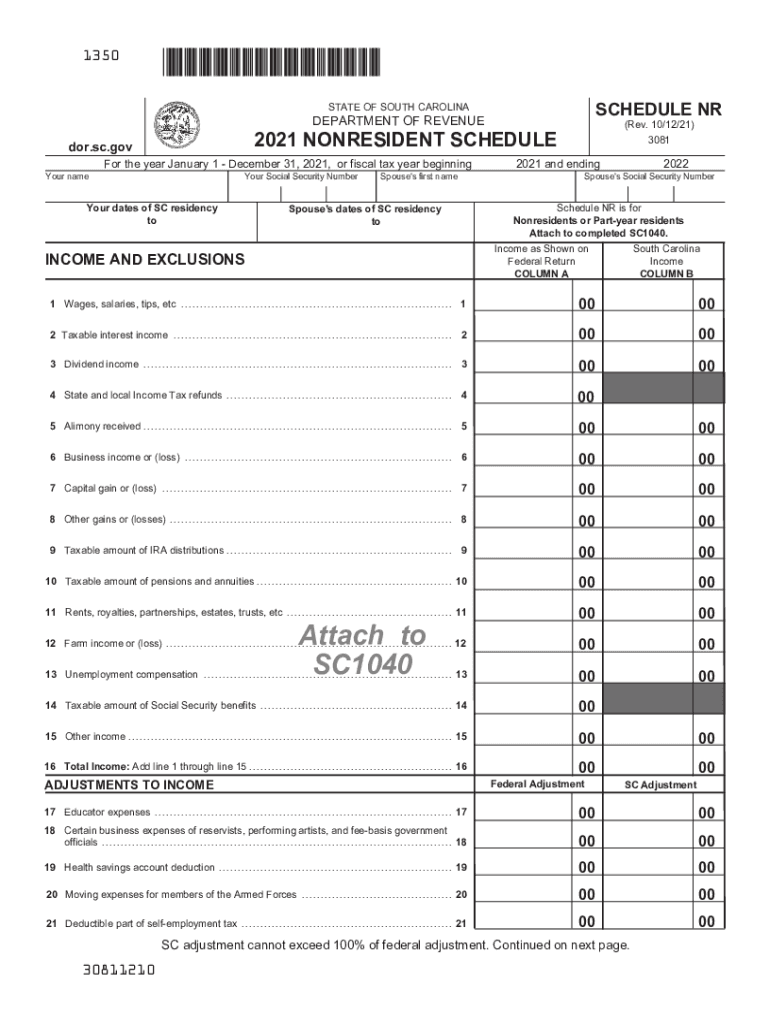

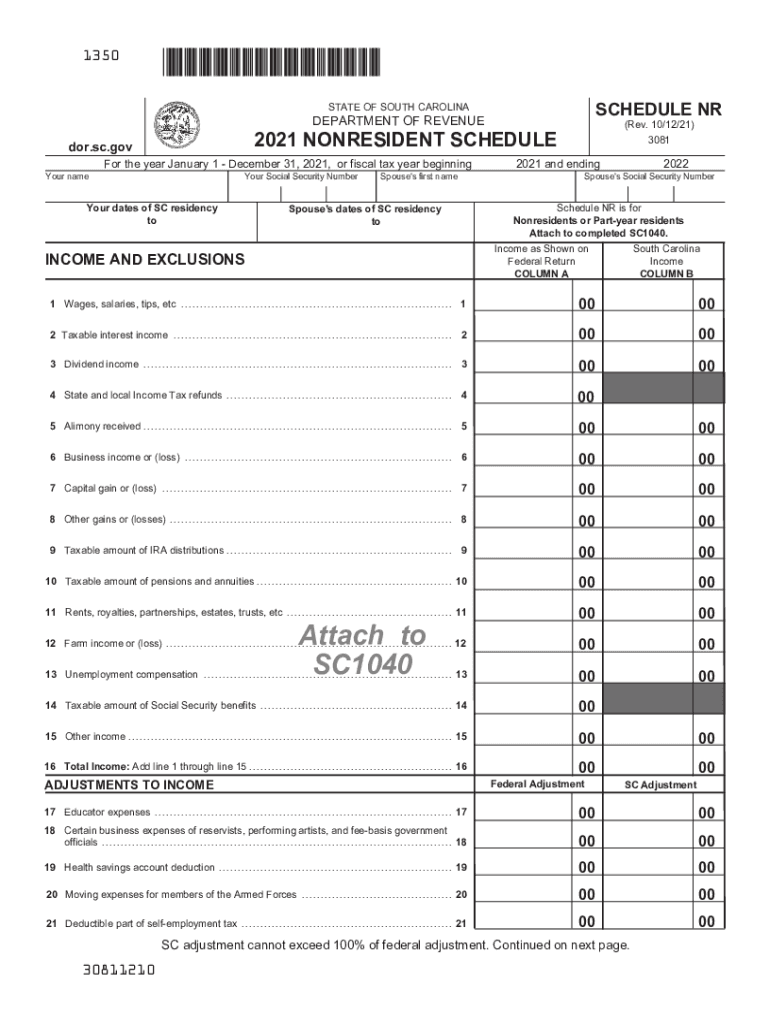

SC Schedule NR 2021 free printable template

Get, Create, Make and Sign attach to sc1040

How to edit attach to sc1040 online

Uncompromising security for your PDF editing and eSignature needs

SC Schedule NR Form Versions

How to fill out attach to sc1040

How to fill out SC Schedule NR

Who needs SC Schedule NR?

Instructions and Help about attach to sc1040

Hi this is John with PDF tax this is the 1040 for 2018 it has changed quite a bit from 2017 so were going to go through this form and look at some of those changes first we want to fill out the name address and that sort of thing, so I'm going to use autohotkey to do that just like this and that works pretty well, so we have a married couple, and they're going to file married joint so well check that box right there, and they have full-year health care coverage, so they don't have to pay the Obama care tax and then were going to say that their three dependents qualify for the child tax credit, so that's how that works just like that now let's click right here to go down to page two, so we can start entering some of our numbers and will say that they have wages here on line 1 of 35000 and then well look over here to see married filing jointly has a standard deduction of 24000, so that goes on line 8 right here like that and their taxable income on line 10 is 11000 and then if we look in the instructions for 1040 will find the tax on that is 1103 like that so next we want to work on their credits, and they have a child tax credit part of that is refundable and part of that is non-refundable the non-refundable part goes right here and that is 1103 and so right now they don't have any tax next we want to go to schedule EIC so well click right here and were going to use autohotkey again to fill this one out, so there's our information for schedule EIC it looks just like that and well go back here to page two and the EIC amount works out to 41 82 which goes right here and so right now anyway they're showing a refund of 41 82 the next thing we want to do is work on the refundable part of that child tax credit, and we need to go to 88 12 to do that so here it is on line one they want the amount from line ten of the child tax credit worksheet and that is three dependents times two thousand dollars or six thousand dollars so that goes right there like that and on line two they want the amount from 1040 line twelve a which was the non-refundable part of that credit and remember that was 1103, so that goes there and line three is the difference between those two numbers which is 48 97 that goes there and then line four is three dependents times 1400 is 4200 right there and then line five is the smaller of three or four which is forty-two hundred and nine six is the Earned Income and you remember that was 35000 wages that we put on 1040 and line 6b is we don't have any non-taxable combat pay, so line seven is the amount on line six a more than 2500 and the answer that is yes it is so what we need to do is subtract 2500 from 6a and that is 32 509 8 we multiply line 7 by 15 so on line 8 we ended up with 4875 right there like that, and then we move down here, and it says next on line 4 is the amount on line four is forty-two hundred or more and it is so well check this box, and then it says if line eight is equal to or more than line five skip part two so were...

People Also Ask about

Do non residents have to file an Illinois tax return?

Who must file SC1040?

How many days can I work in Illinois without paying taxes?

Who pays SC income tax?

What is Illinois Schedule M?

Who must file a SC 1040?

What does schedule NR mean?

What is South Carolina Schedule NR?

Who must file a South Carolina tax return?

Do I have to file an South Carolina nonresident tax return?

Who can file a South Carolina composite return?

Should I file as resident or nonresident for South Carolina?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify attach to sc1040 without leaving Google Drive?

How can I send attach to sc1040 for eSignature?

How do I fill out attach to sc1040 using my mobile device?

What is SC Schedule NR?

Who is required to file SC Schedule NR?

How to fill out SC Schedule NR?

What is the purpose of SC Schedule NR?

What information must be reported on SC Schedule NR?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.