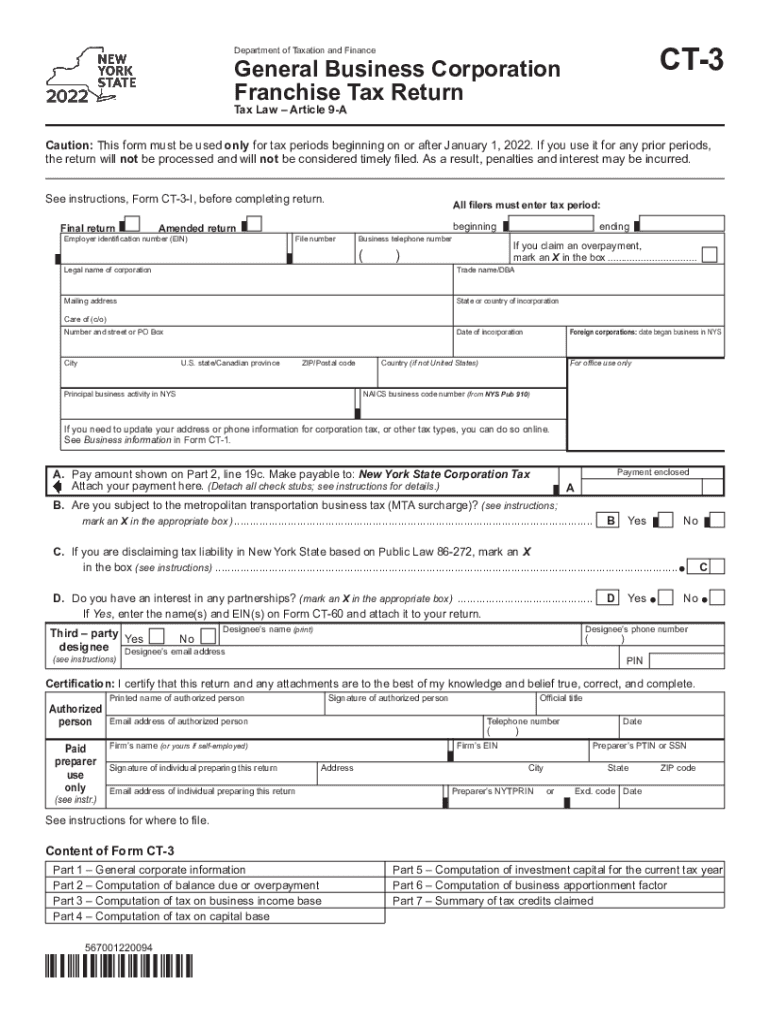

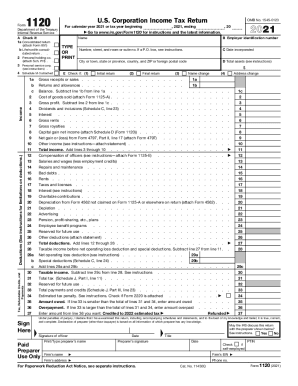

Who needs CT-3 form?

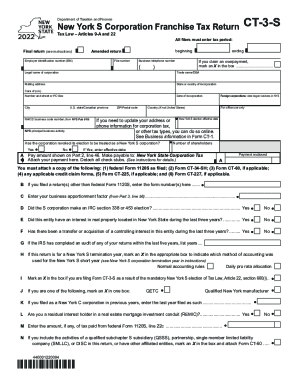

CT-3 Form is the Department of Taxation and Finance in the New York State form, the full name of which is General Business Corporation Franchise Tax Return. Business Corporation operating in NYS must file this form in order to report the state franchise tax owed. The liable business corporations include associations, limited liability companies, limited liability partnerships and publicly traded partnerships that are taxed as corporations.

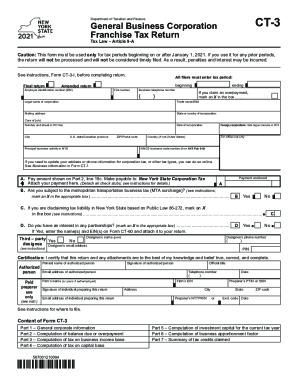

Is the form CT-3 accompanied by any other documents?

Depending upon the circumstances of doing business and earning income, corporations may be required to attach a number of supporting documents while filing the CT-3. The list of forms to submit must be looked up on page 4 in this instruction. Besides, attaching a copy of the federal tax return is a must.

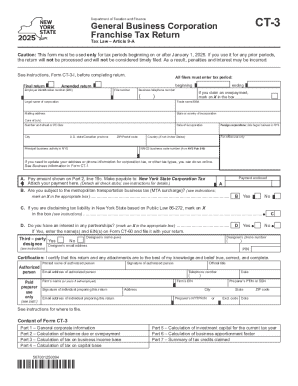

When is the form CT-3 due?

The General Business Corporation Franchise Tax Return must be filled out on an annual basis and report the tax year. The NYS Department of Taxation and Finance expects businesses to file their return within two and a half months after the end of the tax year. If the tax year is adjusted to the calendar year. The due date for CT-3 is normally March, 15.

How do I fill out the CT-3 form?

The following information must be covered on the General Business Corporation Franchise Tax Return:

-

Basic information about the reporting corporation (EIN, legal name, mailing address, etc.);

-

Calculations of entire net income;

-

Calculations of capital base;

-

Minimum taxable income;

-

Tax calculations;

-

Claimed credits;

-

Shareholders’ interest, etc.

Finally, the authorized person must certify the completed form.

Where do I send the filled out CT-3 form?

Upon completing, the NYS Business Corporation Franchise Tax Return, the federal tax return and all applicable attachments must be directed to the address: NYS Corporation Tax, PO Box 15181, Albany NY 12212-5181.