Get the free Renewal Application for Insurance Agents and Brokers Professional Liability Insuranc...

Show details

Este es un formulario de renovación para una póliza de responsabilidad profesional que cubre agentes y corredores de seguros. El límite de responsabilidad disponible para pagar daños o acuerdos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign renewal application for insurance

Edit your renewal application for insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your renewal application for insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing renewal application for insurance online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit renewal application for insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out renewal application for insurance

How to fill out Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy

01

Gather all necessary documentation, including previous policy details, financial statements, and any claims history.

02

Obtain the Renewal Application form from your insurance provider or their website.

03

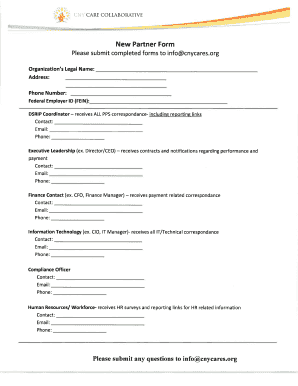

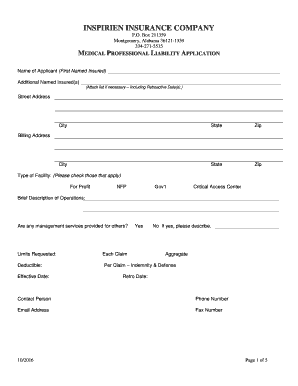

Fill out the personal details section, including name, address, and contact information.

04

Provide details of your insurance agency, including the number of employees and areas of specialization.

05

Answer questions related to the volume of business and types of services provided over the past year.

06

Disclose any claims made during the previous policy period, providing specifics on each incident.

07

Review any changes in operations or management that may affect the policy.

08

Make sure to sign and date the application.

09

Submit the completed application to your insurance provider before the expiration date of your current policy.

Who needs Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy?

01

Insurance agents and brokers who are looking to renew their professional liability insurance coverage.

02

Individuals or businesses that have previously held a professional liability insurance policy and require continued protection against claims of negligence or malpractice in their professional services.

Fill

form

: Try Risk Free

People Also Ask about

How do insurance brokers earn money?

The primary way that an insurance broker makes money is from commissions and fees earned on sold policies. These commissions are typically a percentage of the policy's total annual premium. An insurance premium is the amount of money that an individual or business pays for an insurance policy.

How much is E&O insurance for insurance agents?

Errors and omissions insurance costs for insurance professionals. The median cost of E&O insurance is about $45 per month, or $550 annually, for insurance professionals. This policy, also known as professional liability insurance, can protect your business from work mistakes that negatively impact clients.

Do insurance brokers get paid on renewals?

Residual commissions, or renewal commissions, are typically earned on policies with ongoing premiums, otherwise known as their book of business. As long as the insurance policy remains active and the policyholder continues to pay their premiums, the insurance agent will continue to earn a commission on that premium.

What are examples of professional liability insurance?

Examples of liabilities covered by PLI are: Mistakes, errors, and oversights in services provided. Undelivered services. Missed deadlines. Negligence or failure to meet standards. Breach of contract. Defense costs. Copyright infringement1.

What is the professional liability for insurance agents called?

Errors and omissions insurance for insurance agents is a type of professional liability insurance. It helps protect your business from litigation if a customer sues you for a mistake in your professional services. E&O insurance covers the legal fees to defend your insurance agency in court.

Do insurance agents get commission on renewals?

Residual commissions, or renewal commissions, are typically earned on policies with ongoing premiums, otherwise known as their book of business.

How much does an insurance broker make per policy?

Auto insurance brokers work with multiple insurance carriers to find the best rates for clients. They typically earn 5–10% of the premium as a commission. Business insurance brokers may charge a broker fee for complex risk assessments or securing specialized policies for unique business needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy?

The Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy is a formal request submitted by insurance agents and brokers to renew their existing professional liability insurance coverage. It typically involves updating information about the insured's business practices, financial status, and any claims history.

Who is required to file Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy?

Insurance agents and brokers who wish to continue their professional liability insurance coverage must file a Renewal Application. This is usually required for those whose policies are set to expire and who need to maintain continuous coverage.

How to fill out Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy?

To fill out the Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy, applicants should provide accurate and updated information including their business details, any changes to operations, previous claims, and any new services offered. It is essential to carefully follow the instructions provided in the application form.

What is the purpose of Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy?

The purpose of the Renewal Application is to assess the current risk associated with the insured's business operations and determine the terms and premiums of the renewed insurance policy. It also ensures that the insurer has the most up-to-date information to evaluate coverage needs.

What information must be reported on Renewal Application for Insurance Agents and Brokers Professional Liability Insurance Policy?

The information that must be reported on the Renewal Application includes updates on the insured's business activities, any claims made against them during the previous policy term, changes in their professional services, new clients, and any significant financial changes impacting their practice.

Fill out your renewal application for insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Renewal Application For Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.