KY Reconciliation of Occupational License Fee Withheld - Whitley County 2022 free printable template

Show details

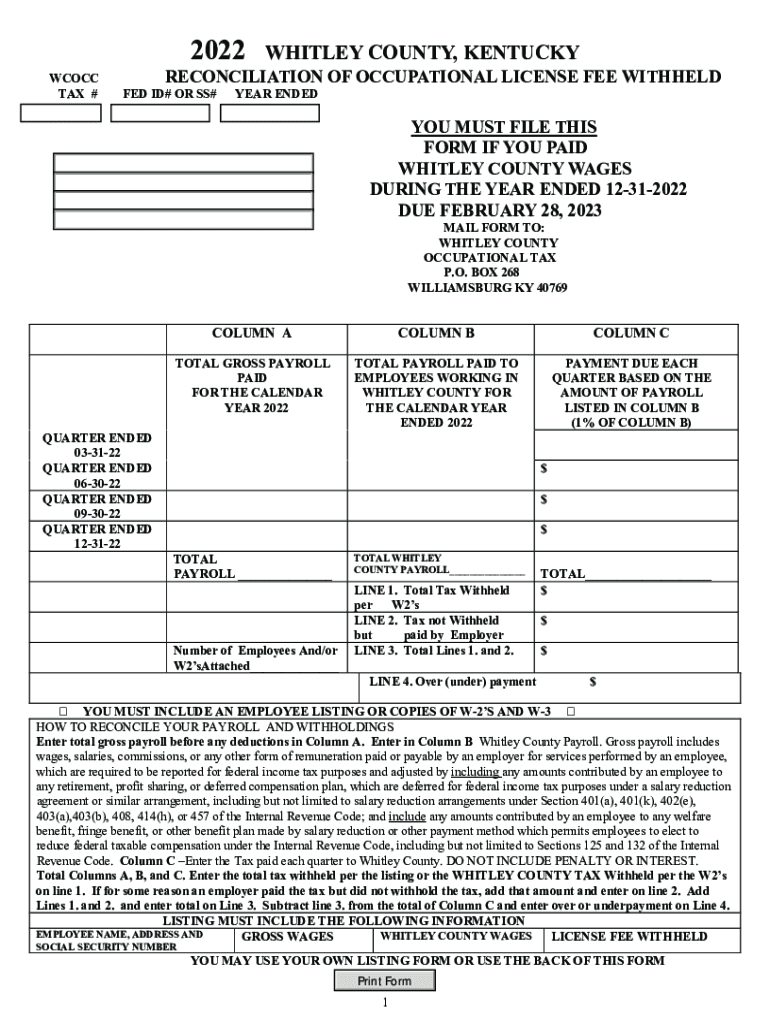

2022WCOCC

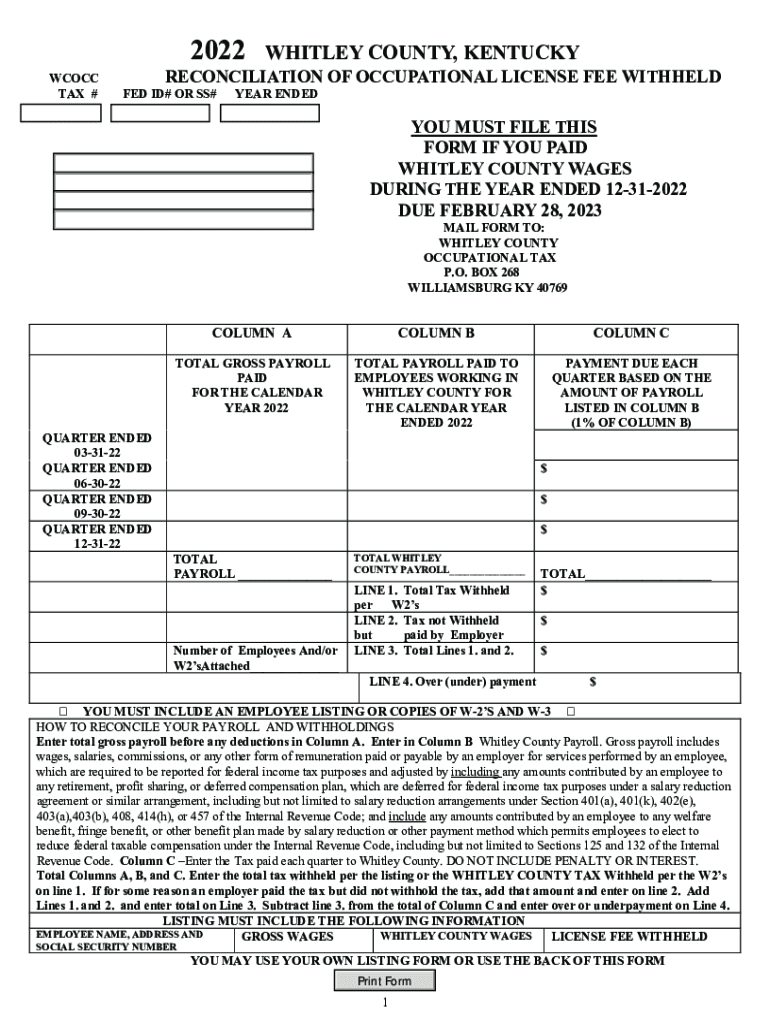

TAX #WHITLEY COUNTY, KENTUCKYRECONCILIATION OF OCCUPATIONAL LICENSE FEE WITHHELD FED ID# OR SS#YEAR ENDED MUST FILE THIS

FORM IF YOU PAID

WHITLEY COUNTY WAGES

DURING THE YEAR ENDED 12312022

DUE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY Reconciliation of Occupational License Fee Withheld

Edit your KY Reconciliation of Occupational License Fee Withheld form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY Reconciliation of Occupational License Fee Withheld form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY Reconciliation of Occupational License Fee Withheld online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KY Reconciliation of Occupational License Fee Withheld. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY Reconciliation of Occupational License Fee Withheld - Whitley County Form Versions

Version

Form Popularity

Fillable & printabley

4.9 Satisfied (26 Votes)

4.8 Satisfied (53 Votes)

4.8 Satisfied (240 Votes)

4.2 Satisfied (64 Votes)

4.2 Satisfied (111 Votes)

4.4 Satisfied (245 Votes)

4.4 Satisfied (152 Votes)

4.3 Satisfied (270 Votes)

How to fill out KY Reconciliation of Occupational License Fee Withheld

How to fill out KY Reconciliation of Occupational License Fee Withheld

01

Gather all necessary documents, including payroll records and prior tax filings.

02

Access the KY Reconciliation of Occupational License Fee Withheld form from the Kentucky Department of Revenue website.

03

Fill out the business information section accurately, including the business name, address, and employer identification number.

04

Report the total gross wages paid to employees for the reconciliation period.

05

Calculate the total Occupational License Fees withheld from employees’ wages during the period.

06

Complete any applicable schedules attached to the form if required.

07

Review the form for accuracy, ensuring all figures add up correctly.

08

Sign and date the form before submission.

09

Submit the form along with any required payments to the Kentucky Department of Revenue by the deadline.

Who needs KY Reconciliation of Occupational License Fee Withheld?

01

Businesses operating in Kentucky that withhold Occupational License Fees from employees' wages.

02

Employers who are required to reconcile the Occupational License Fees withheld for their employees at the end of the reporting period.

03

Individuals responsible for payroll and tax compliance within a Kentucky-based business.

Fill

form

: Try Risk Free

People Also Ask about

What is the net profit license fee in Kentucky?

The rate is equal to the greater of 1.95% of the net profit or $60. Any individual or fiduciary, which receives income from real estate rentals with excess of $100,00.00 in annual gross receipts is presumed to be in the rental business, and is subject to the greater of 1.95% of the net profit or $60.

What is the net profit license fee return in Mayfield Kentucky?

The City of Mayfield Net Profit License Fee is levied at the annual rate of 2% the first $50,000.00, plus 1% of $50,000 thru $500,000 and ½ % over $500,000 with a minimum of $100.00 of the net profits of all occupations, trades, professions or other businesses engaged in said activities in the City.

What is a net profits license fee return franklin county Kentucky?

Registration Renewal Form:Net Profits License Fee ReturnInstructions:License Fee InstructionsAgency Fee:1% of annual net profitDue:Annually by April 15 if the licensee has a December 31 fiscal year end. Otherwise renewal is due 105 days following the end of the fiscal year, sale, liquidation or transfer.

What is net profit license?

An Annual Net Profit License Fee is levied on all persons, fiduciaries, corporations, and associations engaged in the occupation, trade, profession or other business earned for work performed within the city.

What is Laurel County income tax?

Residents of Laurel County pay a flat county income tax of 1.00% on earned income, in addition to the Kentucky income tax and the Federal income tax. Nonresidents who work in Laurel County also pay a local income tax of 1.00%, the same as the local income tax paid by residents.

What is Laurel County net profit tax?

The Laurel County Occupational Tax has a license fee of 1% of gross payroll and 1% on Net Profits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute KY Reconciliation of Occupational License Fee Withheld online?

pdfFiller has made it simple to fill out and eSign KY Reconciliation of Occupational License Fee Withheld. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the KY Reconciliation of Occupational License Fee Withheld in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your KY Reconciliation of Occupational License Fee Withheld in minutes.

Can I create an electronic signature for signing my KY Reconciliation of Occupational License Fee Withheld in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your KY Reconciliation of Occupational License Fee Withheld right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is KY Reconciliation of Occupational License Fee Withheld?

KY Reconciliation of Occupational License Fee Withheld is a form used to reconcile the occupational license fees that have been withheld by an employer on behalf of their employees during the tax year.

Who is required to file KY Reconciliation of Occupational License Fee Withheld?

Employers who withhold occupational license fees from their employees' wages are required to file the KY Reconciliation of Occupational License Fee Withheld.

How to fill out KY Reconciliation of Occupational License Fee Withheld?

To fill out the KY Reconciliation of Occupational License Fee Withheld, employers need to provide information such as the total amount of fees withheld, the names and Social Security numbers of employees, and the respective amounts withheld for each employee.

What is the purpose of KY Reconciliation of Occupational License Fee Withheld?

The purpose of the KY Reconciliation of Occupational License Fee Withheld is to ensure that the correct amount of occupational license fees were withheld and reported to the state, allowing for accurate taxation and compliance.

What information must be reported on KY Reconciliation of Occupational License Fee Withheld?

The information that must be reported includes the total occupational license fees withheld, details of individual employee withholdings, employee names, Social Security numbers, and any adjustments for over- or under-withholding.

Fill out your KY Reconciliation of Occupational License Fee Withheld online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY Reconciliation Of Occupational License Fee Withheld is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.