Get the free Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal - travi...

Show details

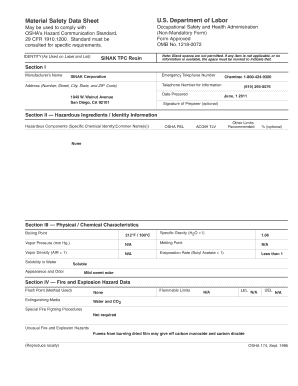

This document is an application for a special appraisal of open-space land in Texas based on its agricultural use. It provides guidance on eligibility criteria, application filing requirements, potential

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax application for

Edit your property tax application for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax application for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax application for online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property tax application for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax application for

How to fill out Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal

01

Obtain the Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal form from your local appraisal district office or their website.

02

Review the eligibility requirements for the 1-d-1 agricultural use appraisal to ensure your property qualifies.

03

Fill out the property owner's information, including name, address, and contact details in the designated sections of the application.

04

Provide a description of the property, including the location, size, and type of agricultural use.

05

Detail the specific agricultural activities conducted on the property, including types of crops or livestock raised.

06

Attach any required documentation, such as proof of agricultural income or a management plan, to support your application.

07

Review the completed application for accuracy and completeness before submission.

08

Submit the application by the specified deadline to your local appraisal district office, either in person or electronically, if permitted.

Who needs Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal?

01

Landowners or property owners who are engaged in agricultural activities and wish to receive a tax benefit through the 1-d-1 (Open – Space) agricultural use appraisal.

02

Farmers and ranchers who manage land primarily for agricultural production and want to reduce their property tax burden.

03

Individuals or entities that own land classified as open-space and intend to maintain agricultural use to ensure compliance with appraisal requirements.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my property classified as agricultural?

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

How do I get an agricultural property tax exemption in Texas?

Beekeeping is the easiest and least expensive way to keep or obtain an AG valuation for an experienced beekeeper. Honeybees do not require fences, livestock trailers, veterinarians, hay, and you are not tied to the land. Keep that last part in mind.

What is the easiest ag exemption in Texas?

0:23 4:08 And farmed by a single operation. If you have less than 7 acres you can still qualify. But you needMoreAnd farmed by a single operation. If you have less than 7 acres you can still qualify. But you need to have an average gross sales revenue of $50,000. Or more from that property.

How to qualify for an agricultural property tax exemption in Texas?

Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have occurred for 5 of the last 5 years.) The landowner must file a timely and valid application with the appraisal district.

What is a 1 D 1 agricultural exemption in Texas?

Agricultural land shall generally include land that is actively farmed, ranched, or used to raise timber for timber products to obtain a fair rate of return. The use of the land must be consistent with the land's capability to produce.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

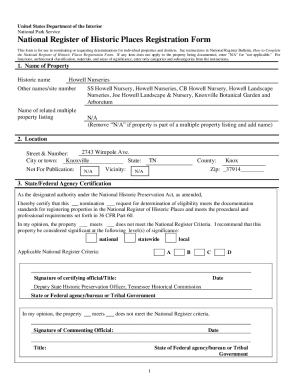

What is Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal?

The Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal is a form that landowners use to apply for property tax relief based on the agricultural use of their land. It allows qualifying land to be appraised based on its productive agricultural capacity rather than its market value.

Who is required to file Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal?

Landowners or property owners who wish to receive the 1-d-1 agricultural use appraisal must file the application. This typically includes individuals, entities, or organizations that own land used for agricultural purposes.

How to fill out Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal?

To fill out the application, landowners should provide details about the property, including its location, type of agricultural use, and any relevant supporting documentation. The form must also be signed and submitted to the county appraisal district by the designated deadline.

What is the purpose of Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal?

The purpose of the Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal is to enable agricultural landowners to benefit from reduced property tax rates, reflecting the land's use for agricultural productivity rather than its market value.

What information must be reported on Property Tax Application for 1-d-1 (Open – Space) Agricultural Use Appraisal?

The application requires information such as the property owner's name, address, detailed description of the property, the type of agricultural use being conducted, the acreage involved, and any other details that demonstrate the land's qualification for agricultural use appraisal.

Fill out your property tax application for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Application For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.