Get the free The Taxpayer Relief Application for Homestead and

Show details

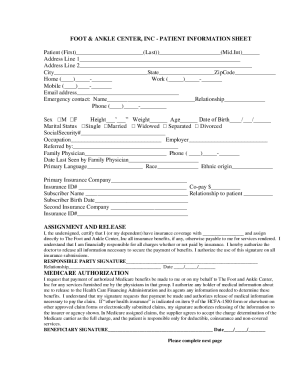

Cumberland County, Pennsylvania Application for Homestead and Farmstead Exclusions The following Homestead/Farmstead Exclusion application is being provided to you in accordance with the requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form taxpayer relief application

Edit your form taxpayer relief application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form taxpayer relief application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form taxpayer relief application online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form taxpayer relief application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form taxpayer relief application

How to fill out form taxpayer relief application:

01

Start by reviewing the instructions: Before filling out the form, carefully read the instructions provided. This will give you a better understanding of the requirements and necessary information to include in the application.

02

Gather the required documents: Ensure you have all the necessary documents and supporting evidence that may be required to support your claims. This may include financial records, tax returns, and any relevant correspondence with the tax authorities.

03

Provide personal information: Begin by filling out your personal details accurately, including your name, address, social security number, and contact information. Make sure to double-check the accuracy of these details to avoid any processing delays.

04

State the reason for your application: Clearly explain the basis for your application for taxpayer relief. Whether it's due to financial hardship, inability to pay taxes owed, or any other valid reason, provide a concise and convincing explanation.

05

Detail the specific relief being sought: Indicate the specific relief or remedy you are seeking from the tax authorities. For example, you may be requesting penalty abatement, installment payments, or an offer in compromise. Be clear and specific in your request.

06

Provide supporting information: Attach any supporting documentation that reinforces your claims and validates the relief you are seeking. This can include financial statements, medical reports, or any relevant information that strengthens your case.

07

Sign and date the application: Ensure you have signed and dated the form properly. Unsigned or undated applications may not be processed, so make sure to review this before submitting your application.

Who needs form taxpayer relief application?

01

Individuals facing financial hardship: If you are struggling to pay your taxes, have experienced a significant change in your financial circumstances, or face extreme difficulty in meeting your tax obligations, you may need to file a taxpayer relief application.

02

Taxpayers with legitimate reasons for relief: If you have a valid reason for seeking relief from penalties, interest, or other tax-related obligations, the taxpayer relief application is essential. This could include situations such as natural disasters, medical emergencies, or other circumstances beyond your control.

03

Taxpayers with outstanding tax liabilities: If you owe taxes that you are unable to pay in full, the taxpayer relief application provides a platform to request alternative payment arrangements or debt reduction options.

It is important to note that the eligibility criteria for taxpayer relief may vary depending on jurisdiction. Therefore, it is recommended to consult the specific guidelines and instructions provided by your local tax authority when filling out the form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form taxpayer relief application to be eSigned by others?

Once your form taxpayer relief application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in form taxpayer relief application?

The editing procedure is simple with pdfFiller. Open your form taxpayer relief application in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I edit form taxpayer relief application on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing form taxpayer relief application.

What is form taxpayer relief application?

Form taxpayer relief application is a document that allows taxpayers to apply for relief from penalties, interest, and other fees resulting from late or incorrect filings.

Who is required to file form taxpayer relief application?

Taxpayers who have experienced circumstances beyond their control that have prevented them from meeting their tax obligations may be required to file form taxpayer relief application.

How to fill out form taxpayer relief application?

To fill out form taxpayer relief application, taxpayers must provide detailed information about their financial situation, the reasons for their late or incorrect filings, and any supporting documentation.

What is the purpose of form taxpayer relief application?

The purpose of form taxpayer relief application is to allow taxpayers to request relief from penalties, interest, and other fees that have accrued as a result of late or incorrect filings.

What information must be reported on form taxpayer relief application?

Information such as the taxpayer's financial situation, the reasons for late or incorrect filings, and any supporting documentation must be reported on form taxpayer relief application.

Fill out your form taxpayer relief application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Taxpayer Relief Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.