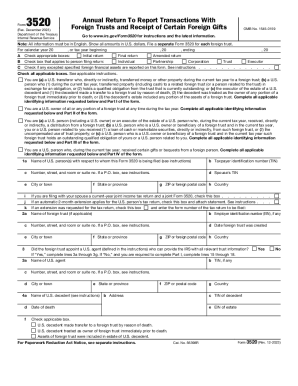

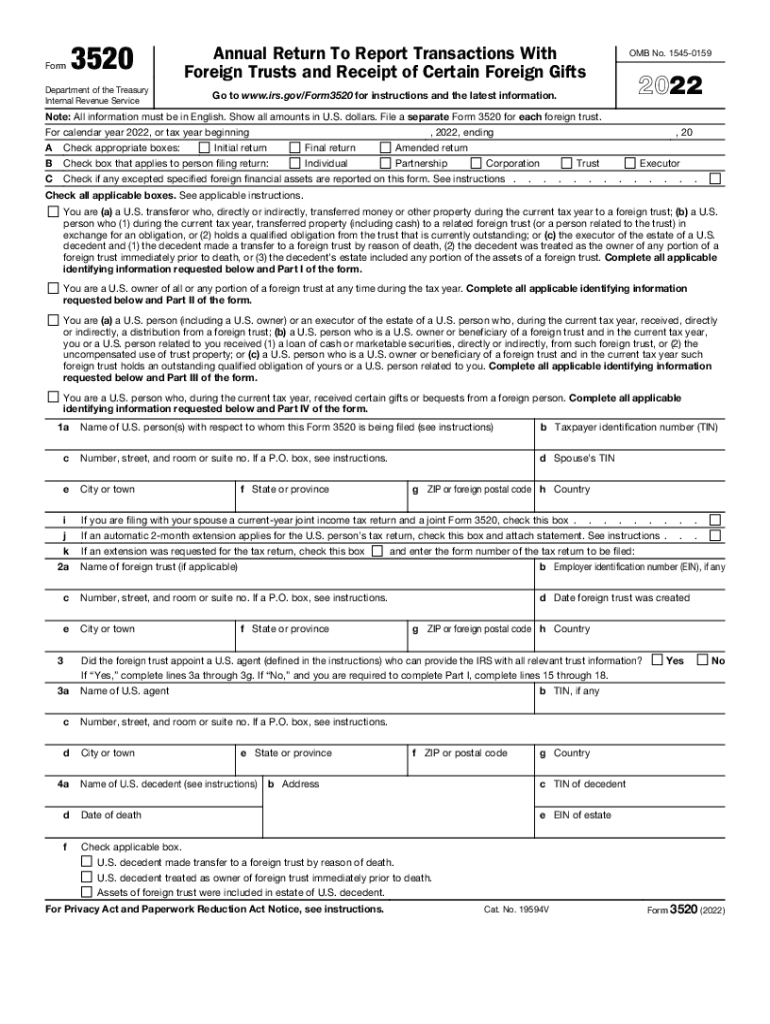

IRS 3520 2022 free printable template

Instructions and Help about IRS 3520

How to edit IRS 3520

How to fill out IRS 3520

About IRS 3 previous version

What is IRS 3520?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 3520

What should I do if I realize I've made an error after submitting my IRS 3520?

If you find an error after submission, you can submit an amended IRS 3520 form. It’s important to clearly indicate any changes and provide any necessary documentation to support your corrections. Make sure to keep copies of your original and amended forms for your records.

How can I check the status of my IRS 3520 filing?

To verify the receipt and processing status of your IRS 3520, you can use the IRS 'Where's My Refund?' tool online or contact the IRS directly. Be prepared to provide details such as your Social Security number or taxpayer identification number and the filing date.

What can I do if my IRS 3520 was rejected when I tried to e-file it?

If your IRS 3520 submission was rejected, carefully review the error message provided. Common rejection codes can guide you on what corrections are needed. Make the necessary adjustments to your form and resubmit it as soon as possible to avoid penalties.

Are there specific technological requirements for e-filing the IRS 3520?

Yes, when e-filing your IRS 3520, ensure that you are using compatible software that supports the form. Additionally, it is advisable to check that your browser is up to date to minimize technical issues during submission.

What should I do if I receive a notice from the IRS regarding my IRS 3520?

If you receive a notice or letter from the IRS concerning your IRS 3520, carefully read the communication for specific instructions on how to respond. Gather any required documents and consider consulting a tax professional for assistance in preparing your response.

See what our users say