Get the free 2009 Form 540 2EZ -- California Resident Income Tax Return - ftb ca

Show details

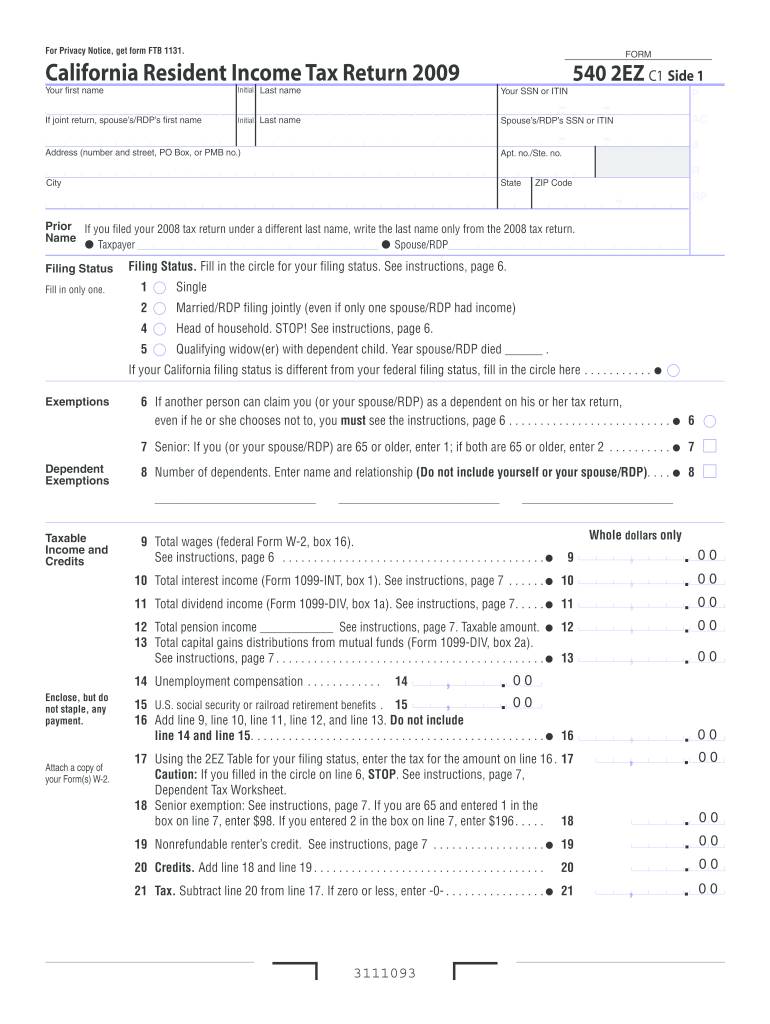

9 total wages (federal Form W-2, box 16). ... Enter name and relationship (Do not include yourself or your spouse/RDP).... 8 m ... Side 2 Form 540 2EZ C1 2009 ...

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

How to fill out CA FTB 540 2EZ

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

To edit the CA FTB 540 2EZ, download a copy of the form from the California Franchise Tax Board (FTB) website. You can use pdfFiller to fill in or change information on the form easily. You can upload your completed form to pdfFiller to add signatures or save it securely.

How to fill out CA FTB 540 2EZ

Filling out the CA FTB 540 2EZ requires specific financial information to ensure accurate reporting. Follow these steps:

01

Gather your income documents such as W-2s and 1099s.

02

Access the form online and input your personal information, including your name, address, and Social Security number.

03

Enter your total income and any applicable adjustments.

04

Calculate your taxable income and applicable credits.

05

Review the form for accuracy and completeness before submission.

About CA FTB 540 2EZ 2009 previous version

What is CA FTB 540 2EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB 540 2EZ 2009 previous version

What is CA FTB 540 2EZ?

CA FTB 540 2EZ is a simplified tax form designed for California residents with straightforward tax situations. This form allows eligible individuals to report their income and calculate their tax obligations in a more accessible format than the standard Form 540.

What is the purpose of this form?

The purpose of the CA FTB 540 2EZ is to facilitate the filing process for individuals who have simple tax situations. By using this form, taxpayers can avoid the complexities associated with longer forms, thus expediting their tax filing process and potentially reducing the likelihood of errors.

Who needs the form?

Taxpayers who need the CA FTB 540 2EZ typically include single filers, married couples filing jointly, and qualified individuals with simple income sources such as wages or interest. Specific eligibility criteria include no dependents, no itemized deductions, and a total income that does not exceed the filing limits set by the FTB.

When am I exempt from filling out this form?

Individuals may be exempt from filling out the CA FTB 540 2EZ if they have income exceeding the threshold limits or complex tax situations that require itemized deductions or additional schedules. Taxpayers with a requirement to file other forms due to business income or investment losses should consider those more complex tax forms instead.

Components of the form

The CA FTB 540 2EZ consists of sections that request basic information, income details, and adjustments. Key components include personal identification sections, income statements, tax credits, and signature lines for the taxpayer and spouse if applicable. Understanding these components is essential for accurate completion.

Due date

The due date for filing the CA FTB 540 2EZ typically aligns with the federal tax return deadline, which is usually April 15th. Taxpayers can file for an extension if they cannot meet this deadline, but it is important to pay any taxes owed by the original due date to avoid penalties and interest.

What are the penalties for not issuing the form?

Failure to file the CA FTB 540 2EZ or any necessary tax form can result in various penalties, including fines and interest on any taxes owed. The California FTB imposes penalties based on the amount due, and taxpayers may incur additional charges for prolonged failure to file.

What information do you need when you file the form?

When filing the CA FTB 540 2EZ, you will need personal identification details, your Social Security number, total income amounts, and any relevant tax credits. This information ensures that the FTB can accurately process your return and calculate your tax obligations effectively.

Is the form accompanied by other forms?

Generally, the CA FTB 540 2EZ does not require additional forms unless there are special circumstances, such as claiming certain tax credits. It is important to check the instructions for any guidance on additional paperwork to ensure compliance.

Where do I send the form?

Taxpayers must send the completed CA FTB 540 2EZ to the address specified in the form's instructions. Typically, this is the Franchise Tax Board’s processing center. Ensure to use the correct mailing address based on whether you are including a payment or not to avoid processing delays.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.