IL RUT-5 2024-2025 free printable template

Show details

Illinois Department of RevenuePrivate Party Vehicle Use Tax Chart for 2023 (Use with Form RUT50) Effective January 1, 2023, through December 31, 2023Illinois Private Party Vehicle Use Tax (Step 6,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rut 5 form

Edit your rut5 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rut 5 private party form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rut 5 form 2024-2025 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rut 5 form 2024-2025. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL RUT-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rut 5 form 2024-2025

How to fill out rut-5 private party vehicle

01

Obtain the RUT-5 form from your local tax authority or online.

02

Fill in the required personal information, such as name, address, and identification number.

03

Provide details about the vehicle, including make, model, and year.

04

Specify the purpose of the vehicle use, indicating that it is for private party use.

05

List any additional relevant information as required by the form.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the appropriate tax authority, either in person or by mail.

Who needs rut-5 private party vehicle?

01

Individuals who own vehicles that they use for private parties or events.

02

Businesses that utilize vehicles specifically for private functions, such as catering or event planning.

03

Anyone who needs to report the use of a vehicle for tax purposes related to private gatherings.

Fill

form

: Try Risk Free

People Also Ask about

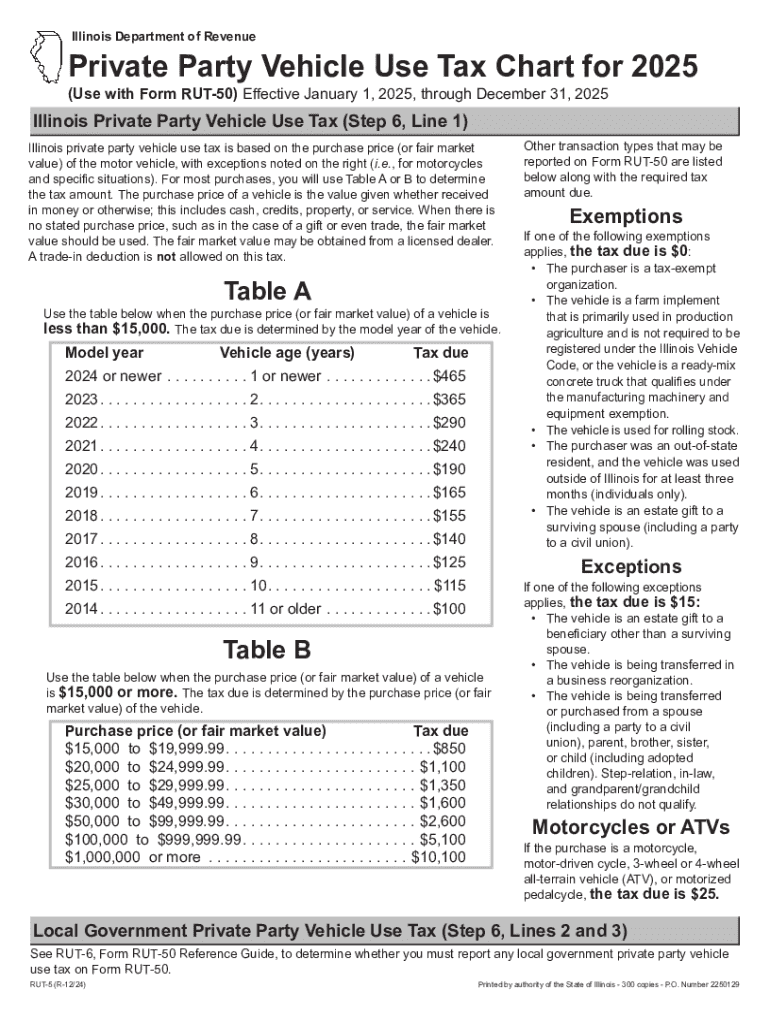

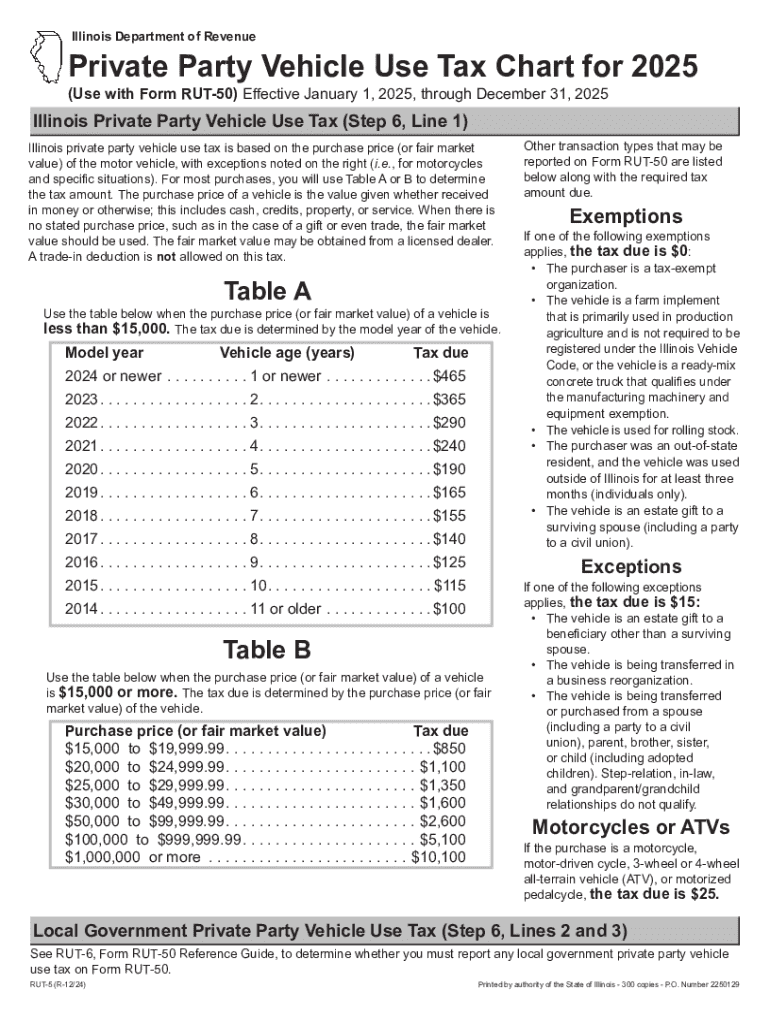

What is rut-50 private party vehicle Use Tax transaction?

Form RUT-50 must be filed by a person or business titling a motor vehicle in Illinois when the person or business: purchased or acquired a motor vehicle by gift or transfer from a private party either within or outside Illinois; or.

Do you pay sales tax on a used car from private seller in Illinois?

When you buy a car and register it in Illinois, you owe sales tax—whether you purchase it from a dealer or a private seller. The tax law does not make a distinction for private-party vehicle sales. The statewide sales tax on vehicles in Illinois currently stands at 6.25% of the purchase price of the car.

What is a rut-50 in Illinois?

Form RUT-50 must be filed by a person or business titling a motor vehicle in Illinois when the person or business: purchased or acquired a motor vehicle by gift or transfer from a private party either within or outside Illinois; or.

Where can I get a rut-50 in Illinois?

These forms are available at the offices of the Illinois Secretary of State, the Illinois Department of Transportation, or the Illinois Department of Natural Resources. If you need to obtain the forms prior to registering the vehicle, send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302.

Where can you get Illinois tax forms?

How to get Forms Download Forms. Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

Do you pay taxes on a private car sale in Texas?

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (SPV), whichever is the highest value. SPV applies wherever you buy the vehicle, in Texas or out of state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my rut 5 form 2024-2025 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your rut 5 form 2024-2025 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find rut 5 form 2024-2025?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific rut 5 form 2024-2025 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit rut 5 form 2024-2025 online?

With pdfFiller, it's easy to make changes. Open your rut 5 form 2024-2025 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is rut-5 private party vehicle?

The rut-5 private party vehicle is a form used in certain jurisdictions to report the sale or transfer of a vehicle between private parties, primarily for tax assessment purposes.

Who is required to file rut-5 private party vehicle?

Typically, the seller of the vehicle is required to file the rut-5 private party vehicle form to report the transaction and ensure proper tax compliance.

How to fill out rut-5 private party vehicle?

To fill out the rut-5 private party vehicle form, the seller must provide information such as the vehicle's identification number (VIN), sale price, date of sale, and both the seller's and buyer's information, including names and addresses.

What is the purpose of rut-5 private party vehicle?

The purpose of the rut-5 private party vehicle form is to facilitate the reporting of vehicle sales for tax purposes, ensuring that the appropriate sales tax is collected based on the sale price of the vehicle.

What information must be reported on rut-5 private party vehicle?

The information that must be reported on the rut-5 private party vehicle includes the vehicle's VIN, sale price, sale date, buyer's name and address, seller's name and address, and any other required details as specified by the jurisdiction.

Fill out your rut 5 form 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rut 5 Form 2024-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.