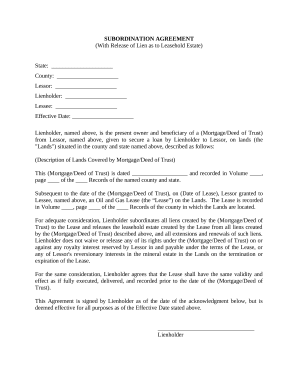

Canada E677 2011 free printable template

Show details

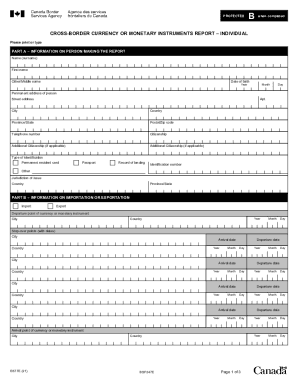

Restore - Restaurer Help Instructions PROTECTED PROT G B Aide when completed une fois rempli CROSS-BORDER CURRENCY OR MONETARY INSTRUMENTS REPORT INDIVIDUAL D CLARATION SUR LES MOUVEMENTS TRANSFRONTALIERS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada E677

Edit your Canada E677 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada E677 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada E677 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada E677. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada E677 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada E677

How to fill out Canada E677

01

Obtain a copy of the Canada E677 form.

02

Read the instructions included with the form to understand the requirements.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide information regarding the purpose of your application.

05

Complete any additional sections related to your specific situation or application.

06

Review your entries for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form according to the instructions provided, either by mail or electronically.

Who needs Canada E677?

01

Individuals applying for a visitor visa to Canada.

02

Foreign nationals looking to extend their stay in Canada.

03

Those seeking to change their immigration status while in Canada.

Fill

form

: Try Risk Free

People Also Ask about

How do I declare more than 10000 CAD?

When you arrive in Canada with Can$10,000 or more in your possession, you must report it on the CBSA Declaration Card (if one was provided to you), on an Automated Border Clearance kiosk or a Primary Inspection Kiosk, or in the verbal declaration made to a border services officer.

Are checks considered monetary instruments?

Banks sell a variety of monetary instruments, such as bank checks or drafts, cashier's checks, money orders, and traveler's checks.

What happens if you declare more than $10000 Canada?

When leaving Canada by air with currency or monetary instruments valued at CAN$10,000 or more in your possession, you must report to the CBSA office within the airport before clearing security. Prior to leaving Canada by land, boat or rail, report to the CBSA office nearest your location.

What are considered monetary instruments?

31 CFR § 1010.100 (dd) defines “monetary instrument” as: Incomplete instruments (including personal checks, business checks, official bank checks, cashiers' checks, third-party checks, promissory notes, and money orders) signed but with the payee's name omitted.

What happens when you declare more than $10 000 in Canada?

If you are sending $10,000 or more or its equivalent in a foreign currency from Canada by mail, you have to complete Form E667 and include it with the item being mailed, and mail or submit a completed copy of Form E667 to the nearest CBSA office at the same time or before you mail the package.

How much cash can you legally carry in Canada?

Travelling with $10,000 or more Any time you enter or leave Canada, you must declare any money or monetary instruments, such as stocks, bond or cheques, you are carrying valued at $10,000 or more.

What happens when you declare more than 10000?

If you bring more than $10,000 USD you have to notify customs and fill out a Report of International Transportation of Currency and Monetary Instruments (FinCEN 105). It's very important to know that this means any form of cash that equals $10,000 USD.

How much cash you can take to Canada?

Any time you enter or leave Canada, you must declare any money or monetary instruments, such as stocks, bond or cheques, you are carrying valued at $10,000 or more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada E677 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including Canada E677. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit Canada E677 in Chrome?

Install the pdfFiller Google Chrome Extension to edit Canada E677 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out Canada E677 on an Android device?

Use the pdfFiller Android app to finish your Canada E677 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Canada E677?

Canada E677 is a form used to report certain international transactions conducted by Canadian residents as part of their income tax filings.

Who is required to file Canada E677?

Individuals and entities that engage in specified international transactions, such as those involving foreign affiliates or investments, are required to file Canada E677.

How to fill out Canada E677?

To fill out Canada E677, taxpayers must provide details about the relevant international transactions, including amounts and the nature of the transactions, and submit the form alongside their tax return.

What is the purpose of Canada E677?

The purpose of Canada E677 is to ensure compliance with tax laws regarding international transactions and to provide the Canada Revenue Agency (CRA) with necessary information for proper assessment.

What information must be reported on Canada E677?

The information reported on Canada E677 includes details of the transactions, involved parties, financial amounts, and any other relevant data that pertains to international dealings.

Fill out your Canada E677 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada e677 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.