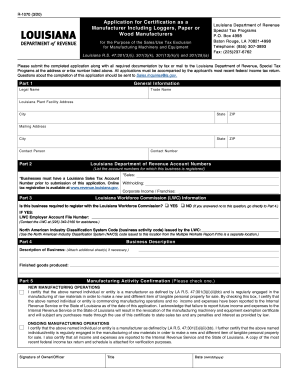

LA LDR R-1070 2022-2025 free printable template

Get, Create, Make and Sign r 1070 form

Editing louisiana r 1070 2022-2025 online

Uncompromising security for your PDF editing and eSignature needs

LA LDR R-1070 Form Versions

How to fill out louisiana r 1070 2022-2025

How to fill out LA LDR R-1070

Who needs LA LDR R-1070?

Video instructions and help with filling out and completing louisiana r 1070

Instructions and Help about louisiana r 1070 2022-2025

All right here's an absolutely beautiful locksmith our 1070 receiver stopping line is a day apparently it retails for about 300 u.s. back in the 70s a very pretty piece beautiful condition and that more importantly it works what you want to see is the protection light that flashes it till it gets the proper current and there we go, and you've gone through all the controls I recap the power supply circuit board and the driver and the driver board and the chairs of protection circuitry at the back, so it's all been done quite a bit of work, but it's worth it because what you want to make sure you've got some longevity with this unit you stabilized both the power, and it back and for the outputs because the outputs aren't easy to come by no I'm possible, but they're not easy to come by, and it's a beautiful piece a shame to see it go let's try funnel we're just losing on my test speakers, and it'll what a half salmon gathering in Paris foreign affairs minister Stephane Dion says Canada is supporting projects like tuck in Paterson broadcast rubric beautiful schools analog controller light it's all been real act all look everything works it's a really nice piece is it very well looked after and since I've dealt with if it's so even better

People Also Ask about

What are Louisiana exemptions?

How do I apply for sales tax exemption in Louisiana?

Where do I find my Louisiana Revenue account number?

How do I get a resale certificate in Louisiana?

Where can I get Louisiana tax forms?

Do I need Louisiana resale certificate?

What is Revenue registration number?

How long are Louisiana resale certificates valid?

How much is a resellers permit in Louisiana?

Do I have to pay taxes on reselling items?

How long does it take to get a Louisiana Revenue account number?

Do Louisiana sales tax exemption certificates expire?

Do I need a sellers permit to sell in Louisiana?

Where do I get a Louisiana tax ID number?

Who is exempt from property tax in Louisiana?

How many digits is a Louisiana Revenue account number?

Where can I get Louisiana state tax forms?

What is exempt from sales tax in Louisiana?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send louisiana r 1070 2022-2025 to be eSigned by others?

How can I get louisiana r 1070 2022-2025?

Can I create an eSignature for the louisiana r 1070 2022-2025 in Gmail?

What is LA LDR R-1070?

Who is required to file LA LDR R-1070?

How to fill out LA LDR R-1070?

What is the purpose of LA LDR R-1070?

What information must be reported on LA LDR R-1070?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.