Get the free Bonus Program for Non-Represented Classified Staff - uvm

Show details

Este programa de bonificación permite que el personal no representado de la UVM sea reconocido por logros laborales ejemplares que superan los requisitos estándar del trabajo y que contribuyen significativamente

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bonus program for non-represented

Edit your bonus program for non-represented form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bonus program for non-represented form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bonus program for non-represented online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bonus program for non-represented. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

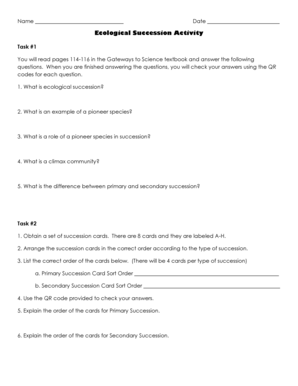

How to fill out bonus program for non-represented

How to fill out Bonus Program for Non-Represented Classified Staff

01

Review the eligibility criteria for the Bonus Program for Non-Represented Classified Staff.

02

Gather necessary documentation, such as performance evaluations and any relevant recommendations.

03

Complete the application form specifically designed for the Bonus Program.

04

Clearly detail your contributions and achievements that warrant the bonus.

05

Submit the application by the specified deadline to the appropriate office or individual.

06

Follow up to ensure that your application has been received and is being processed.

Who needs Bonus Program for Non-Represented Classified Staff?

01

Non-Represented Classified Staff members who have demonstrated exceptional performance.

02

Employees looking to be recognized for their contributions to the organization.

03

Individuals seeking financial incentives based on their work accomplishments.

Fill

form

: Try Risk Free

People Also Ask about

Should I accept a retention bonus?

Retention bonuses are taxable and subject to federal income tax, Social Security tax and Medicare tax. The flat federal withholding rate for retention bonuses paid separately from regular wages is 22%. Both employers and employees have specific responsibilities in reporting and managing the taxes on retention bonuses.

How to categorize employee bonuses?

Bonus payments fall under the “payments to employees” category, provided the bonus is for services rendered, such as not a gift.

How does the employee retention program work?

The average retention bonus amount usually falls within a range of between 10-15% of the employee's annual salary. Experienced and extremely talented employees may receive offers that dwarf that amount, of course, depending on how serious the company is about keeping them on staff.

What is the bonus program for employees?

What Is an Employee Bonus Plan? An employee bonus plan provides compensation beyond annual salary to employees as an incentive or reward for reaching certain predetermined individual or team goals. The purpose of bonus plans is to provide recognition for employees who go above and beyond normal work obligations.

When should bonuses be accrued in the GAAP?

Most companies have an annual bonus that is paid out after year-end. Under U.S. GAAP, the company should accrue for the annual bonus expense throughout the year.

What is the employee retention bonus program?

Retention bonus rates typically range between 10% and 15% of an employee's base pay, and companies often offer them as a lump sum or in biweekly or biannual installments. They're powerful retention tools as long as business and employee needs align.

How does a retention bonus work?

The Employee Retention Credit is a fully refundable tax credit that eligible employers claim against certain employment taxes. It is not a loan and does not have to be paid back. For most taxpayers, the refundable credit is in excess of the payroll taxes paid in a credit-generating period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bonus Program for Non-Represented Classified Staff?

The Bonus Program for Non-Represented Classified Staff is a program designed to provide financial incentives to eligible staff members who are not represented by a labor union, based on their performance and contributions to the organization.

Who is required to file Bonus Program for Non-Represented Classified Staff?

All non-represented classified staff members who meet the eligibility criteria set forth by the organization's policies are required to file the Bonus Program.

How to fill out Bonus Program for Non-Represented Classified Staff?

To fill out the Bonus Program for Non-Represented Classified Staff, individuals must complete the designated form with accurate personal and professional details, including performance metrics, and submit it to the appropriate department for review.

What is the purpose of Bonus Program for Non-Represented Classified Staff?

The purpose of the Bonus Program for Non-Represented Classified Staff is to reward and acknowledge exceptional performance and contributions, thereby improving employee morale and productivity.

What information must be reported on Bonus Program for Non-Represented Classified Staff?

The information that must be reported includes the staff member's name, position, performance evaluation scores, specific achievements, and any other relevant details that demonstrate the individual's contributions to the organization.

Fill out your bonus program for non-represented online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bonus Program For Non-Represented is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.