OK 511-EF 2022 free printable template

Show details

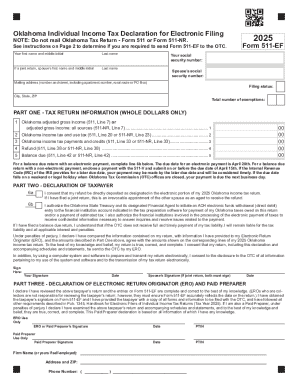

Oklahoma Individual Income Tax Declaration for Electronic Filing NOTE: Do not mail Oklahoma Tax Return Form 511 or Form 511NR. See instructions on Page 2 to determine if you are required to send Form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK 511-EF

Edit your OK 511-EF form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK 511-EF form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK 511-EF online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK 511-EF. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK 511-EF Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK 511-EF

How to fill out OK 511-EF

01

Gather all necessary financial information and records from the designated tax year.

02

Start by filling out the identification section with your name, address, and taxpayer ID number.

03

Fill in your income information, including all sources of income received during the tax year.

04

Deduct any allowable expenses to arrive at your net income.

05

Calculate the tax owed based on your net income and include any credits or prepayments.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs OK 511-EF?

01

Individuals who have income from self-employment or business activities.

02

Taxpayers who need to report additional income that is not included in the main tax return.

03

Anyone required to file an amended tax return for the specified tax year.

Fill

form

: Try Risk Free

People Also Ask about

Do you need a bill of sale for a trailer Oklahoma?

Registering a new trailer in Oklahoma will require an Oklahoma trailer bill of sale form to protect both the buyer and the seller. You need documentation to legally establish ownership when buying and registering a new or used trailer in Oklahoma.

Is a handwritten bill of sale OK?

Can a bill of sale be handwritten? While it is common to present a bill of sale in a digital format, you can also create a handwritten bill of sale. What's most important is to include all of the pertinent details in the bill of sale in order to protect both parties.

Does a bill of sale have to be notarized in Oklahoma?

Does a bill of sale have to be notarized in Oklahoma? Yes. Oklahoma has a form called a Declaration of Purchase Price, which is equivalent to a bill of sale and is legally required for all private party transactions. This form needs to be signed in front of a notary public.

How much does it cost to change the name on a car title in Oklahoma?

Title transfer fees in Oklahoma are relatively affordable compared to other states. You'll need to pay a $17.00 ownership transfer fee to successfully have your title transferred.

Does Oklahoma bill of sale need to be notarized?

Oklahoma requires that the seller(s) signature be notarized.

Can I do a title transfer online in Oklahoma?

A Notice of Transfer is a form which can be completed online or at a tag agency and submitted in order to put the Oklahoma Tax Commission Motor Vehicle Division on notice that you have sold your vehicle and to whom you have sold it to. The cost is $10.00. Download the Notice of Transfer form here.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OK 511-EF from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your OK 511-EF into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send OK 511-EF for eSignature?

When you're ready to share your OK 511-EF, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in OK 511-EF?

With pdfFiller, the editing process is straightforward. Open your OK 511-EF in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is OK 511-EF?

OK 511-EF is an electronic filing form used for reporting income and financial data by taxpayers in Oklahoma.

Who is required to file OK 511-EF?

Individuals and entities that have a tax liability in Oklahoma and are required to report their income are required to file OK 511-EF.

How to fill out OK 511-EF?

To fill out OK 511-EF, taxpayers must enter their personal information, income details, deductions, and any applicable tax credits in the designated fields of the electronic form.

What is the purpose of OK 511-EF?

The purpose of OK 511-EF is to provide a standardized format for filing state income tax returns electronically and to streamline the processing of tax information.

What information must be reported on OK 511-EF?

Information that must be reported on OK 511-EF includes taxpayer identification details, income sources, allowable deductions, tax credits, and total tax liability.

Fill out your OK 511-EF online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK 511-EF is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.