OH Instructions for IT 1040/SD 100 2022-2025 free printable template

Show details

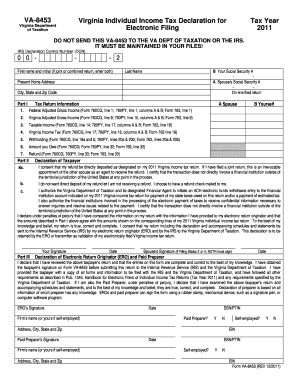

INSTRUCTIONS ONLY NO RETURNS hio2022Instructions for Filing Original and Amended:Individual Income Tax (IT 1040)School District Income Tax (SD 100)hioDepartment of Taxationtax. hio.gov22022 Ohio IT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ohio instructions it 1040 form

Edit your ohio instructions income 2022-2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio instructions income 2022-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ohio instructions income 2022-2025 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ohio instructions income 2022-2025. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH Instructions for IT 1040/SD 100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ohio instructions income 2022-2025

How to fill out OH Instructions for IT 1040/SD 100

01

Gather all necessary tax documents, including income statements, W-2s, and any other relevant financial information.

02

Begin with the IT 1040 form and carefully read through the instructions provided for the Ohio tax filing.

03

Fill out your personal information at the top of the IT 1040, including your name, address, and Social Security number.

04

Report your income in the appropriate sections, ensuring accuracy in amounts from your income statements.

05

Follow the guidelines provided in the OH Instructions for any adjustments or deductions you may qualify for.

06

Complete the SD 100 if you are applying for a school district tax, ensuring to check the school district code based on your residence.

07

Review all information filled out on both forms for completeness and correctness.

08

Sign and date your forms, and keep copies for your records.

09

Submit your forms either electronically or via mail, according to the instructions provided.

Who needs OH Instructions for IT 1040/SD 100?

01

Residents of Ohio who have earned income and are required to file income tax returns.

02

Individuals who owe school district taxes and need to complete the SD 100 form.

03

Taxpayers seeking to claim credits or deductions specific to Ohio state taxes.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out my 1040 form?

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

How do I write a check to the Ohio Department of Taxation?

You may pay your Ohio Income Tax balance due(s) by personal check or money order. Ohio Treasurer of State. OR. School District Income Tax. Also write on the check or money order the 4 digit school district number, taxpayer name, a daytime telephone number and the phrase "2019 SD 100".

How much is the Ohio IT 1040 exemption?

Ohio allows a dependent exemption for dependent children and persons other than yourself and your spouse to whom you provide support and claim on your federal tax return. You are entitled to a $1,850 - $2,350 deduction for each dependent exemption depending on your modified adjusted gross income.

What is an Ohio IT 1040 form?

Revised on 12/22. 2022 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040, Schedule of Adjustments, IT BUS, Schedule of Credits, Schedule of Dependents, IT WH, and IT 40P. FILE ONLINE Fill-In.

What is the exemption amount on Ohio tax return?

Qualified homeowners are permitted to exempt up to $25,000 of their home's market value from all local property taxes. For 2022, eligibility for new exemptions is limited to qualifying taxpayers (by age) with Ohio adjusted gross income of $34,600 or less.

Who do I make the check out to for Ohio state taxes?

To mail your Ohio payment due, please print the payment voucher (Ohio IT 40P found at the bottom of your accepted return. Mail your payment (check or money order) payable to Ohio Treasurer of State.

How many exemptions should I claim Ohio?

Line 3: You are allowed one exemption for each dependent. Your dependents for Ohio income tax purposes are the same as your dependents for federal income tax purposes. See R.C. 5747.01(O).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ohio instructions income 2022-2025 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ohio instructions income 2022-2025, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute ohio instructions income 2022-2025 online?

Completing and signing ohio instructions income 2022-2025 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out ohio instructions income 2022-2025 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your ohio instructions income 2022-2025 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is OH Instructions for IT 1040/SD 100?

OH Instructions for IT 1040/SD 100 provide guidelines and procedures for individuals who need to file their income tax returns in the state of Ohio, specifically for individual income tax and school district tax.

Who is required to file OH Instructions for IT 1040/SD 100?

Individuals who have earned income in Ohio, residents of Ohio, and certain non-residents who had Ohio income are required to file the OH Instructions for IT 1040/SD 100.

How to fill out OH Instructions for IT 1040/SD 100?

To fill out OH Instructions for IT 1040/SD 100, individuals must provide their personal information, report their income, claim deductions and credits, and calculate their tax liability following the detailed instructions provided in the form.

What is the purpose of OH Instructions for IT 1040/SD 100?

The purpose of OH Instructions for IT 1040/SD 100 is to facilitate the accurate reporting of income and the calculation of tax owed to the state of Ohio and any applicable school district taxes.

What information must be reported on OH Instructions for IT 1040/SD 100?

The information that must be reported on OH Instructions for IT 1040/SD 100 includes personal identification details, total income earned, allowable deductions, credits, and the computed tax due or refund amount.

Fill out your ohio instructions income 2022-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio Instructions Income 2022-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.