Get the free FTB Notice 2008-1

Show details

Cette notice explique les obligations de divulgation en vertu de l'article 18628 du Code de la fiscalité et de la réglementation du Trésor, concernant les exigences de déclaration pour certaines

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ftb notice 2008-1

Edit your ftb notice 2008-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb notice 2008-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ftb notice 2008-1 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ftb notice 2008-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ftb notice 2008-1

How to fill out FTB Notice 2008-1

01

Obtain FTB Notice 2008-1 form from the official California Franchise Tax Board website or request a copy by contacting them.

02

Read the instructions carefully to understand the purpose of the notice and the information required.

03

Fill in your personal information including your name, address, and social security number accurately.

04

Provide the necessary financial information as requested in the form, ensuring that all figures are accurate and current.

05

Review all entries for any errors or omissions before finalizing the form.

06

Sign and date the form where indicated to certify that the information is true and correct.

07

Submit the filled form through the prescribed method, whether by mail or electronically, as specified in the notice.

Who needs FTB Notice 2008-1?

01

Individuals or entities who have received a notice regarding prior tax filings that may require clarification or correction.

02

Taxpayers who are involved in a situation that necessitates additional documentation or information related to California state tax matters.

03

Anyone who has been notified by the Franchise Tax Board about discrepancies or requests related to their tax returns from the tax year mentioned in the notice.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for dishonored payment to the FTB?

Dishonored Payment Penalty The California Franchise Tax Board imposes a penalty if your financial institution does not honor a payment you make to the FTB by your check, money order, or electronic funds transfer. For a payment of $1,250 or more, the penalty is 2 percent of the payment amount.

What is the report of state income tax refund from the California Franchise Tax Board?

FTB issues Form 1099-G to report certain government payments including state income tax refunds. The tax year 2024 Form 1099-G sent by FTB may contain incorrect amounts when an estimate transfer from the previous year has occurred.

What is the dishonored payment penalty?

The Dishonored Check or Other Form of Payment Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.

Why would I get a letter from the Department of Taxation?

The IRS sends notices and letters for the following reasons: You have a balance due. The IRS changed your return - You are due a larger or smaller refund The IRS has a question about your tax return. The IRS needs to verify your identity. The IRS needs additional information.

What happens if you don't pay FTB?

Failure to Pay Tax / Late Payment Penalty 5% of the total tax unpaid plus 1/2 of 1% for every month the payment of tax was late up to 40 months. Not to exceed 25% of the total unpaid tax. Reasonable cause and not willful neglect.

What is the report of state income tax refund in California?

Form 1099-G, Report of State Income Tax Refund. Form 1099-Gs will specify from which tax year the refund originated. Form 1099-INT, Statement of Interest Income. FTB issues Form 1099-INTs for all interest paid during the 2024 calendar year, regardless of tax year.

Why would I get a letter from FTB?

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Why am I getting a letter from FTB?

These notices request additional information to help validate the taxpayer's identity and confirm their refund. ing to FTB, the letters are not the result of any altered processes, and there has been no change in the number of notices that have gone out compared to previous years.

What is the FTB penalty?

The rate is 5 percent of the total unpaid tax, and a further 0.5 percent for each month or part of a month over the due date that the tax remains unpaid, up to 40 months. Other penalties for returned checks, understatement, negligence and fraud may also add to the overall total owed to the FTB.

What is FTB used for?

Description. Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

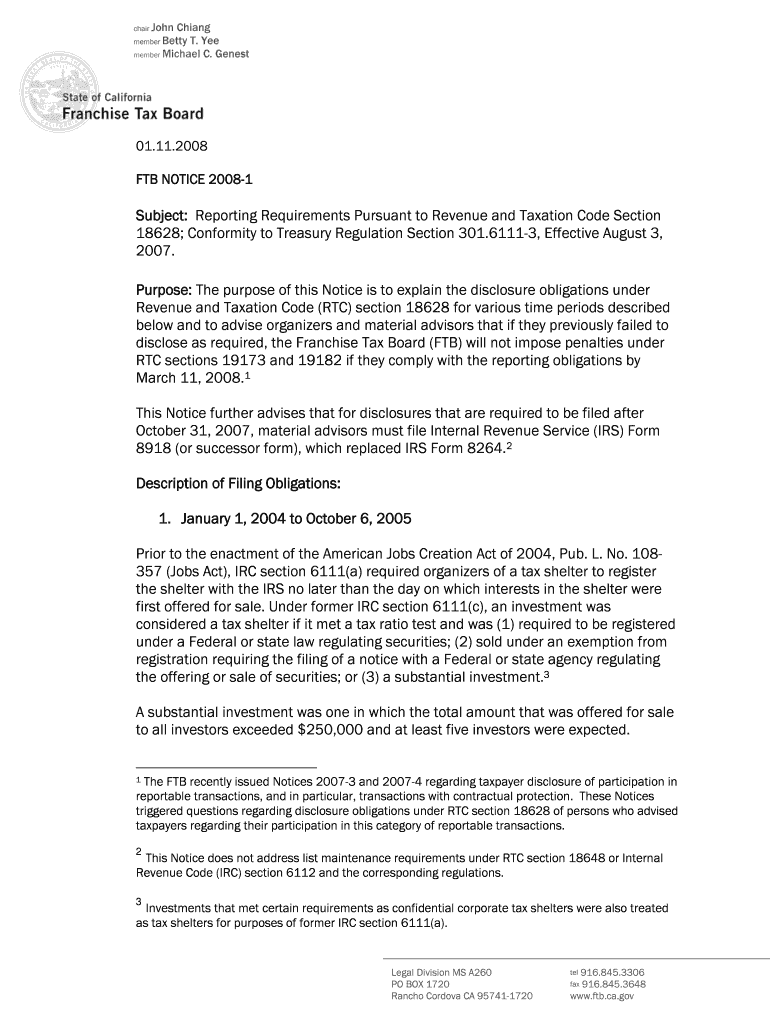

What is FTB Notice 2008-1?

FTB Notice 2008-1 is a notice issued by the California Franchise Tax Board that provides guidance regarding certain reporting requirements for transactions involving the transfer of property.

Who is required to file FTB Notice 2008-1?

Any taxpayer who has engaged in specific transactions involving the transfer of property that fall under the reporting requirements set by the Notice is required to file FTB Notice 2008-1.

How to fill out FTB Notice 2008-1?

To fill out FTB Notice 2008-1, a taxpayer needs to provide their identifying information, details of the transaction, and any other required disclosures as specified in the instructions of the notice.

What is the purpose of FTB Notice 2008-1?

The purpose of FTB Notice 2008-1 is to ensure compliance with California's tax laws by requiring taxpayers to report certain transactions that may result in tax liabilities.

What information must be reported on FTB Notice 2008-1?

The information that must be reported on FTB Notice 2008-1 includes details of the parties involved in the transaction, the nature of the property transferred, and the financial terms of the transaction.

Fill out your ftb notice 2008-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb Notice 2008-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.