CA CDTFA-501-ER (former BOE-501-ER) 2022-2025 free printable template

Show details

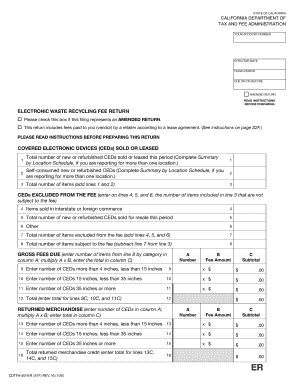

CDTFA501ER (S1F) REV. 17 (722)STATE OF CALIFORNIAELECTRONIC WASTE RECYCLING FEE RETURN DUE ON OR BEFORECALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATIONPERIOD BEGIN DATEPERIOD END DATECDTFA USE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ca electronic waste fee form

Edit your form electronic waste form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca electronic recycling fee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california electronic recycling fee online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit electronic waste fee form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-501-ER (former BOE-501-ER) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out boe 501 er form

How to fill out CA CDTFA-501-ER (former BOE-501-ER)

01

Begin by downloading the CA CDTFA-501-ER form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Fill in your business name, address, and CDTFA account number at the top of the form.

03

Enter the reporting period for which you are filing the return.

04

Indicate the type of tax or fee being reported by checking the appropriate box.

05

Complete the sections detailing your sales, use tax, or other taxable transactions as required.

06

Calculate your total tax due by following the instructions provided for each section.

07

If applicable, deduct any allowable credits or prepayments from your total tax due.

08

Sign and date the form, affirming that the information provided is accurate.

09

Submit the form by the due date via mail or electronically, as preferred.

Who needs CA CDTFA-501-ER (former BOE-501-ER)?

01

Businesses operating in California that are required to report tax due for sales, use, or other applicable transactions.

02

Taxpayers needing to apply for a waiver or report amended tax returns.

03

Entities such as retailers, wholesalers, and service providers that are subject to California tax regulations.

Fill

electronic fee

: Try Risk Free

People Also Ask about

What is the recycling law in California 2023?

Come Aug. 1, 2023, residents will only be able to dispose of primary or rechargeable batteries through battery recycling programs or “other approved means,” DOEE said. It's working mainly with Call2Recycle to “help consumers get ready for the compliance date.”

What is the Electronic Waste Recycling Act in California?

Electronic Waste Recycling Act of 2003 California enacted the Electronic Waste Recycling Act (Act) of 2003 (SB 20, Sher, Chapter 526, Statutes of 2003) to establish a funding system for the collection and recycling of certain electronic wastes.

Why does California charge a recycling fee?

California's eWaste fees are collected on in-state sales of covered electronic devices (CEDs). The state uses these revenues to fund safe, cost-free, convenient collection and recycling of CEDs which contain hazardous materials.

Is recycling taxable in California?

The California Legislature has approved a bill (AB 199) that would provide a sales-and-use tax exemption on recycling and composting equipment, and on equipment that uses recycled content in the manufacturing of new products. The bill, authored by Assembly Member Susan Eggman, now goes to Gov. Jerry Brown.

How much is the screen recycling fee in California?

(1) Four dollars ($4) for each covered electronic device with a screen size of greater than 4 inches measured diagonally but less than 15 inches measured diagonally.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in electronic waste recycling fee without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your electronic waste recycling fee, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit electronic waste recycling fee straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing electronic waste recycling fee.

Can I edit electronic waste recycling fee on an iOS device?

Use the pdfFiller mobile app to create, edit, and share electronic waste recycling fee from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is CA CDTFA-501-ER (former BOE-501-ER)?

CA CDTFA-501-ER, formerly known as BOE-501-ER, is a form used by businesses in California to report use tax on purchases made from out-of-state sellers, where sales tax was not collected.

Who is required to file CA CDTFA-501-ER (former BOE-501-ER)?

Any individual or business that has made purchases from out-of-state sellers without paying California sales tax is required to file CA CDTFA-501-ER.

How to fill out CA CDTFA-501-ER (former BOE-501-ER)?

To fill out CA CDTFA-501-ER, provide necessary details such as the buyer's information, a description of the items purchased, the total purchase amount, and calculate the applicable use tax. Follow the instructions provided on the form carefully.

What is the purpose of CA CDTFA-501-ER (former BOE-501-ER)?

The purpose of CA CDTFA-501-ER is to enable California residents and businesses to report and pay use tax on items purchased out-of-state, ensuring compliance with California tax laws.

What information must be reported on CA CDTFA-501-ER (former BOE-501-ER)?

The information required includes the purchaser's name and address, a detailed list of the purchased items, total amount of purchases, the sales tax rate applied, and the total use tax owed.

Fill out your electronic waste recycling fee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electronic Waste Recycling Fee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.