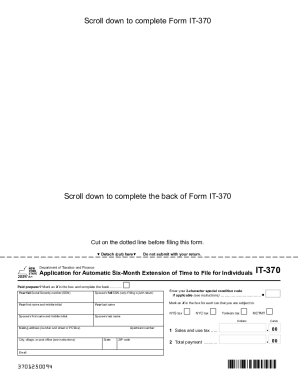

NY DTF IT-370 2021 free printable template

Instructions and Help about NY DTF IT-370

How to edit NY DTF IT-370

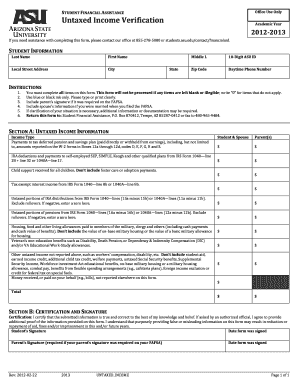

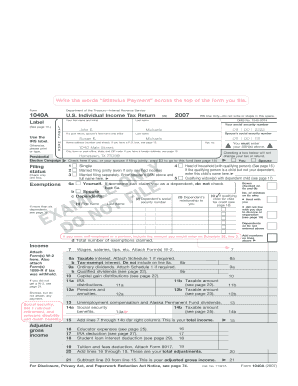

How to fill out NY DTF IT-370

About NY DTF IT previous version

What is NY DTF IT-370?

Who needs the form?

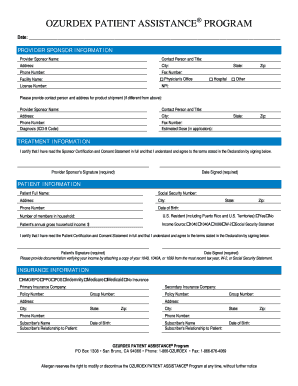

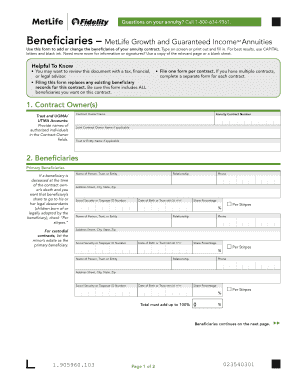

Components of the form

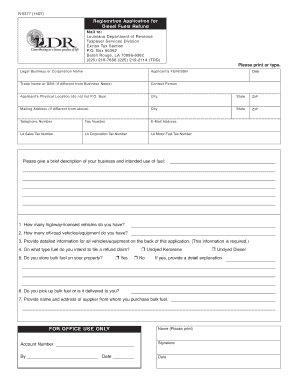

What payments and purchases are reported?

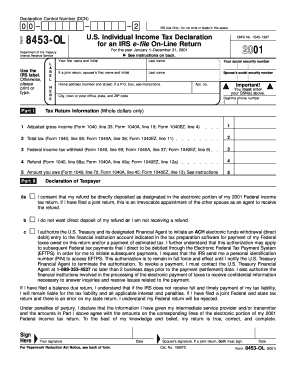

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about NY DTF IT-370

What should I do if I need to correct a mistake on my it 370 pf after filing?

If you need to correct any mistakes on your filed it 370 pf, you should submit an amended form. Ensure that the amendments are clearly marked and follow the state guidelines for corrections. Filing an amendment timely can help mitigate potential penalties.

How can I verify the status of my it 370 pf submission?

You can verify the status of your it 370 pf submission by checking the state’s online tracking system. If you filed electronically, be on the lookout for any rejection codes that may indicate issues requiring your attention.

Are e-signatures accepted when submitting the it 370 pf electronically?

Yes, e-signatures are generally accepted for the it 370 pf when you file electronically. However, it's important to confirm that your e-filing method complies with any specific state requirements regarding digital signatures.

What should I do if I receive a notice or letter related to my it 370 pf?

If you receive a notice regarding your it 370 pf, carefully read the communication and follow the instructions provided. Prepare any necessary documentation and, if needed, reach out to the appropriate office for clarification or to address discrepancies.

How can I avoid common errors when filing my it 370 pf?

To avoid common errors while filing your it 370 pf, double-check all entries for accuracy, ensure you have the required supporting documents, and review any guidance offered by the state. Using tax software can also help catch mistakes before submission.

See what our users say