Get the free BAPPLICATIONb FOR LOAN Intermediary Relending bb - AgLearn - aglearn usda

Show details

Form RD 42741 (Rev. 799) UNITED STATES DEPARTMENT OF AGRICULTURE RURAL BUSINESSCOOPERATIVE SERVICE (RBS) FORM APPROVED OMB NO. 05700021 APPLICATION FOR LOAN (Intermediary Relenting Program) General

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bapplicationb for loan intermediary

Edit your bapplicationb for loan intermediary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bapplicationb for loan intermediary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bapplicationb for loan intermediary online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bapplicationb for loan intermediary. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

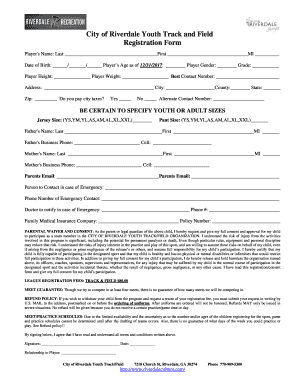

How to fill out bapplicationb for loan intermediary

How to fill out an application for a loan intermediary:

01

Gather all necessary documents: To fill out an application for a loan intermediary, you will need to have certain documents ready. This may include identification proof, income statements, bank statements, and any other relevant financial documents.

02

Research loan intermediaries: Before filling out the application, it is important to research different loan intermediaries to find one that suits your needs. Look for reputable intermediaries with positive customer reviews and a good track record in the industry.

03

Fill out the personal information section: The application will typically begin with a personal information section. Provide accurate details about your name, contact information, date of birth, and social security number.

04

Provide employment and income details: The application will require information about your current employment, including your job title, company name, and address. Additionally, you will need to provide details about your income, such as salary, bonuses, or any other sources of income.

05

Include information about your current financial situation: In this section, you will need to provide details about your assets, liabilities, and any outstanding debts. This information is necessary for the intermediary to evaluate your financial stability and loan eligibility.

06

Answer questions about the purpose of the loan: Indicate the purpose of the loan and how you plan to use the funds. Be specific and provide any relevant details that may help the intermediary understand your needs.

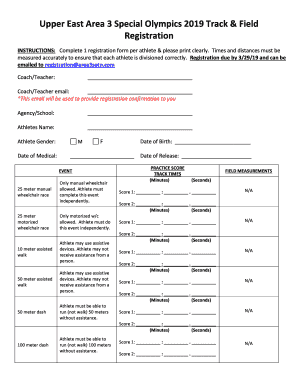

Who needs an application for a loan intermediary:

01

Individuals looking to secure a loan: Anyone who needs financial assistance and wants to work with a loan intermediary can benefit from filling out an application. A loan intermediary can help connect borrowers with lenders and assist in securing a loan that suits their needs.

02

Borrowers with limited financial knowledge or experience: Filling out an application for a loan intermediary can be beneficial for individuals who may have limited knowledge or experience in the loan process. Loan intermediaries can guide borrowers through the application process and provide valuable advice and support.

03

Borrowers seeking competitive loan terms: Loan intermediaries have access to a wide network of lenders, enabling them to find competitive loan terms for borrowers. If you are looking for favorable interest rates, flexible repayment options, or a loan tailored to your specific needs, working with a loan intermediary and filling out the application can be advantageous.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for loan intermediary?

The application for loan intermediary is a formal request submitted by a company or individual seeking to become a middleman in facilitating loans between lenders and borrowers.

Who is required to file application for loan intermediary?

Any entity or individual interested in operating as a loan intermediary is required to file the application.

How to fill out application for loan intermediary?

The application for loan intermediary can be filled out online or submitted in person to the relevant regulatory authority.

What is the purpose of application for loan intermediary?

The purpose of the application is to ensure that the loan intermediary meets all regulatory requirements and is qualified to operate in the lending industry.

What information must be reported on application for loan intermediary?

The application typically requires information about the applicant's business structure, financial history, background checks, and any relevant experience in the lending industry.

Can I sign the bapplicationb for loan intermediary electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your bapplicationb for loan intermediary.

Can I create an electronic signature for signing my bapplicationb for loan intermediary in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your bapplicationb for loan intermediary and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out bapplicationb for loan intermediary using my mobile device?

Use the pdfFiller mobile app to fill out and sign bapplicationb for loan intermediary. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your bapplicationb for loan intermediary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bapplicationb For Loan Intermediary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.