NY IT-203-ATT 2022 free printable template

Show details

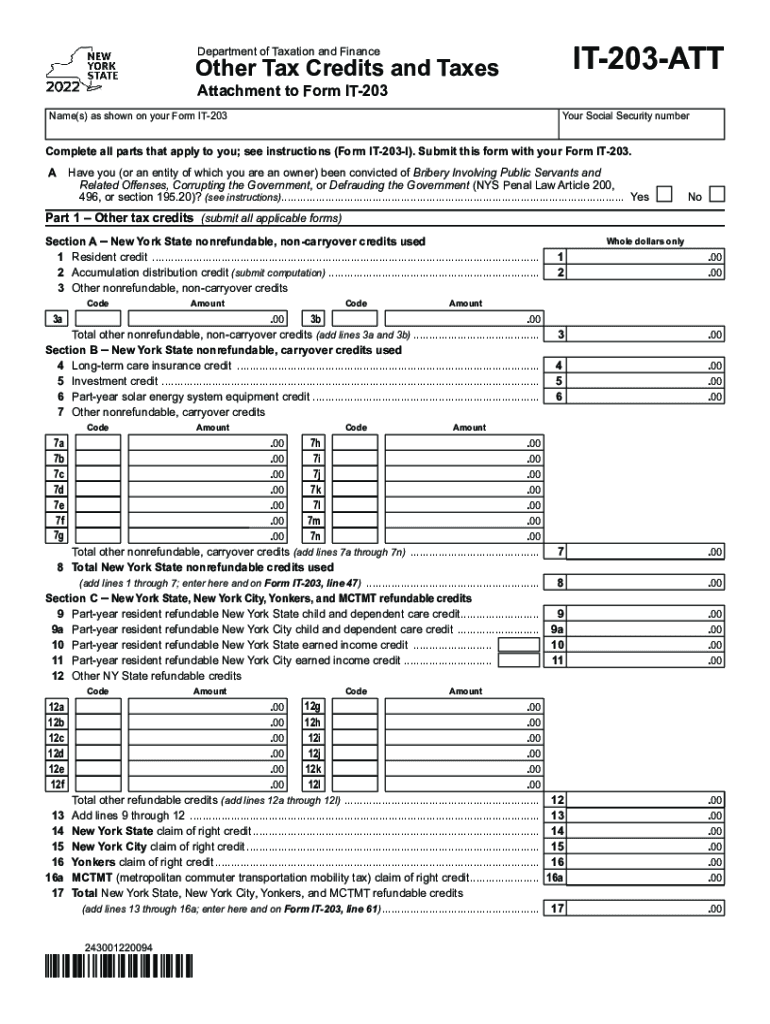

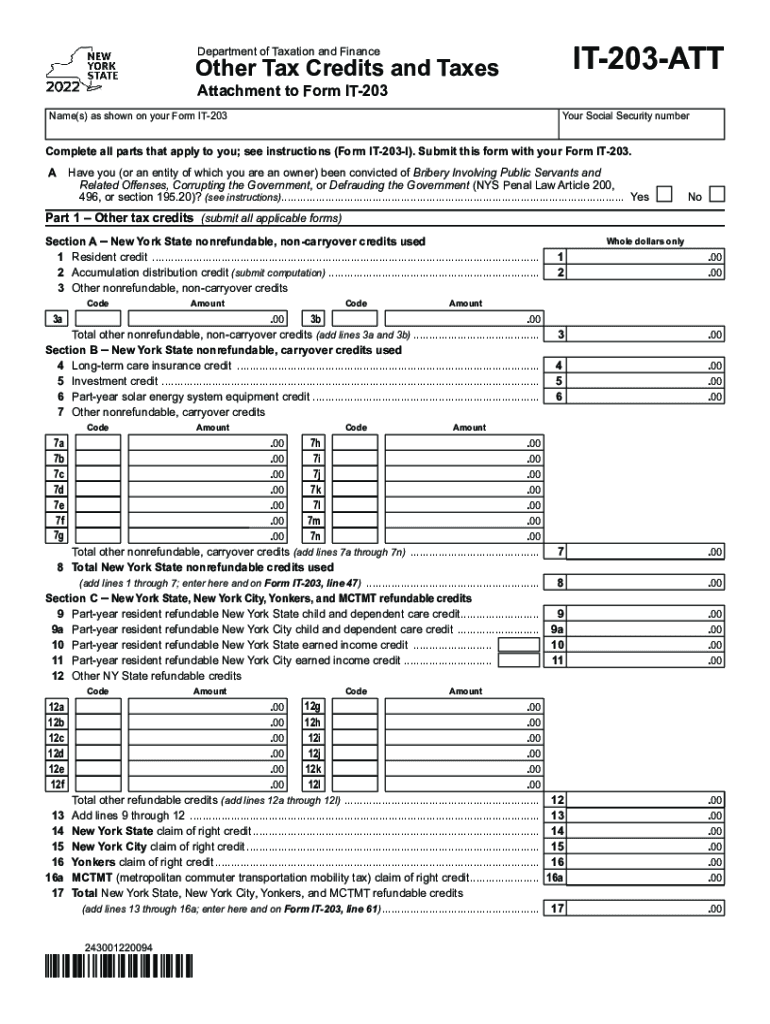

IT203ATTDepartment of Taxation and FinanceOther Tax Credits and Taxes

Attachment to Form IT203Name(s) as shown on your Form IT203Your Social Security numberComplete all parts that apply to you; see

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-203-ATT

Edit your NY IT-203-ATT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-203-ATT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY IT-203-ATT online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY IT-203-ATT. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-203-ATT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-203-ATT

How to fill out NY IT-203-ATT

01

Obtain a copy of Form IT-203-ATT from the New York State Department of Taxation and Finance website or your tax preparer.

02

Review the instructions carefully to understand what information is required.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Indicate your filing status (e.g., single, married filing jointly).

05

List all income you received while you were a non-resident or part-year resident of New York.

06

Deduct any applicable adjustments and exemptions as outlined in the form.

07

Calculate your New York taxable income and tax owed using the provided tables or formulas.

08

Complete any additional sections as needed, including any credits or payments.

09

Review your completed form for accuracy and ensure all required attachments are included.

10

Submit the IT-203-ATT form along with your New York State tax return.

Who needs NY IT-203-ATT?

01

Individuals who are non-residents or part-year residents of New York and need to report income earned in New York State must fill out the NY IT-203-ATT.

02

Taxpayers who qualify for various credits and deductions while filing their New York State tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What triggers a NYS tax audit?

Some of the reasons we select a taxpayer for audit include: Failure to file a return. Failure to report income or sales. Excessive credits or exclusions claimed on a return.

What is the difference between it 201 and it-203?

Form IT-201 can be used only by resident New York taxpayers who want to file their New York income tax returns. If you are a part-year resident or a nonresident, you may use Form IT-203 instead to file your income tax return.

What is the difference between Form 1040 and IT-201?

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

What is form NY IT-203?

Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Why do I owe taxes to NY State?

Similar to federal income taxes, states generally impose income taxes on your earnings if you have a sufficient connection to the state or if you earned income in the state even without sufficient connections. So, if you earn an income or live in NY, you must pay NY state tax.

Who must file a NY nonresident return?

If you had any income during your resident period or if you had New York source income during your nonresident period, you are required to file a New York State return. You will file Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Is NYS sending out tax relief checks?

The homeowner tax rebate credit is a one-year program providing direct property tax relief to about 2.5 million eligible homeowners in 2022. If you qualify, you don't need to do anything; we'll automatically send you a check for the amount of your credit.

What is IT-203 tax form?

New York Resident, Nonresident, and Part-Year Resident Itemized Deductions. Used by nonresident and part-year resident (Form IT-203) filers who need to report other New York State or New York City taxes, and tax credits other than those reported directly on Form IT-203.

Who must file NY nonresident tax return?

Nonresidents. If you have New York source income and your New York Adjusted Gross Income (NYAGI) federal amount column (Form IT-203, line 31) exceeds your New York State standard deduction amount, you are required to file a New York State return.

Why am I getting letters from NYS tax and finance?

Common reasons we send RFI letters include: We need to verify you reported the correct amount of wages and withholding for New York State, New York City, and Yonkers (see Checklist for acceptable proof of wages and withholding). We need to verify you lived or worked in New York State, New York City, or Yonkers.

Who is exempt from filing?

Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

What is form IT-201 used for?

Form IT-201 is the standard New York income tax return for state residents. Nonresidents and part-time residents must use must use Form IT-203 instead. Form IT-201 requires you to list multiple forms of income, such as wages, interest, or alimony .

Who must file IT-203?

You must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, if you: were not a resident of New York State and received income during the tax year from New York State sources, or. moved into or out of New York State during the tax year.

What does IT-201 resident mean?

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

What is the difference between IT-201 and IT-203?

Form IT-201 can be used only by resident New York taxpayers who want to file their New York income tax returns. If you are a part-year resident or a nonresident, you may use Form IT-203 instead to file your income tax return.

Why would I get a certified letter from NYS tax?

Typically, we send this letter if we need to verify: your amounts of wages and withholding, your residency, your eligibility for refundable tax credits, or.

What is form IT-203 ATT?

Purpose of Form IT-203-ATT If you are claiming other New York State, New York City, or Yonkers credits listed in the chart on pages 53 and 54 (credits that are not entered directly on Form IT-203), or if you are subject to other New York State taxes, you must complete Form IT-203-ATT and attach it to your Form IT-203.

Who must file in North Carolina?

Filing Requirements Chart for Tax Year 2021 Filing StatusA Return is Required if Federal Gross Income ExceedsSingle$10,750Married - Filing Joint Return$21,500Married - Filing Separate ReturnIf spouse does not claim itemized deductions$10,7504 more rows • 9 Nov 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY IT-203-ATT in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign NY IT-203-ATT and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit NY IT-203-ATT on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing NY IT-203-ATT.

How do I fill out NY IT-203-ATT on an Android device?

Use the pdfFiller Android app to finish your NY IT-203-ATT and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NY IT-203-ATT?

NY IT-203-ATT is an attachment used by non-resident taxpayers in New York to report additional information relevant to their New York State income tax returns.

Who is required to file NY IT-203-ATT?

Non-residents who have income from New York State sources may be required to file NY IT-203-ATT, particularly if they are claiming certain credits or adjustments.

How to fill out NY IT-203-ATT?

To fill out NY IT-203-ATT, gather all relevant income documentation, complete the required sections by providing necessary income details and calculations, and ensure to attach it with your NY IT-203 form.

What is the purpose of NY IT-203-ATT?

The purpose of NY IT-203-ATT is to provide additional information for non-residents regarding income earned in New York State, to determine tax liabilities accurately.

What information must be reported on NY IT-203-ATT?

Information that must be reported on NY IT-203-ATT includes details of New York source income, any deductions or credits being claimed, and adjustments to income.

Fill out your NY IT-203-ATT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-203-ATT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.