NY IT-213 2022 free printable template

Show details

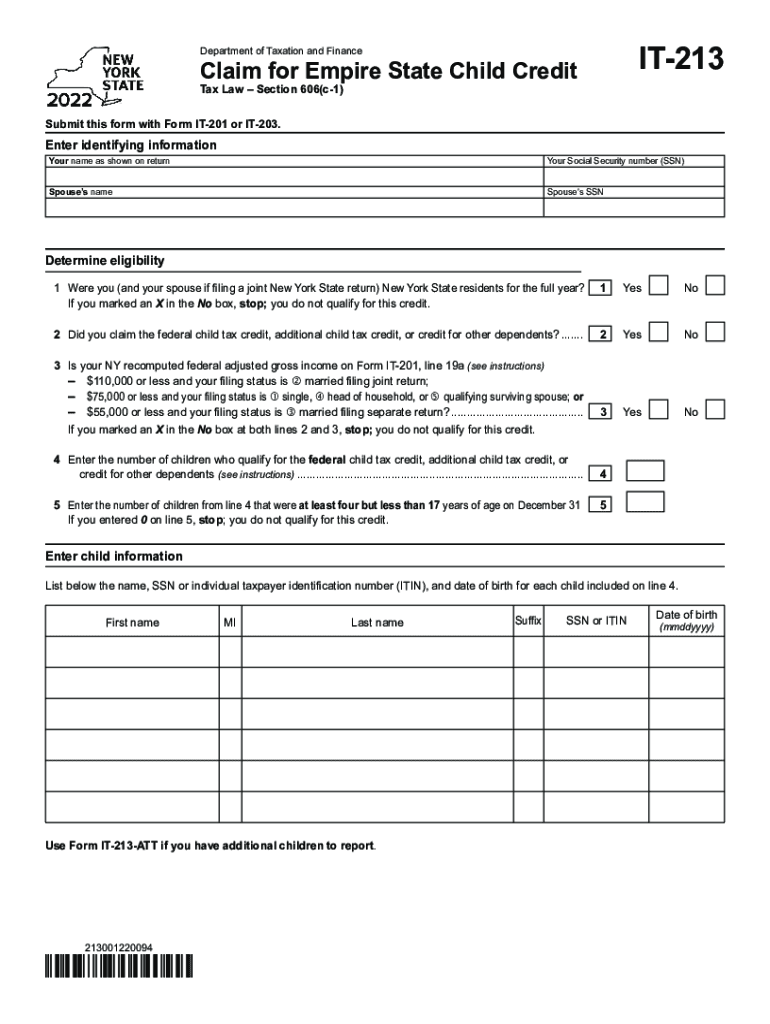

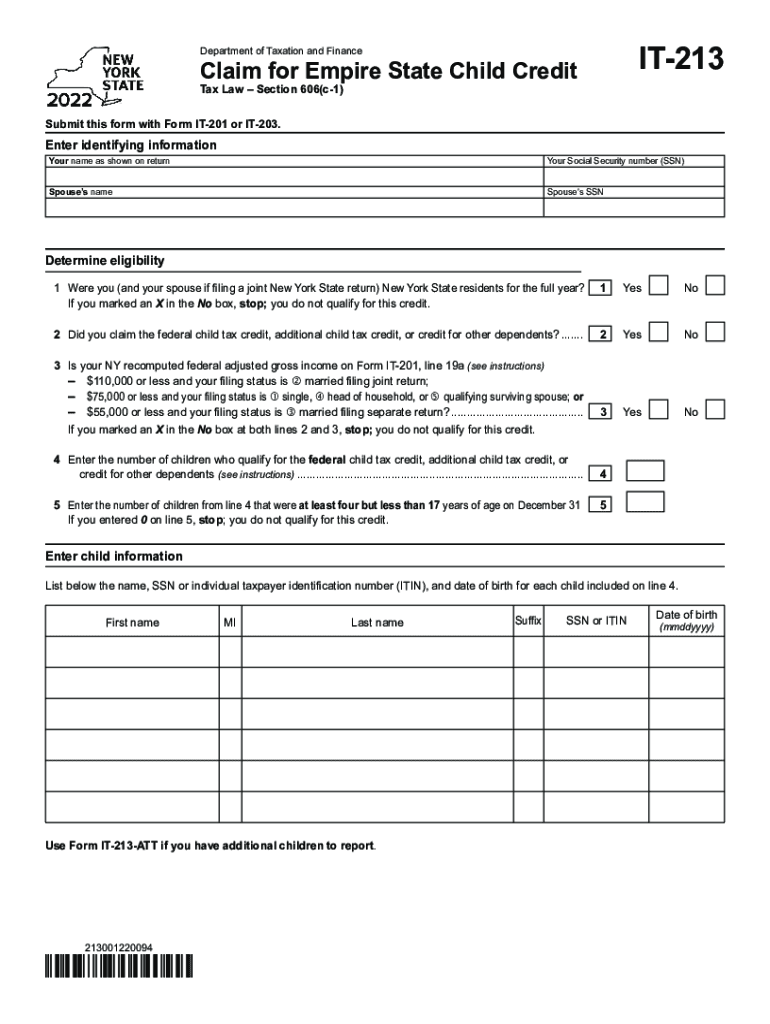

IT213Department of Taxation and FinanceClaim for Empire State Child Credit Tax Law Section 606(c1) Submit this form with Form IT201 or IT203. Enter identifying information Your name as shown on returner

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-213

Edit your NY IT-213 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-213 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY IT-213 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY IT-213. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-213 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-213

How to fill out NY IT-213

01

Gather your personal information, including your Social Security number and New York State income information.

02

Obtain the NY IT-213 form from the New York State Department of Taxation and Finance website or your local tax office.

03

Fill out your name, address, and Social Security number at the top of the form.

04

Complete the income section by reporting all applicable income received during the tax year.

05

Review the instructions for line-by-line guidance on filling out deductions and credits available.

06

If applicable, include information on any other required forms or schedules, such as your federal tax return.

07

Double-check all entries for accuracy to avoid errors that may delay processing.

08

Sign and date the form at the end.

Who needs NY IT-213?

01

Residents of New York State who have earned income and are eligible for tax credits or are claiming certain deductions.

02

Individuals who have filed a federal tax return and need to report additional state-specific information.

03

Taxpayers looking to claim a refund based on specific deductions or tax credits available to them under New York State law.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for additional tax credit?

Additional Child Tax Credit for 2022 The child is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, grandchild, niece, or nephew. You claim the child as a dependent. The child doesn't provide more than half of their own support.

What is the additional tax credit for 2020?

What is the maximum amount of Additional Child Tax Credit? The maximum Additional Child Tax Credit is $1,400 per child. If you don't need any of your Child Tax Credit, the $600 between the $2,000 Child Tax Credit, and the $1,400 Additional Child Tax Credit per child is lost.

How do I claim my 2020 child tax credit?

How to Claim This Credit. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

How much is the additional Child Tax Credit for 2020?

Increased the credit from up to $2,000 per qualifying child in 2020 to up to $3,000 for each qualifying child ages 6 to 16. Makes 17-year-olds eligible for up to $3,000 in credit.

Who is eligible for New York State Earned Income Credit?

The EITC is a federal, state, and New York City tax credit for qualifying families, noncustodial parents, and singles who work full time or part time or are self-employed. On average, most eligible New Yorkers receive $2,400 in combined EITC benefits. The combined credit can be worth up to $8,991.

What is the IT 213 form used for?

automatic calculation of your refund or tax due amount—the form does the math. a unique 2D barcode printed on every page that securely links your form information to your account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY IT-213 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your NY IT-213 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit NY IT-213 online?

The editing procedure is simple with pdfFiller. Open your NY IT-213 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit NY IT-213 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NY IT-213 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is NY IT-213?

NY IT-213 is a New York State tax form used to claim a refundable credit for certain taxpayers who qualify for the Empire State Child Credit and/or the Child and Dependent Care Credit.

Who is required to file NY IT-213?

Taxpayers who have children under the age of 17 or who incurred costs for child and dependent care while working or looking for work may be required to file NY IT-213 to claim the respective credits.

How to fill out NY IT-213?

To fill out NY IT-213, taxpayers need to provide personal information, such as their name and Social Security number, details about qualifying children or dependents, the amounts paid for child and dependent care, and any applicable income information.

What is the purpose of NY IT-213?

The purpose of NY IT-213 is to allow eligible taxpayers to receive credits that can reduce their tax liability and provide financial assistance to families caring for children and dependents.

What information must be reported on NY IT-213?

On NY IT-213, taxpayers must report personal identification details, information about qualifying children or dependents, the credit amount they are claiming, and relevant income information to determine their eligibility.

Fill out your NY IT-213 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-213 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.