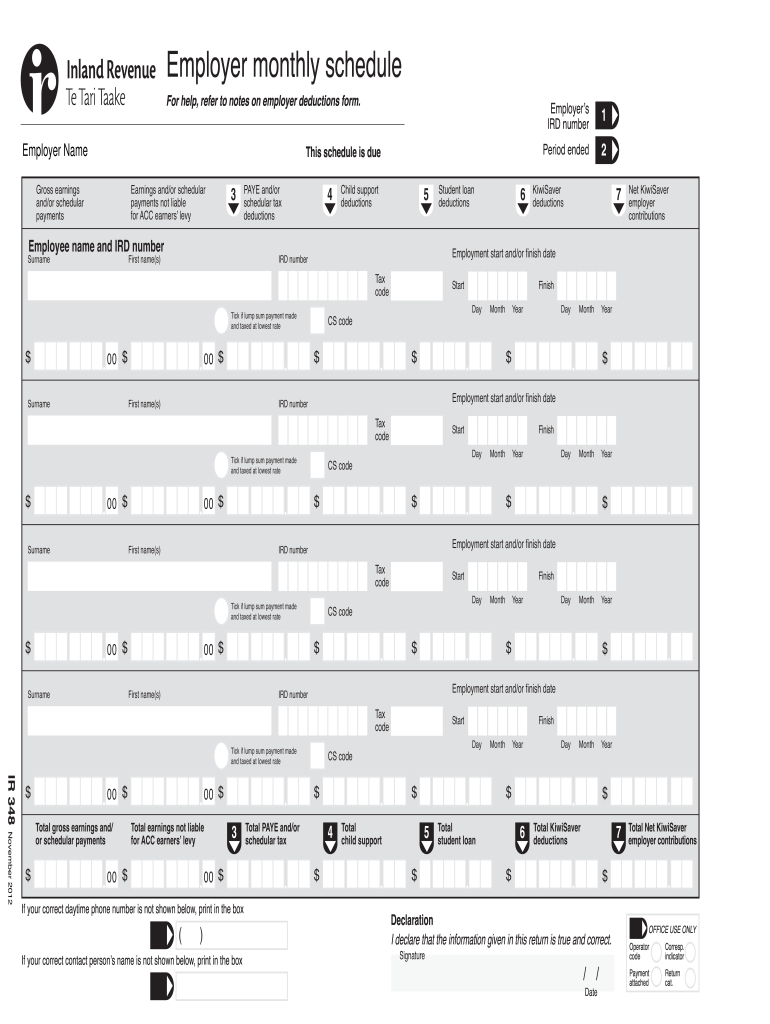

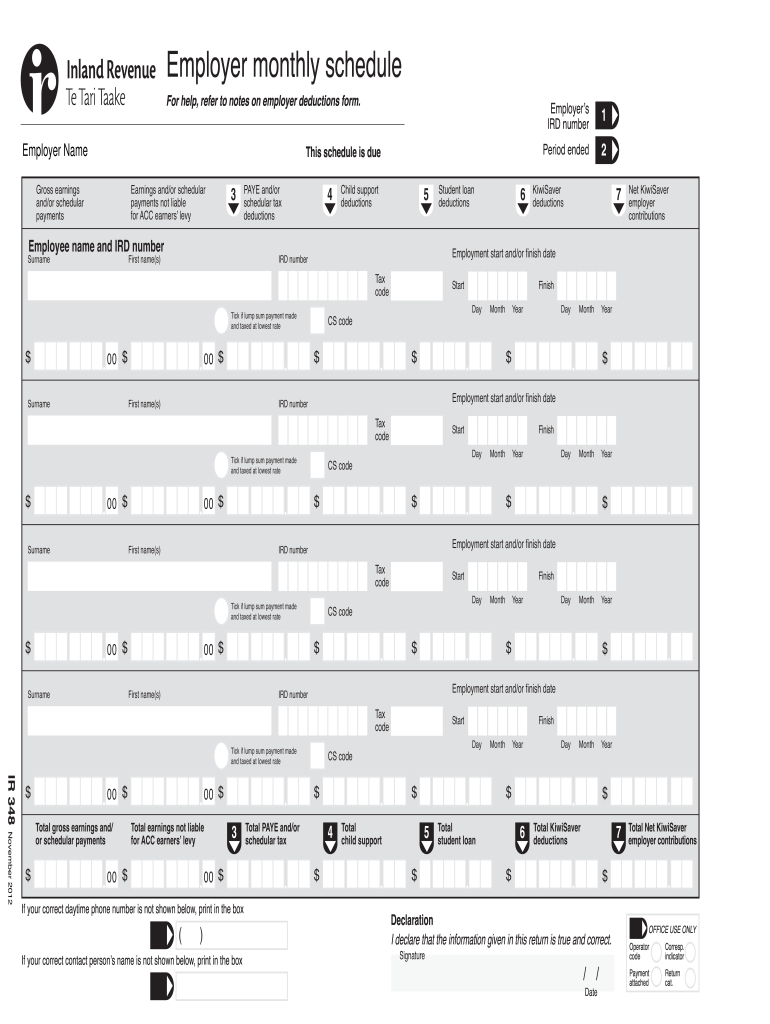

Employer monthly schedule For help, refer to notes on employer deductions form. This schedule is due Employer Name Earnings and/or scheduler payments not liable for ACC earners levy Gross earnings

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NZ IR 348

Edit your NZ IR 348 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ IR 348 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NZ IR 348 online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NZ IR 348. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR 348 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ IR 348

How to fill out NZ IR 348

01

Begin by downloading the NZ IR 348 form from the New Zealand Inland Revenue website.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal details, including your name, address, and IRD number at the top of the form.

04

Indicate the relevant tax year for which you are making the application.

05

Provide information on your income sources as specified in the form, including wages, self-employment, and other income.

06

Fill out expenses incurred during the tax year that you wish to claim, ensuring to keep receipts as proof.

07

Calculate your total income and total expenses to determine your taxable amount.

08

Complete the declaration section by signing and dating the form.

09

Submit the completed form to the Inland Revenue Department either by mail or electronically, depending on available options.

Who needs NZ IR 348?

01

The NZ IR 348 form is required for individuals who need to claim tax credits or refunds for their income taxes.

02

It is necessary for self-employed individuals or those with additional income sources to report their earnings.

03

Anyone who has had tax deducted from their income and wants to reconcile their tax position for the year.

Fill

form

: Try Risk Free

People Also Ask about

What is payroll tax rate in New Zealand?

There are five PAYE tax brackets for the 2021-2022 tax year: 10.50%, 17.50%, 30%, 33% and 39%. Your tax bracket depends on your total taxable income. These are the rates for taxes due in April 2023.

How do I pay my employee tax NZ?

There are three options for payday filing: Directly from your accounting software (if it's been enabled for payday filing). Online through Inland Revenue's myIR service. On paper forms — but only if your annual PAYE and ESCT (employer superannuation contribution tax) is less than $50,000 or you're a new employer.

Do employers pay payroll tax in New Zealand?

Employers in New Zealand are responsible for withholding income taxes, social taxes, and fringe benefit taxes from employee pay and benefits. Employers must also make employer-mandated social tax contributions and pay the Employer Superannuation Contribution Tax (ESCT).

What is IRD in New Zealand?

NZ's IRD number is a unique number issued by Inland Revenue to customers, both individuals and non-individuals (such as Companies, Partnerships, Trusts, Charities), and is usually used for the lifetime of a customer (other than when a person is declared bankrupt).

Is there any payroll tax in New Zealand?

Tax is withheld by the employer from employee's payments through payroll and paid to the Inland Revenue Department.FBT rates. NET REMUNERATION IN NZDRateLess than 12,53011.73%12,531 – 40,58021.21%40,581 – 55,98042.86%55,981 – 129,68049.25%1 more row

What are an employer's tax obligations?

An employer generally must withhold social security and Medicare taxes from employees' wages and pay the employer share of these taxes. Social security and Medicare taxes have different rates and only the social security tax has a wage base limit. The wage base limit is the maximum wage subject to the tax for the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NZ IR 348 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing NZ IR 348 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the NZ IR 348 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your NZ IR 348 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit NZ IR 348 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NZ IR 348 right away.

What is NZ IR 348?

NZ IR 348 is a tax return form used in New Zealand for individuals who have income that is not taxed at source, such as self-employed individuals, contractors, and those with rental income.

Who is required to file NZ IR 348?

Individuals who have income that is not subject to withholding tax, such as self-employed persons, contractors, and those earning rental income, are required to file NZ IR 348.

How to fill out NZ IR 348?

To fill out NZ IR 348, individuals need to provide personal details, report all sources of income, claim any allowable expenses, and calculate the tax owed. Accurate record-keeping is essential.

What is the purpose of NZ IR 348?

The purpose of NZ IR 348 is to report additional income to the New Zealand Inland Revenue Department (IRD) and to ensure proper assessment of tax liabilities for individuals with non-PAYE income.

What information must be reported on NZ IR 348?

NZ IR 348 requires reporting of income from various sources including self-employment, rental income, investment income, and any other relevant income, along with claims for deductions and expenses.

Fill out your NZ IR 348 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ IR 348 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.